This version of the form is not currently in use and is provided for reference only. Download this version of

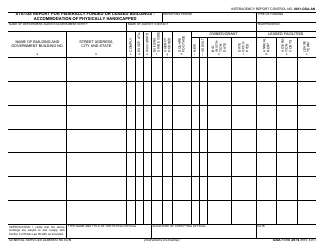

Form ST-3t

for the current year.

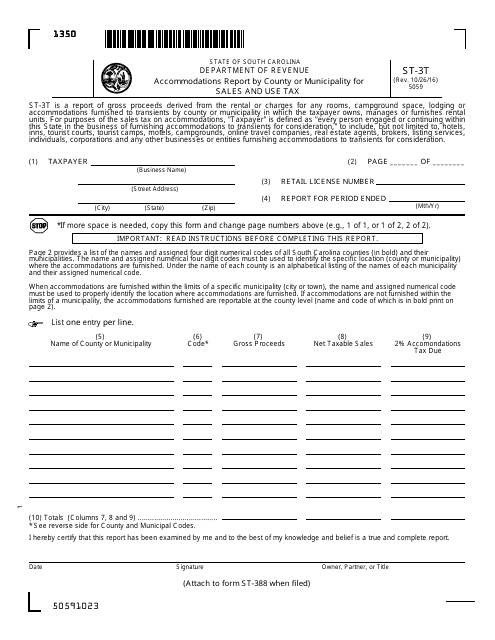

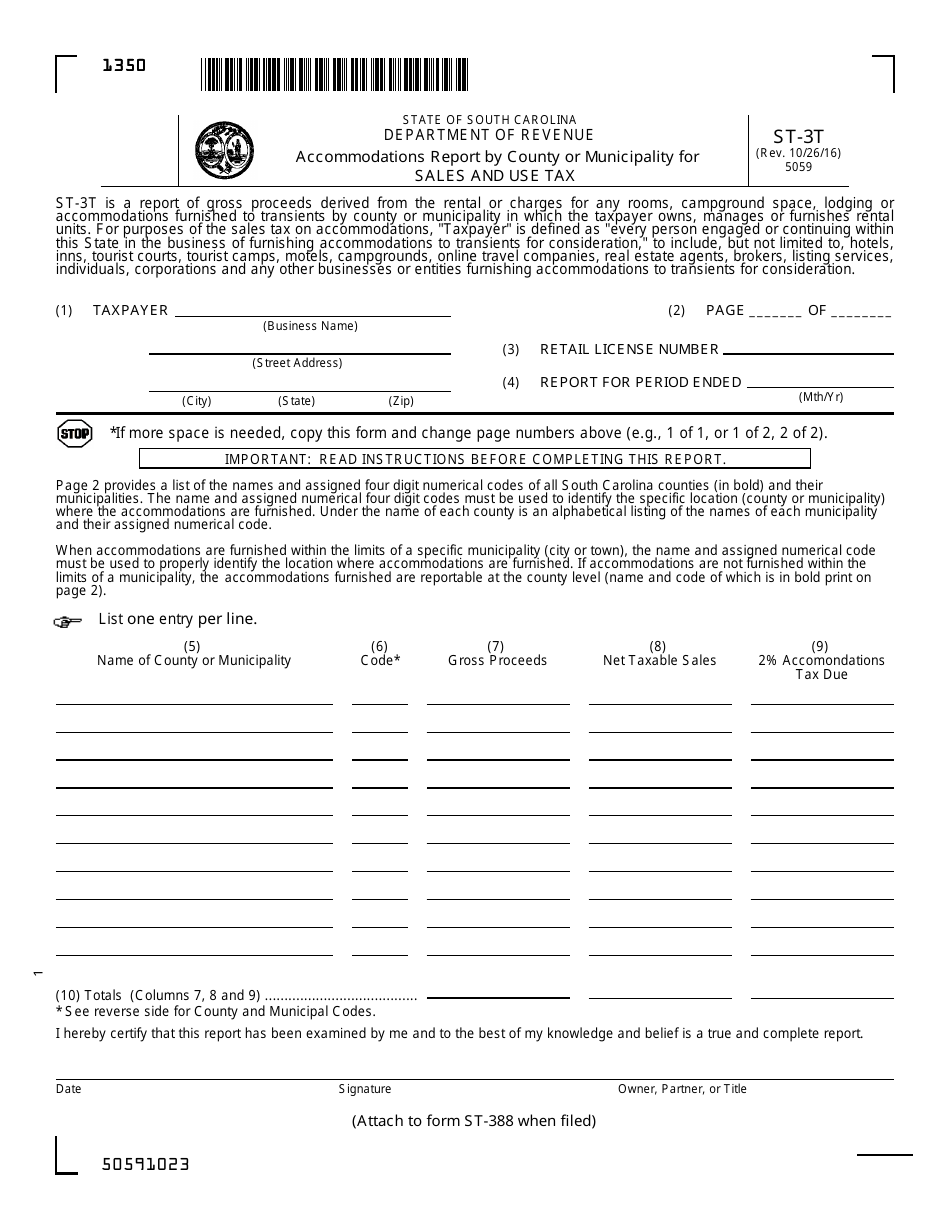

Form ST-3t Accommodations Report by County or Municipality for Sales and Use Tax - South Carolina

What Is Form ST-3t?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-3t?

A: Form ST-3t is the Accommodations Report by County or Municipality for Sales and Use Tax in South Carolina.

Q: Who needs to file Form ST-3t?

A: Anyone who owns or operates an accommodation facility in South Carolina must file Form ST-3t.

Q: What is the purpose of Form ST-3t?

A: Form ST-3t is used to report the sales and use tax collected from customers staying at an accommodation facility.

Q: How often do I need to file Form ST-3t?

A: Form ST-3t must be filed on a monthly basis.

Q: What information do I need to complete Form ST-3t?

A: You will need to provide information about your accommodation facility, including total room rentals, sales and use tax collected, and any exemptions or deductions.

Q: Are there any penalties for not filing Form ST-3t?

A: Yes, failure to file Form ST-3t or underreporting sales and use tax can result in penalties and interest charges.

Q: Are there any exemptions or deductions available for Form ST-3t?

A: Yes, certain exemptions and deductions may apply, such as tax-exempt government or nonprofit entities.

Form Details:

- Released on October 26, 2016;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-3t by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.