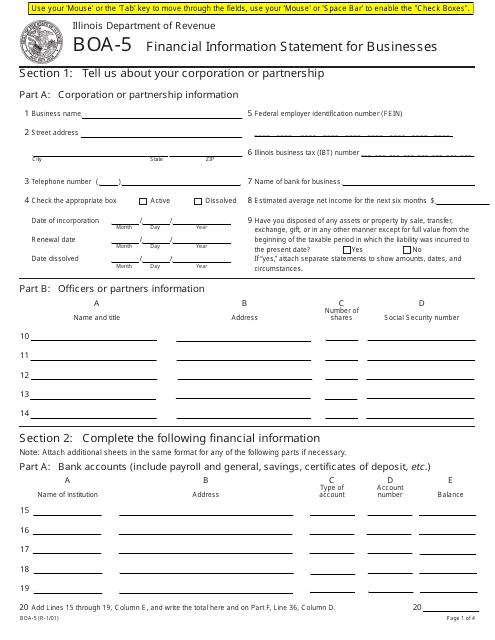

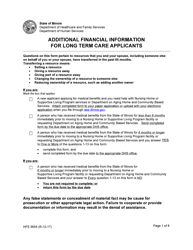

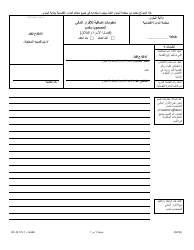

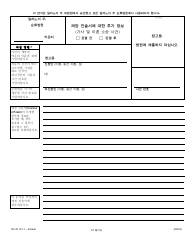

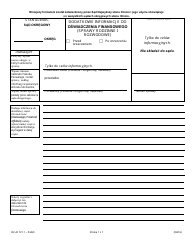

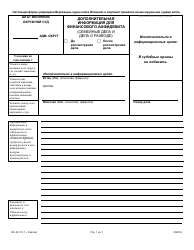

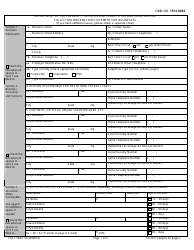

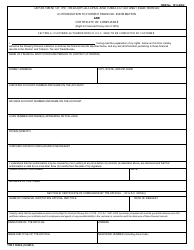

Form BOA-5 Financial Information Statement for Businesses - Illinois

What Is Form BOA-5?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOA-5?

A: BOA-5 is a financial information statement for businesses in Illinois.

Q: Who needs to file BOA-5?

A: Businesses operating in Illinois may need to file BOA-5 if required by the state or local authorities.

