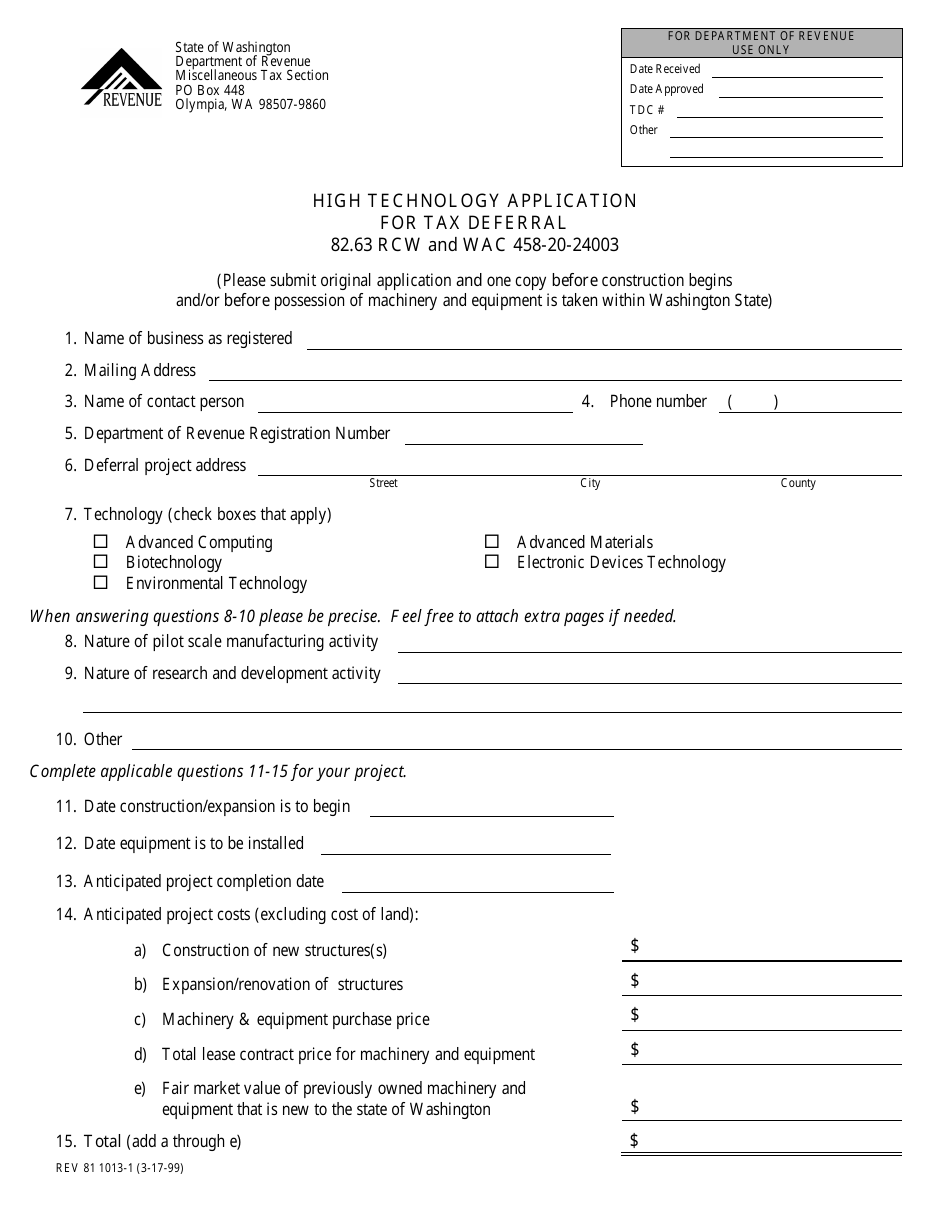

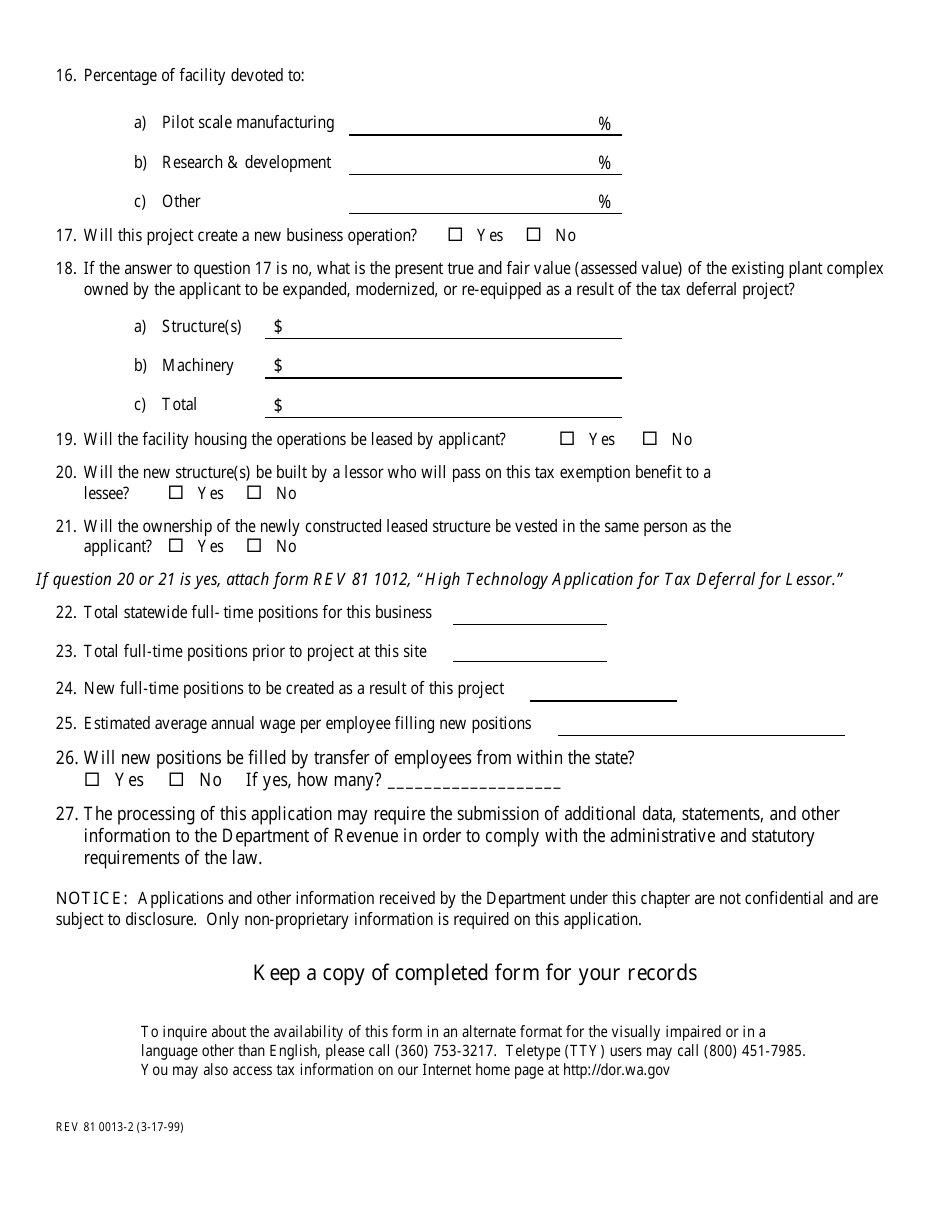

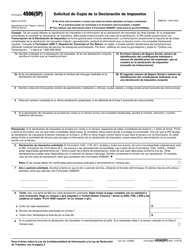

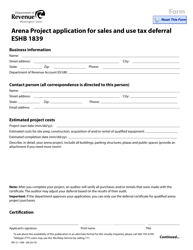

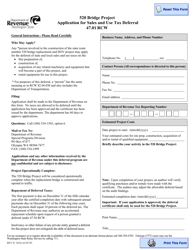

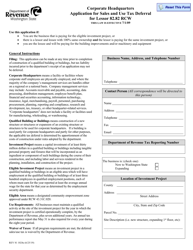

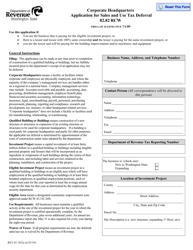

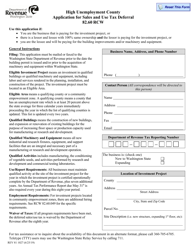

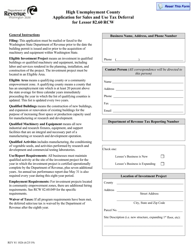

Form REV81 1013-1 High Technology Application for Tax Deferral - Washington

What Is Form REV81 1013-1?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV81 1013-1?

A: Form REV81 1013-1 is the High Technology Application for Tax Deferral in Washington.

Q: What is the purpose of Form REV81 1013-1?

A: The purpose of Form REV81 1013-1 is to apply for tax deferral for high technology businesses in Washington.

Q: Who needs to fill out Form REV81 1013-1?

A: High technology businesses in Washington who wish to apply for tax deferral need to fill out Form REV81 1013-1.

Q: What is tax deferral?

A: Tax deferral is a program that allows eligible high technology businesses in Washington to defer paying certain taxes.

Q: What are the eligibility requirements for tax deferral?

A: To be eligible for tax deferral, a business must meet specific criteria related to the industry, employment, investments, and research and development activities.

Q: What taxes can be deferred with Form REV81 1013-1?

A: Form REV81 1013-1 allows for the deferral of certain taxes, including state and local sales and use taxes, leasehold excise taxes, and business and occupation taxes.

Q: Are there any deadlines to submit Form REV81 1013-1?

A: Yes, Form REV81 1013-1 must be submitted before the eligible high technology business begins operations or applies for any of the specified tax incentives.

Q: Is there a fee for filing Form REV81 1013-1?

A: No, there is no fee for filing Form REV81 1013-1.

Q: Can an eligible high technology business apply for tax deferral retroactively?

A: No, tax deferral is not available retroactively. The application must be submitted before the business begins operations or applies for any tax incentives.

Form Details:

- Released on March 17, 1999;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV81 1013-1 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.