Form ST-124 Certificate of Capital Improvement - New York

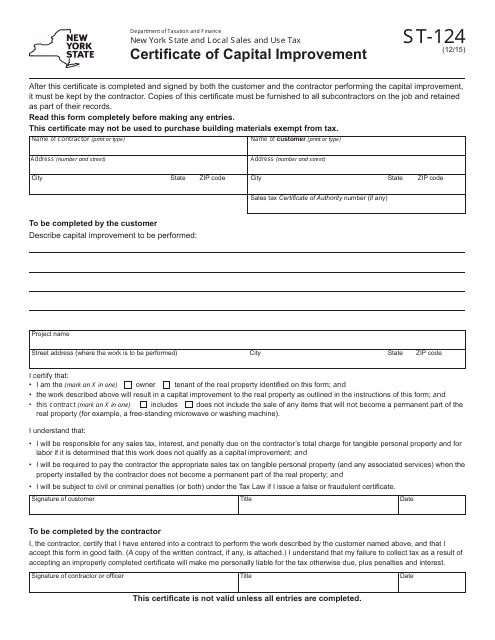

What Is Form ST-124?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-124?

A: Form ST-124 is the Certificate of Capital Improvement for the state of New York.

Q: What is a Certificate of Capital Improvement?

A: A Certificate of Capital Improvement is a document used to claim a sales tax exemption on qualifying capital improvements made to real property.

Q: What is the purpose of Form ST-124?

A: The purpose of Form ST-124 is to allow businesses or individuals to certify that certain capital improvements are eligible for a sales tax exemption in New York.

Q: Who needs to fill out Form ST-124?

A: Businesses or individuals who make qualifying capital improvements and want to claim a sales tax exemption in New York need to fill out Form ST-124.

Q: What are qualifying capital improvements?

A: Qualifying capital improvements are improvements made to real property that are permanent and add value to the property. They typically include things like construction, renovation, or installation of fixtures.

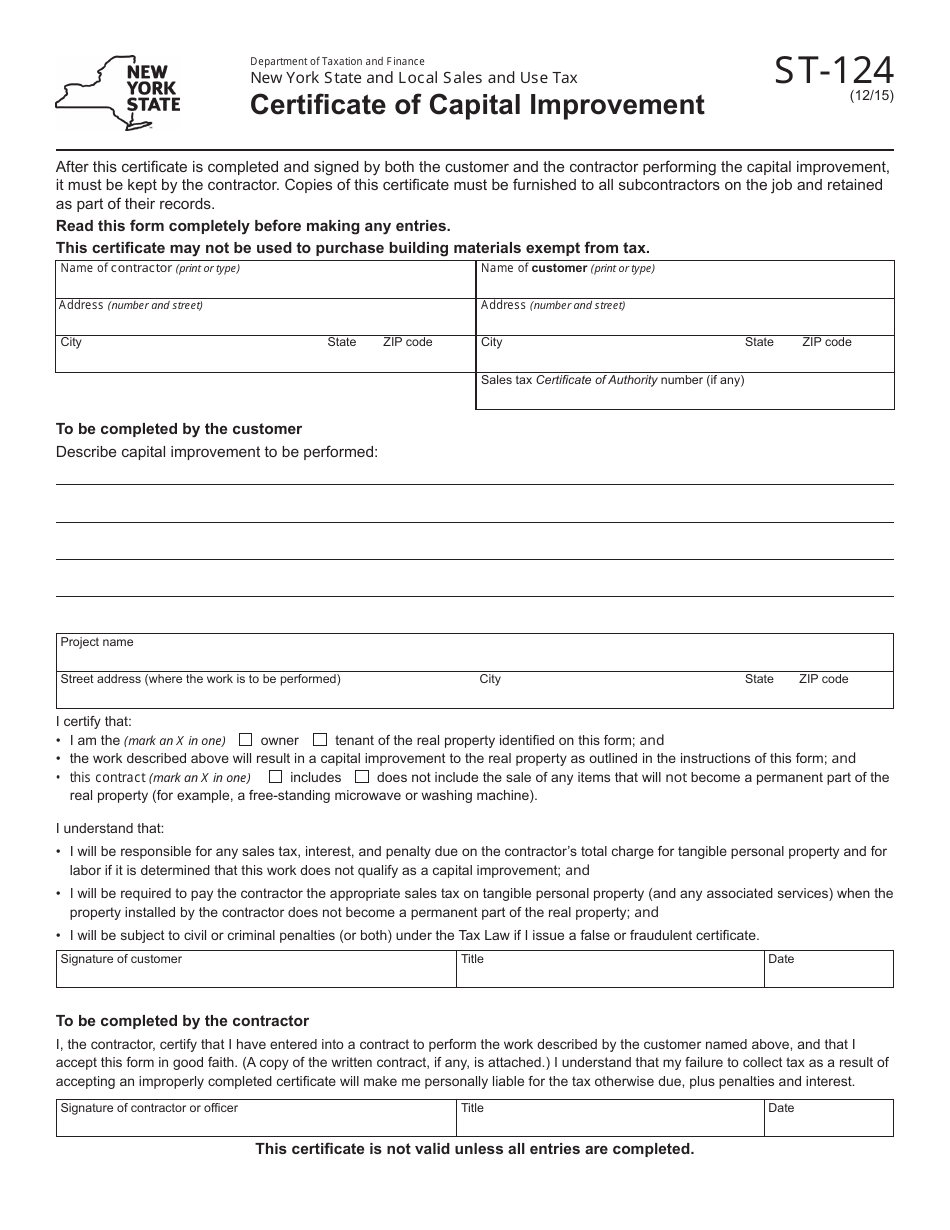

Q: How do I fill out Form ST-124?

A: Form ST-124 requires you to provide information about the taxpayer, the property, and the capital improvements made. You also need to attach supporting documentation, such as invoices or contracts.

Q: Is there a deadline for filing Form ST-124?

A: Yes, Form ST-124 should be filed within 90 days of the completion of the capital improvement project.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-124 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

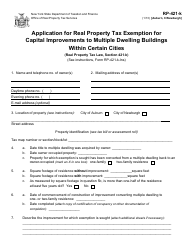

![Document preview: Form RP-421-J [COHOES] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Cohoes, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349863/form-rp-421-j-cohoes-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-cohoes-new-york.png)

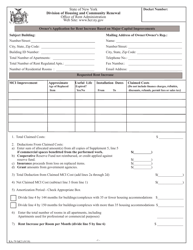

![Document preview: Form RP-421-I [ALBANY] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Albany, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349867/form-rp-421-i-albany-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-albany-new-york.png)

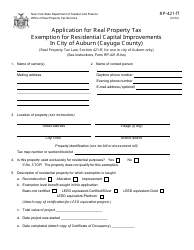

![Document preview: Form RP-421-N [ONEONTA] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Oneonta, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349854/form-rp-421-n-oneonta-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-oneonta-new-york.png)

![Document preview: Form RP-421-I [BUFFALO] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - City of Buffalo, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349865/form-rp-421-i-buffalo-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-city-of-buffalo-new-york.png)

![Document preview: Form RP-421-H [LOCKPORT/PEEKSKILL] Application for Real Property Tax Exemption for Capital Improvements to Multiple Dwelling Buildings Within Certain Cities - Cities of Lockport/Peekskiill, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349869/form-rp-421-h-lockport-peekskill-application-for-real-property-tax-exemption-for-capital-improvements-to-multiple-dwelling-buildings-within-certain-cities-cities-of-lockport-peekskiill-new-york.png)