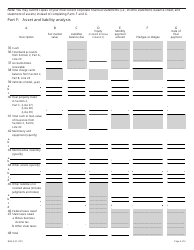

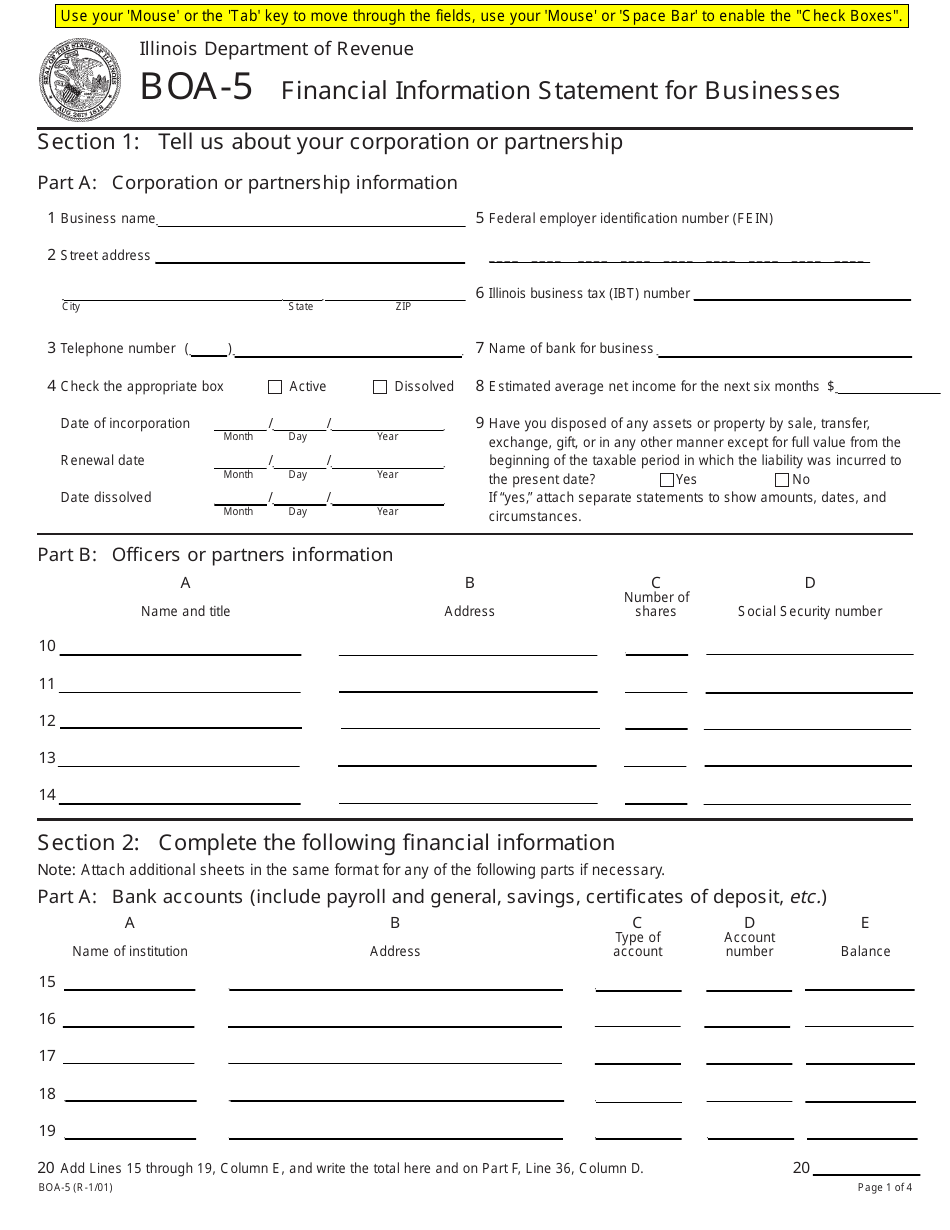

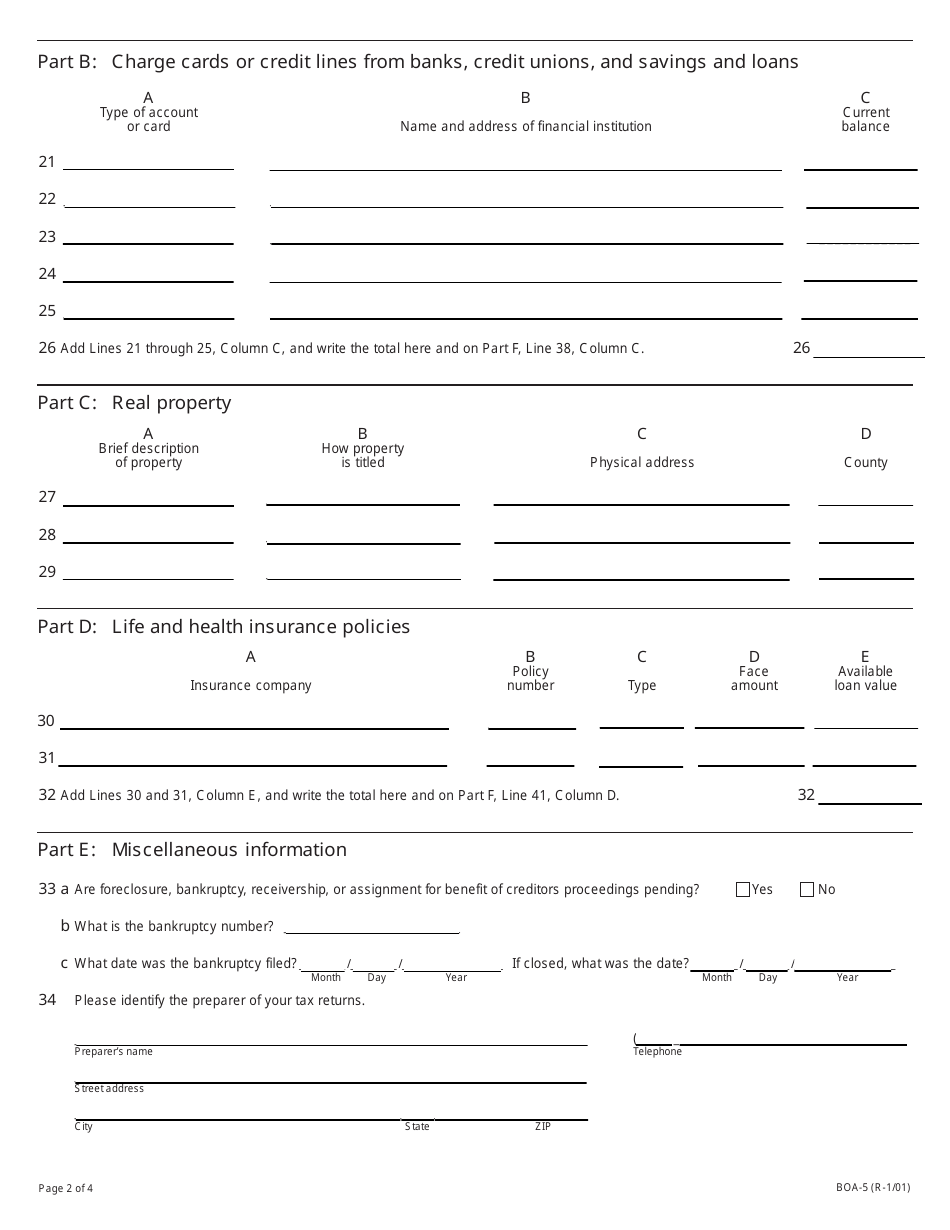

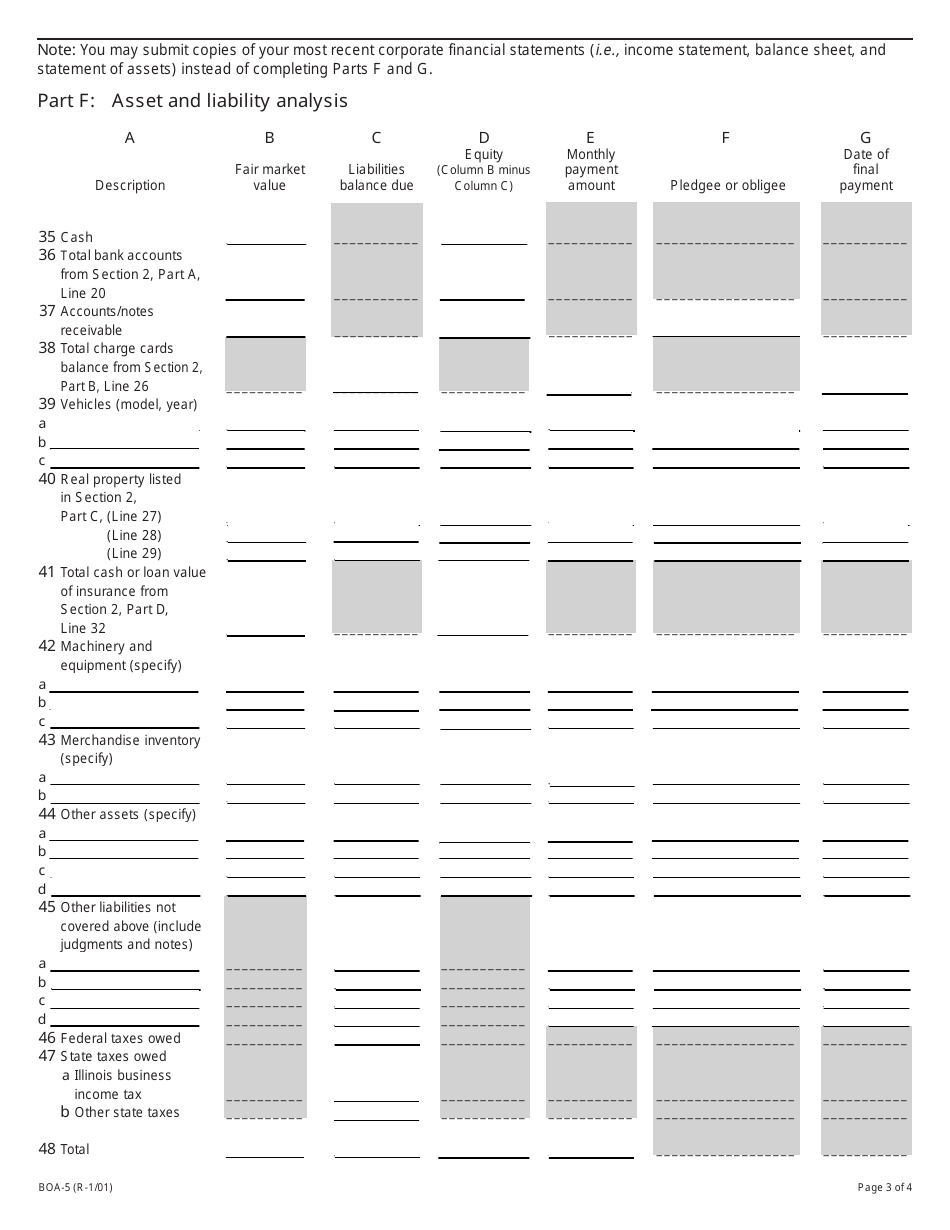

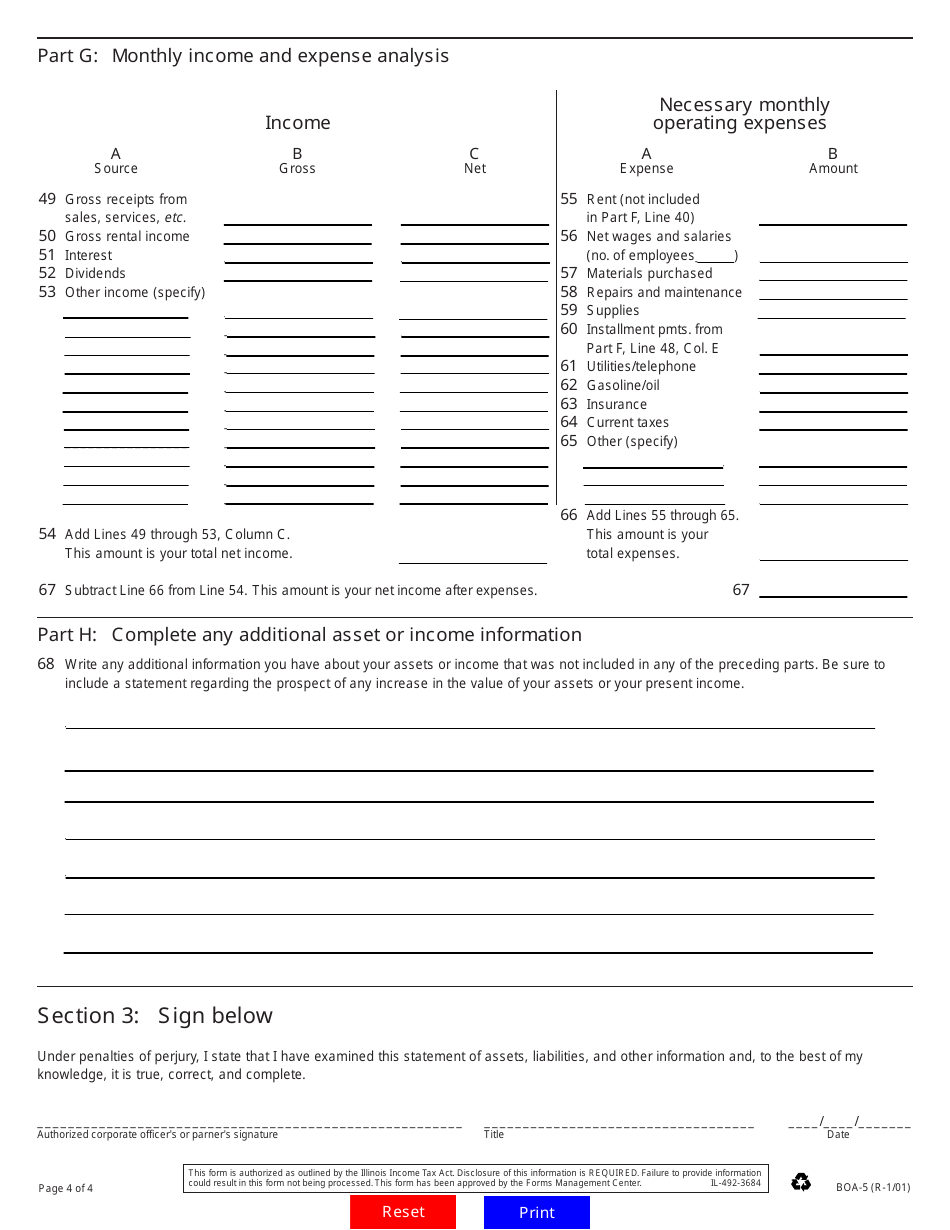

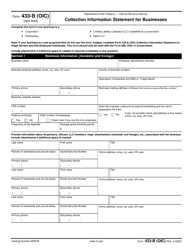

Q: What information does BOA-5 require?

A: BOA-5 requires businesses to provide detailed financial information, including income, expenses, assets, and liabilities.

Q: How often do I need to file BOA-5?

A: The filing frequency of BOA-5 may vary depending on the regulations and requirements set by the state or local authorities.

Q: Are there any filing fees for BOA-5?

A: Filing fees for BOA-5, if any, will be determined by the state or local authorities. It is recommended to check the latest fee schedule.

Q: Is BOA-5 confidential?

A: While specific confidentiality rules may apply, generally, BOA-5 is considered confidential and is protected by privacy laws.

Q: What happens if I don't file BOA-5?

A: Failure to file BOA-5, if required, may result in penalties, fines, or other legal consequences imposed by the state or local authorities.

Q: Can I request an extension to file BOA-5?

A: Extension options for filing BOA-5, if available, can vary depending on the regulations and requirements set by the state or local authorities.

Q: Are there any exemptions for BOA-5?

A: Exemptions or exceptions for BOA-5, if any, will be specified by the state or local laws and regulations.

Form Details:

- Released on January 1, 2001;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOA-5 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.