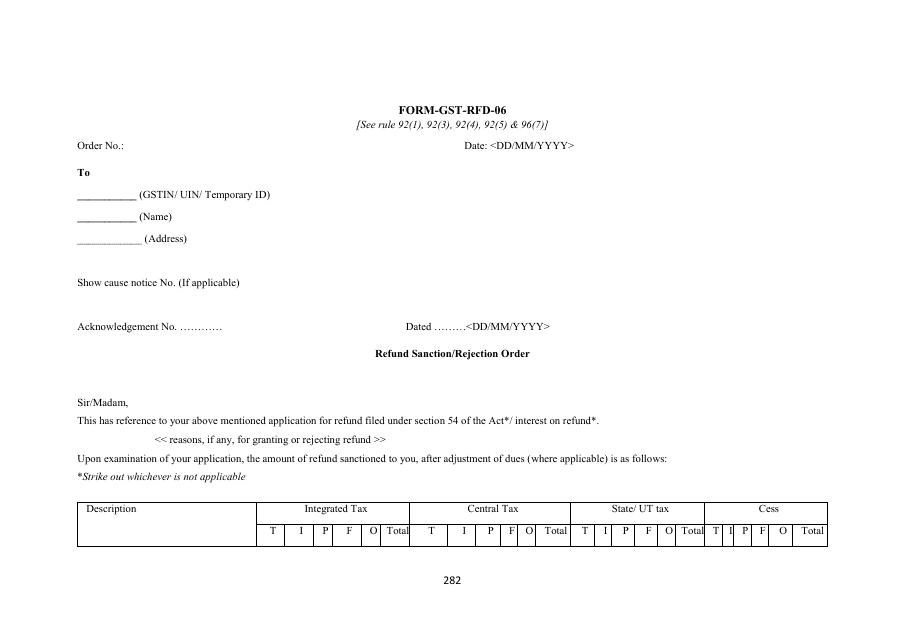

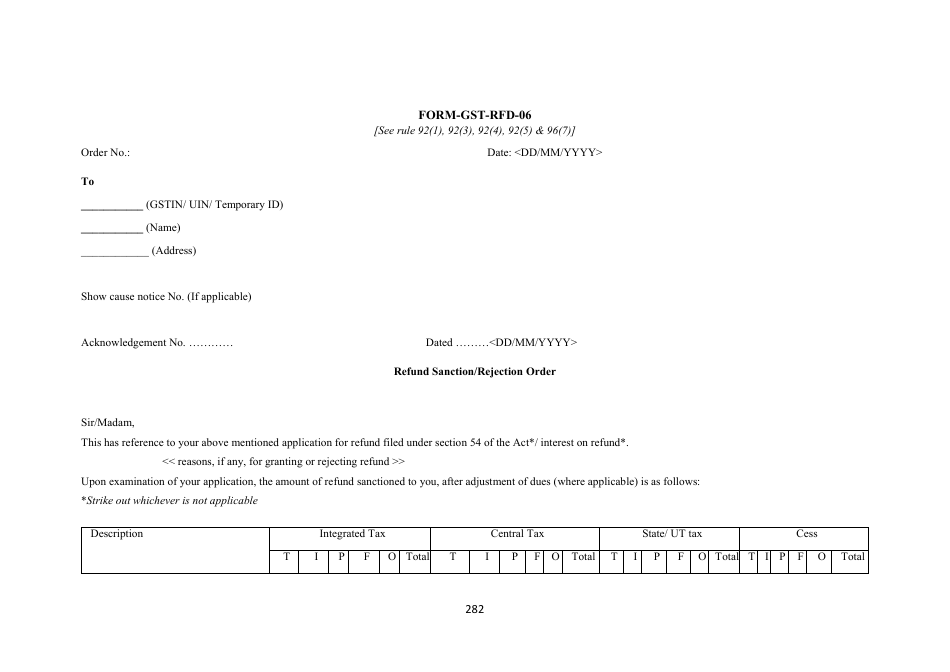

Form GST-RFD-06 Refund Sanction / Rejection Order - India

Form GST-RFD-06 Refund Sanction/Rejection Order in India is used to communicate the decision of the tax authorities regarding a refund claim made by a taxpayer under the Goods and Services Tax (GST) system. It states whether the refund claim is approved or rejected.

