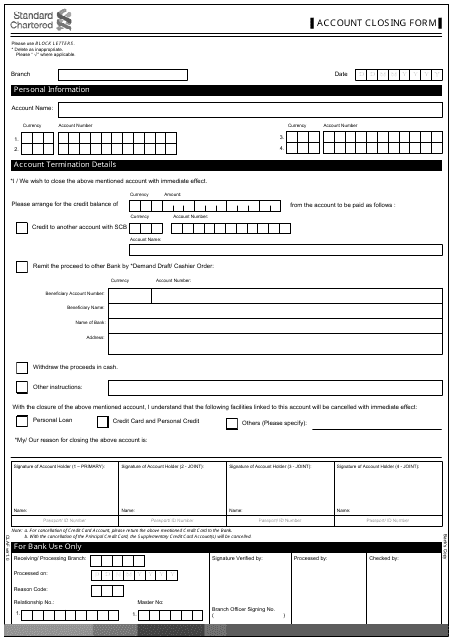

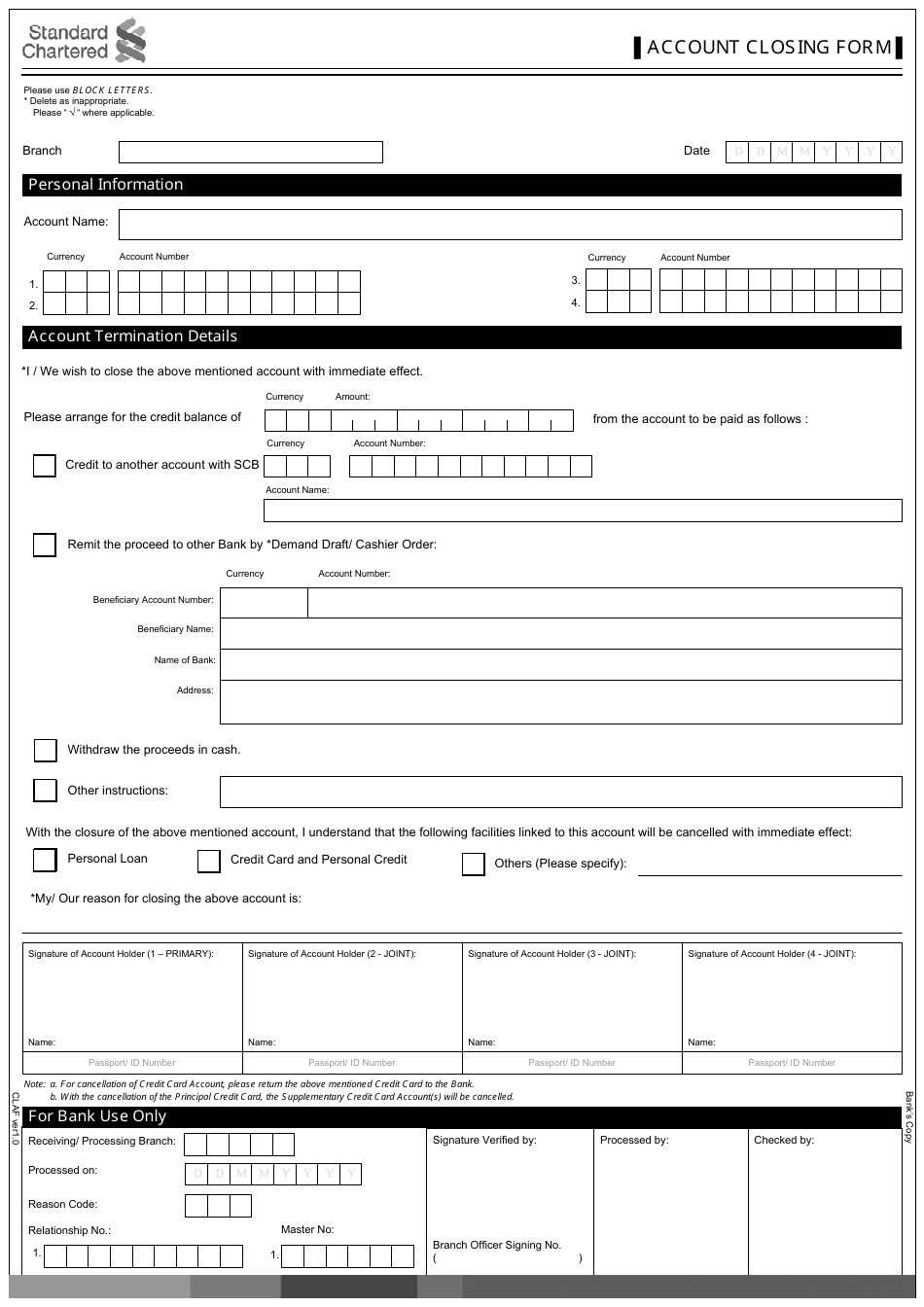

Account Closing Form - Standard Chartered

The Account Closing Form of Standard Chartered is used to request the closure of a bank account with Standard Chartered.

The account holder files the account closing form at Standard Chartered bank.

FAQ

Q: What is an account closing form?

A: An account closing form is a document used to officially close a bank account.

Q: Why would I need to close my bank account?

A: There could be several reasons for closing a bank account, such as switching to another bank, moving to a different location, or no longer needing the account.

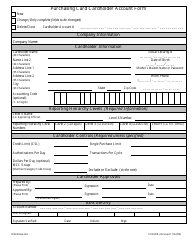

Q: What information is typically required in an account closing form?

A: An account closing form typically requires you to provide personal information, such as your name, account number, and ID proof.

Q: Are there any fees or charges for closing a bank account?

A: Some banks may charge a fee for closing a bank account. You can check with Standard Chartered for their specific policy on account closure fees.

Q: Once I submit the account closing form, how long does it take to close my bank account?

A: The time it takes to close a bank account may vary. It is advisable to check with Standard Chartered for their processing time.

Q: What should I do after submitting the account closing form?

A: After submitting the account closing form, make sure to withdraw any remaining funds from the account and update any automatic payments or direct deposits linked to that account.

Q: Is it possible to reopen a closed bank account?

A: In some cases, it may be possible to reopen a closed bank account. However, it is best to check with Standard Chartered for their policy on reopening closed accounts.

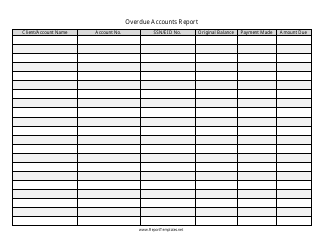

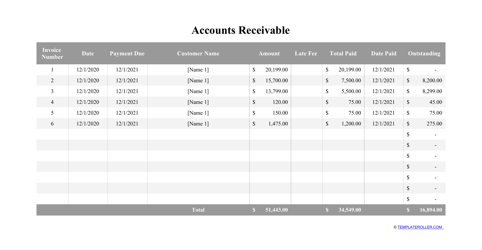

Q: What happens to the funds in my closed bank account?

A: After closing the bank account, the funds are usually either transferred to a different account specified by you or returned to you in the form of a check.