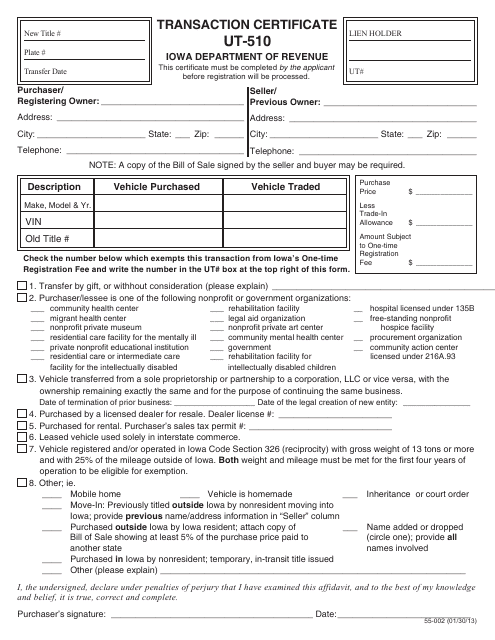

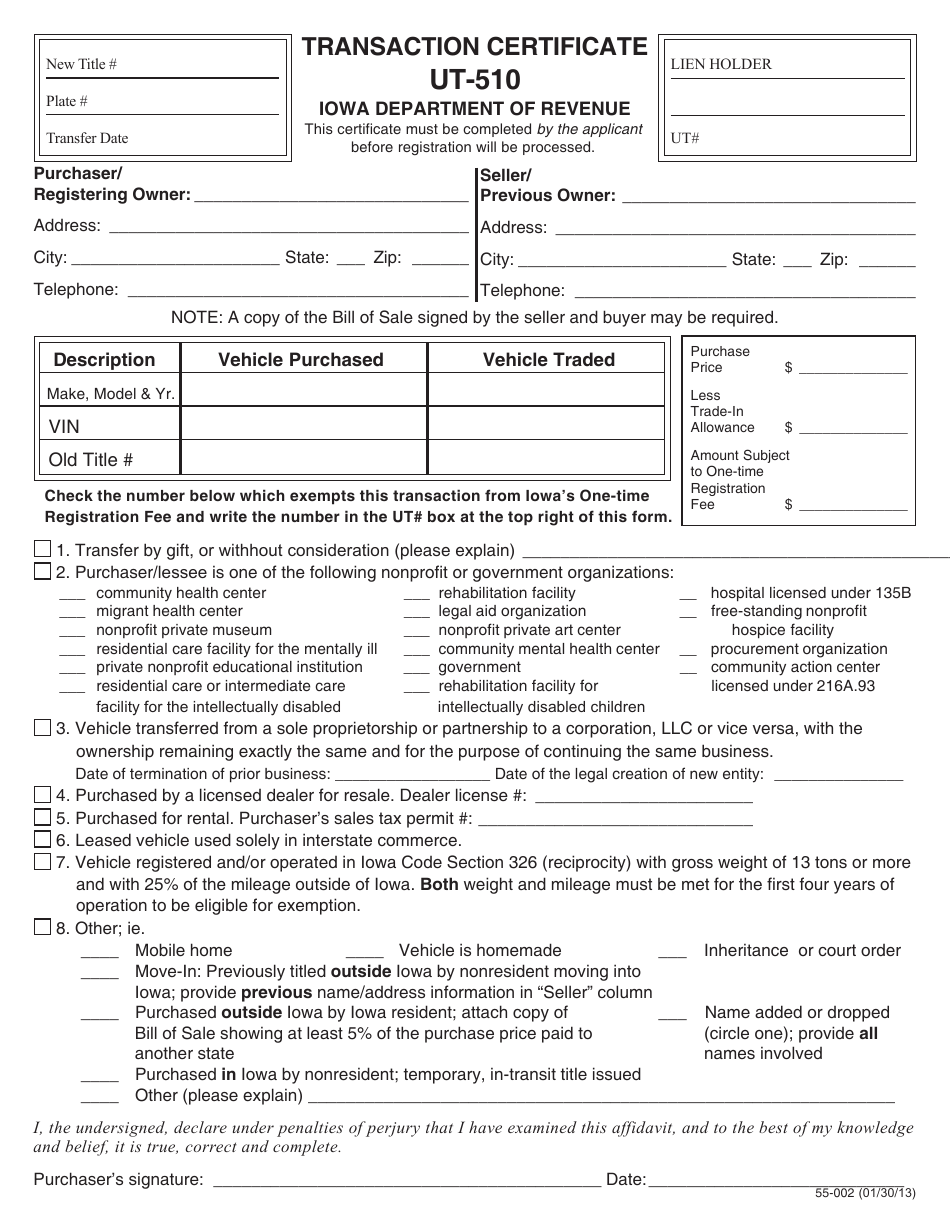

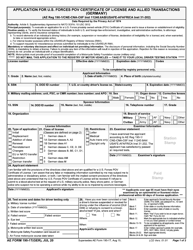

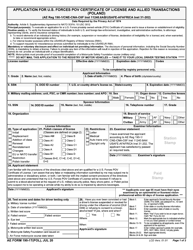

Form 55-002 (UT-510) Transaction Certificate - Iowa

What Is Form 55-002 (UT-510)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 55-002 (UT-510)?

A: It is a Transaction Certificate used in Iowa.

Q: What is the purpose of Form 55-002 (UT-510)?

A: It is used to report and document various transactions in Iowa.

Q: Who needs to fill out Form 55-002 (UT-510)?

A: Businesses and individuals engaged in taxable transactions in Iowa.

Q: What information is required on Form 55-002 (UT-510)?

A: The form requires information such as the buyer and seller's details, transaction details, and tax amount.

Q: When is Form 55-002 (UT-510) due?

A: The due date varies depending on the type of transaction. Check the form instructions or contact the Iowa Department of Revenue for specific deadlines.

Q: Are there any penalties for not filing Form 55-002 (UT-510)?

A: Yes, failure to file or late filing may result in penalties and interest charges.

Q: Can I file Form 55-002 (UT-510) electronically?

A: Yes, Iowa offers an electronic filing system called eFile & Pay for submitting the form.

Q: What should I do with the completed Form 55-002 (UT-510)?

A: You should keep a copy for your records and submit the original form to the Iowa Department of Revenue.

Q: Are there any additional forms or attachments required with Form 55-002 (UT-510)?

A: Depending on the type of transaction, you may need to include supporting documentation such as invoices or receipts.

Form Details:

- Released on January 30, 2013;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 55-002 (UT-510) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.