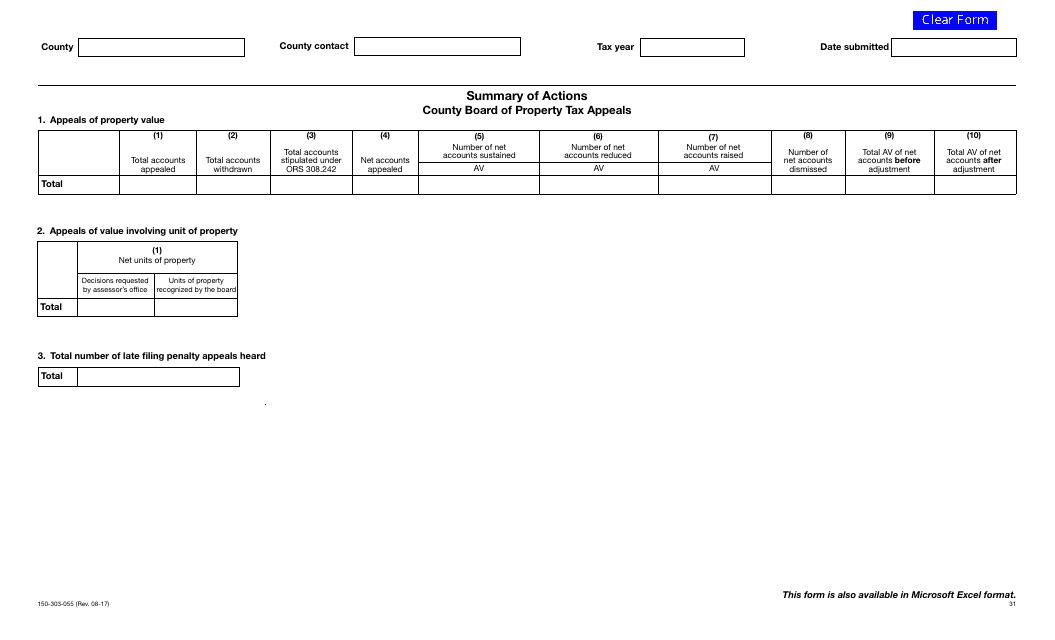

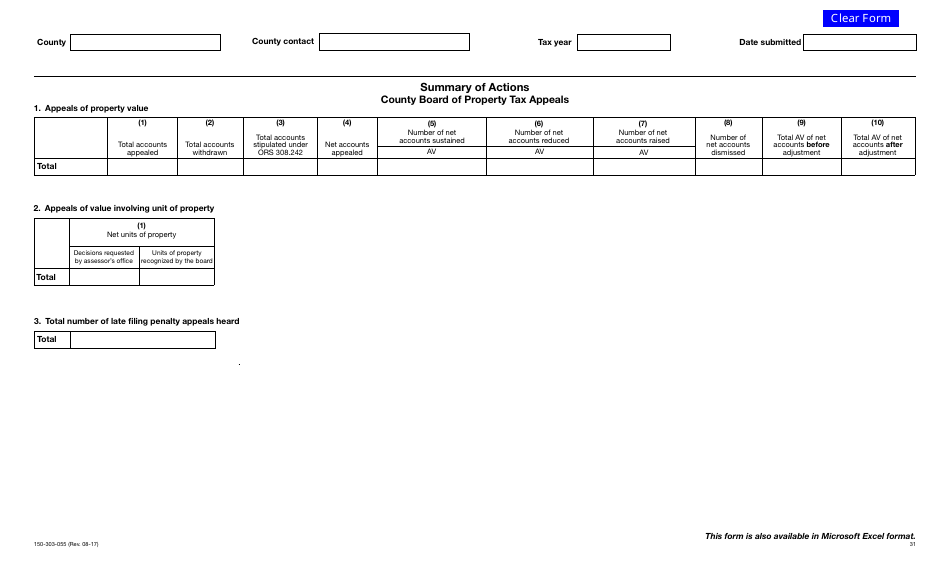

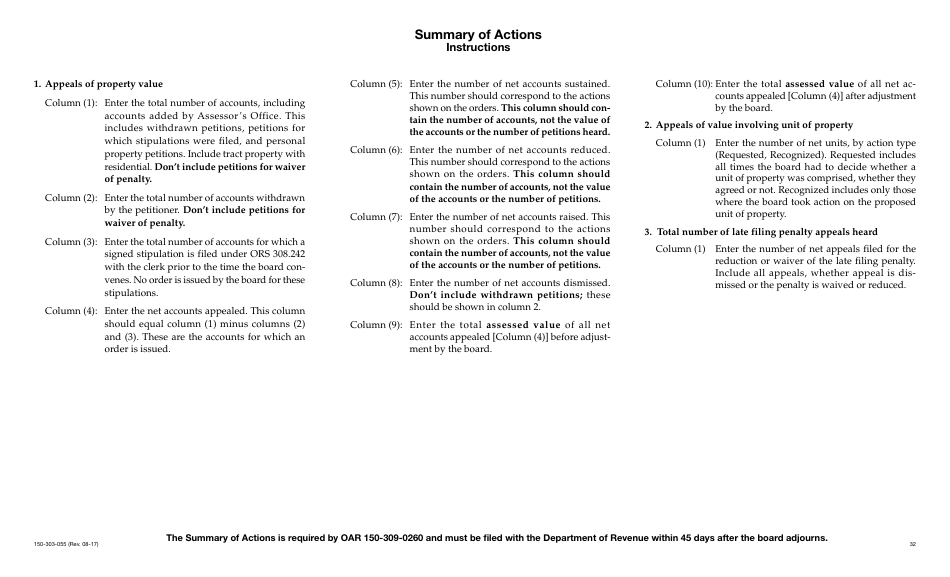

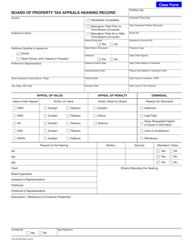

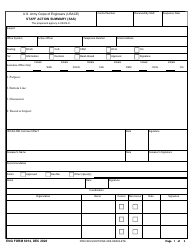

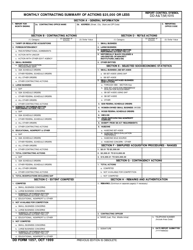

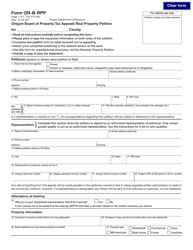

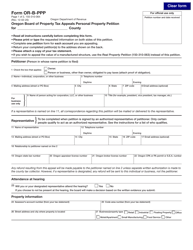

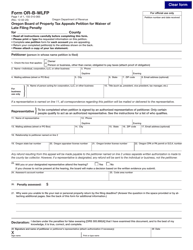

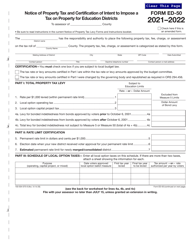

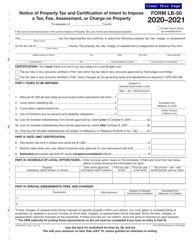

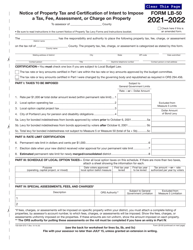

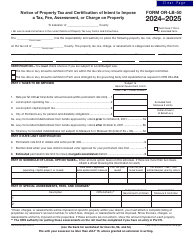

Form 150-303-055 Summary of Actions - County Board of Property Tax Appeals Form - Oregon

What Is Form 150-303-055?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-303-055?

A: Form 150-303-055 is a Summary of Actions form used by the County Board of Property Tax Appeals in Oregon.

Q: When is Form 150-303-055 used?

A: Form 150-303-055 is used to summarize the actions taken by the County Board of Property Tax Appeals regarding property tax appeals.

Q: What information is required on Form 150-303-055?

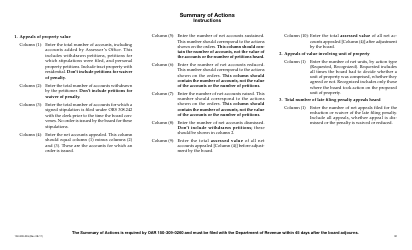

A: Form 150-303-055 requires information such as the tax year, property identification, petitioner's name, and details of the actions taken by the Board.

Q: Do I need to file Form 150-303-055 if I have an ongoing property tax appeal?

A: Yes, it is important to file Form 150-303-055 to document the actions taken by the County Board of Property Tax Appeals during the appeal process.

Q: Can I submit Form 150-303-055 electronically?

A: The availability of electronic submission may vary by county. It is best to check with your local County Board of Property Tax Appeals office for their accepted methods of submission.

Q: Is there a deadline to file Form 150-303-055?

A: The deadline to file Form 150-303-055 may vary by county. It is important to check with your local County Board of Property Tax Appeals office for their specific deadlines.

Q: What will happen after I submit Form 150-303-055?

A: After you submit Form 150-303-055, the County Board of Property Tax Appeals will review the information provided and take appropriate actions on your property tax appeal.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-055 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.