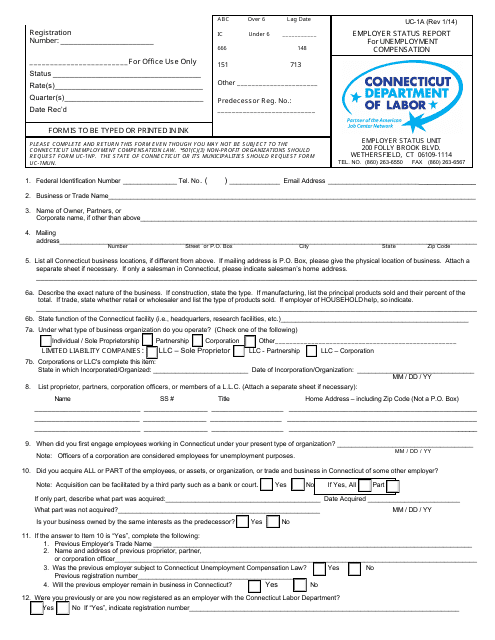

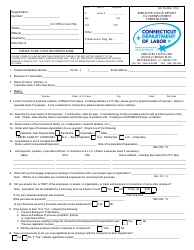

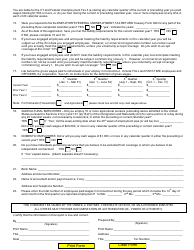

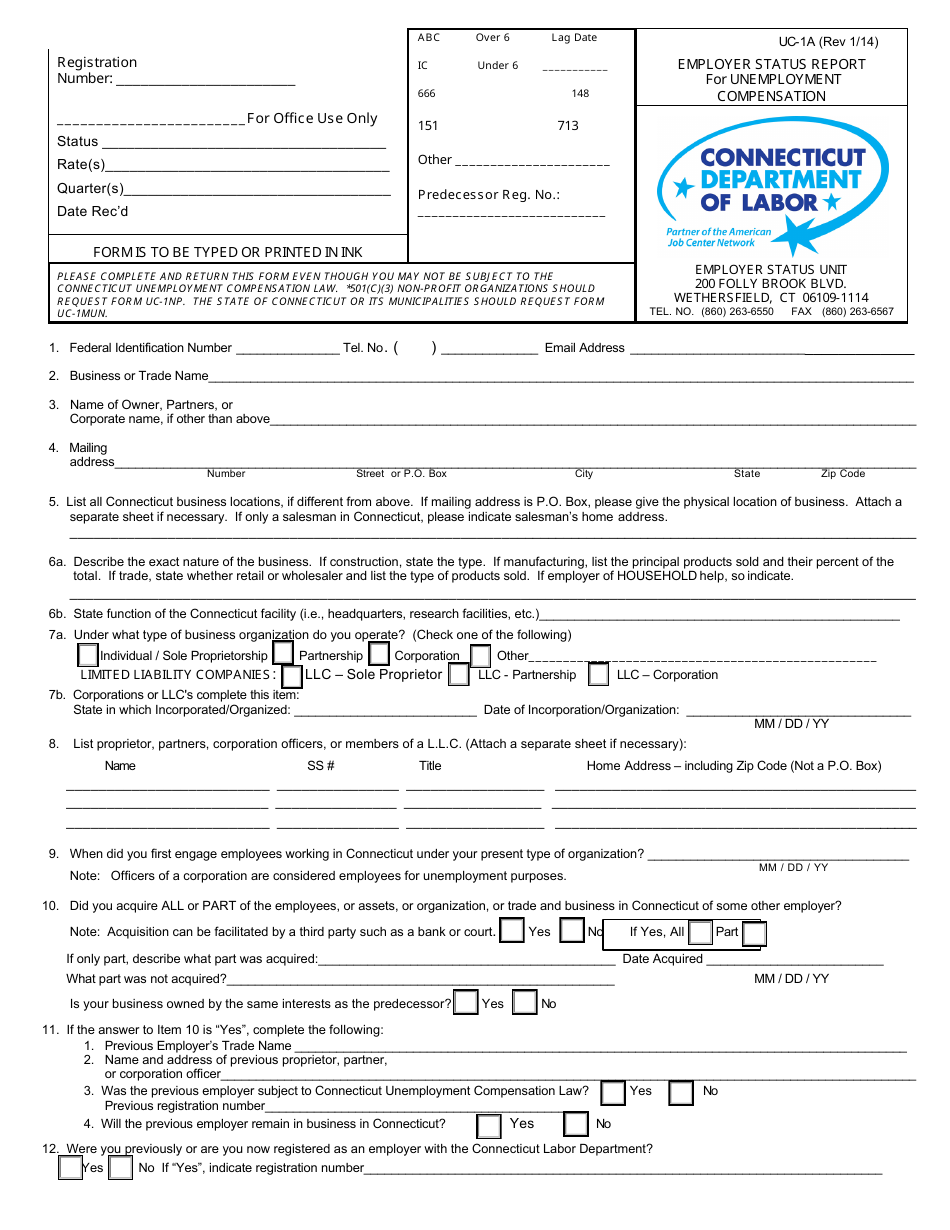

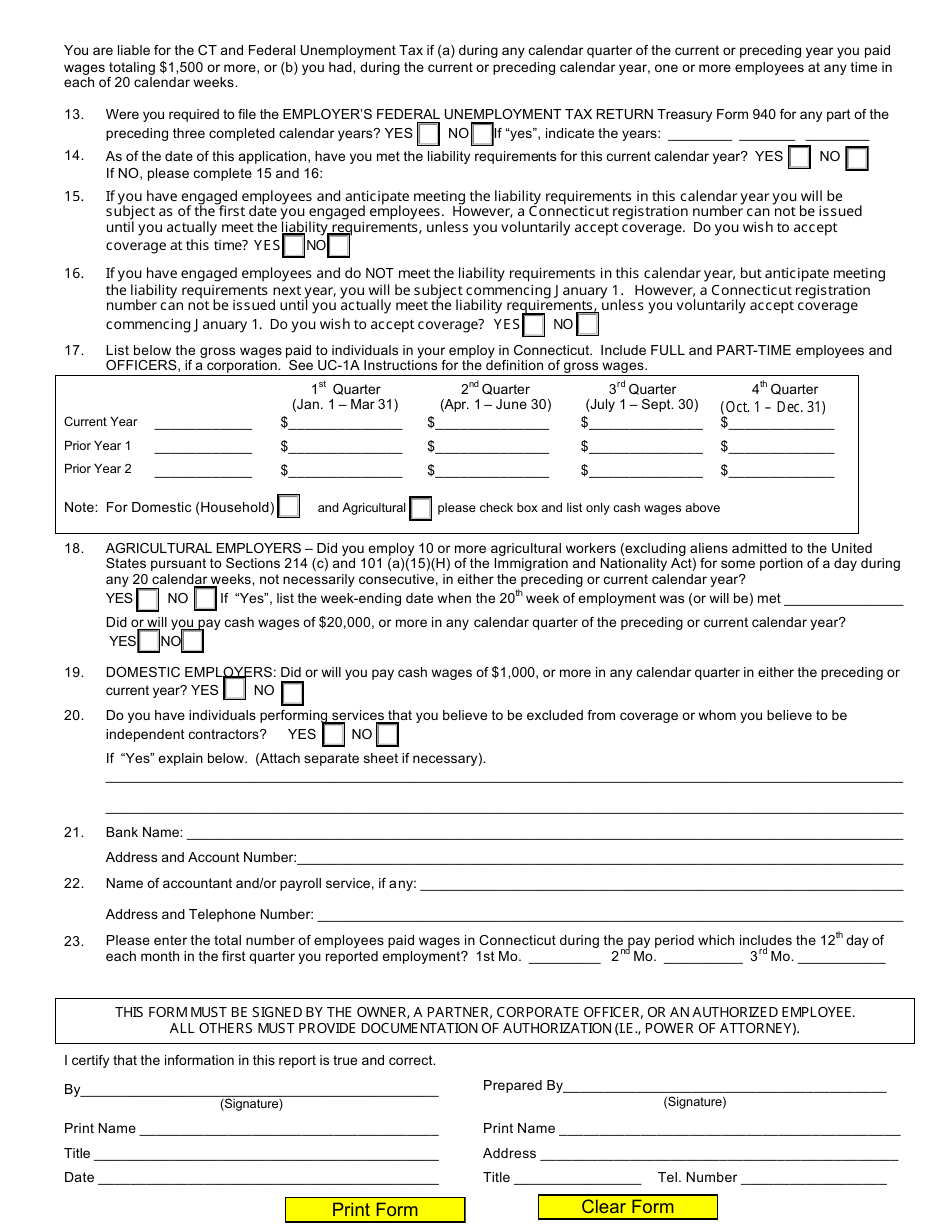

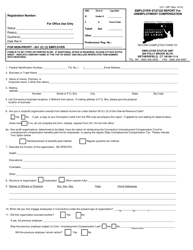

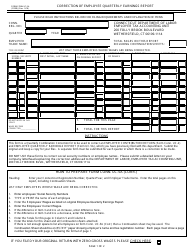

Form UC-1A Employer Status Report for Unemployment Compensation - Connecticut

What Is Form UC-1A?

This is a legal form that was released by the Connecticut Department of Labor - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UC-1A?

A: Form UC-1A is the Employer Status Report for Unemployment Compensation in Connecticut.

Q: Why do employers need to file Form UC-1A?

A: Employers need to file Form UC-1A to report their employment status for the purpose of unemployment compensation.

Q: Who needs to file Form UC-1A?

A: All employers in Connecticut who are subject to the state's unemployment compensation laws need to file Form UC-1A.

Q: When does Form UC-1A need to be filed?

A: Form UC-1A needs to be filed within 10 days after becoming subject to the state's unemployment compensation laws or after changing the existing ownership or organization of a business.

Q: Are there any penalties for not filing Form UC-1A?

A: Yes, failure to file Form UC-1A or filing it late may result in penalties and interest charges.

Q: Is Form UC-1A the only form that employers need to file for unemployment compensation?

A: No, in addition to Form UC-1A, employers may also need to file other forms such as Form UC-5A, Employer's Quarterly Wage Report.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Connecticut Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UC-1A by clicking the link below or browse more documents and templates provided by the Connecticut Department of Labor.