The Form GST-RFD-06 Refund Sanction/Rejection Order in India is filed by the appropriate officer in the Goods and Services Tax (GST) department.

FAQ

Q: What is Form GST-RFD-06?

A: Form GST-RFD-06 is a document used in India for refund sanction/rejection orders.

Q: What is the purpose of Form GST-RFD-06?

A: The purpose of Form GST-RFD-06 is to communicate the decision on refund claims to the taxpayer.

Q: Who uses Form GST-RFD-06?

A: Form GST-RFD-06 is used by the tax authorities in India to issue refund sanction/rejection orders.

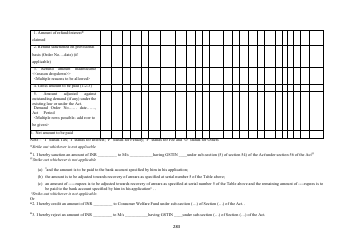

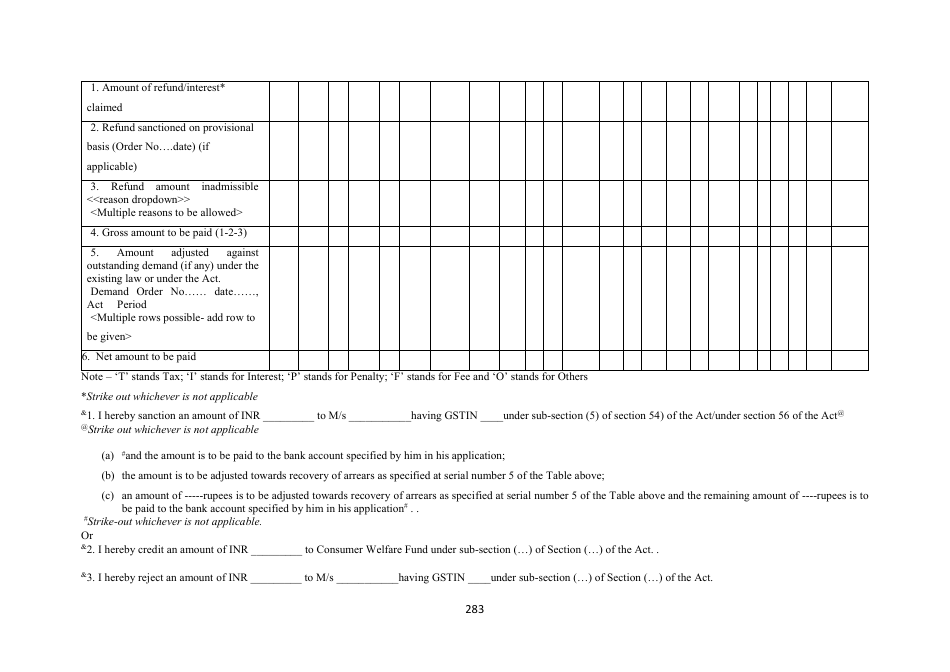

Q: What information is included in Form GST-RFD-06?

A: Form GST-RFD-06 includes details of the refund claim, reasons for sanction/rejection, and the amount approved or rejected.

Q: What should I do if my refund claim is rejected in Form GST-RFD-06?

A: If your refund claim is rejected in Form GST-RFD-06, you should review the reasons provided and address any issues or discrepancies before reapplying for the refund.

Q: Can I appeal against a rejection in Form GST-RFD-06?

A: Yes, you can file an appeal against the rejection of a refund claim in Form GST-RFD-06 with the appropriate appellate authority.

Q: Is Form GST-RFD-06 applicable only to businesses?

A: No, Form GST-RFD-06 is applicable to both businesses and individuals who are eligible for GST refunds.

Q: Is there a time limit for issuing Form GST-RFD-06?

A: Yes, as per the GST laws in India, Form GST-RFD-06 should be issued within sixty days from the date of receipt of the refund claim.

Q: What should I do if I do not receive Form GST-RFD-06 within the specified time?

A: If you do not receive Form GST-RFD-06 within the specified time, you can follow up with the tax authorities or seek assistance from a GST practitioner.