The Growth Effects of Corporate Tax Reform and Implications for Wages

The Growth Effects of Corporate Tax Reform and Implications for Wages is a 41-page legal document that was released by the Executive Office of the President of the United States on October 1, 2017 and used nation-wide.

FAQ

Q: What is the topic of the document?

A: The growth effects of corporate tax reform and implications for wages.

Q: What does the document discuss?

A: The document discusses the impact of corporate tax reform on economic growth and wages.

Q: What are the implications of corporate tax reform?

A: Corporate tax reform can potentially lead to increased economic growth and have implications for wages.

Q: What is corporate tax reform?

A: Corporate tax reform refers to changes in the tax policies that affect businesses and corporations.

Q: How does corporate tax reform impact economic growth?

A: Corporate tax reform can stimulate economic growth by encouraging businesses to invest and expand.

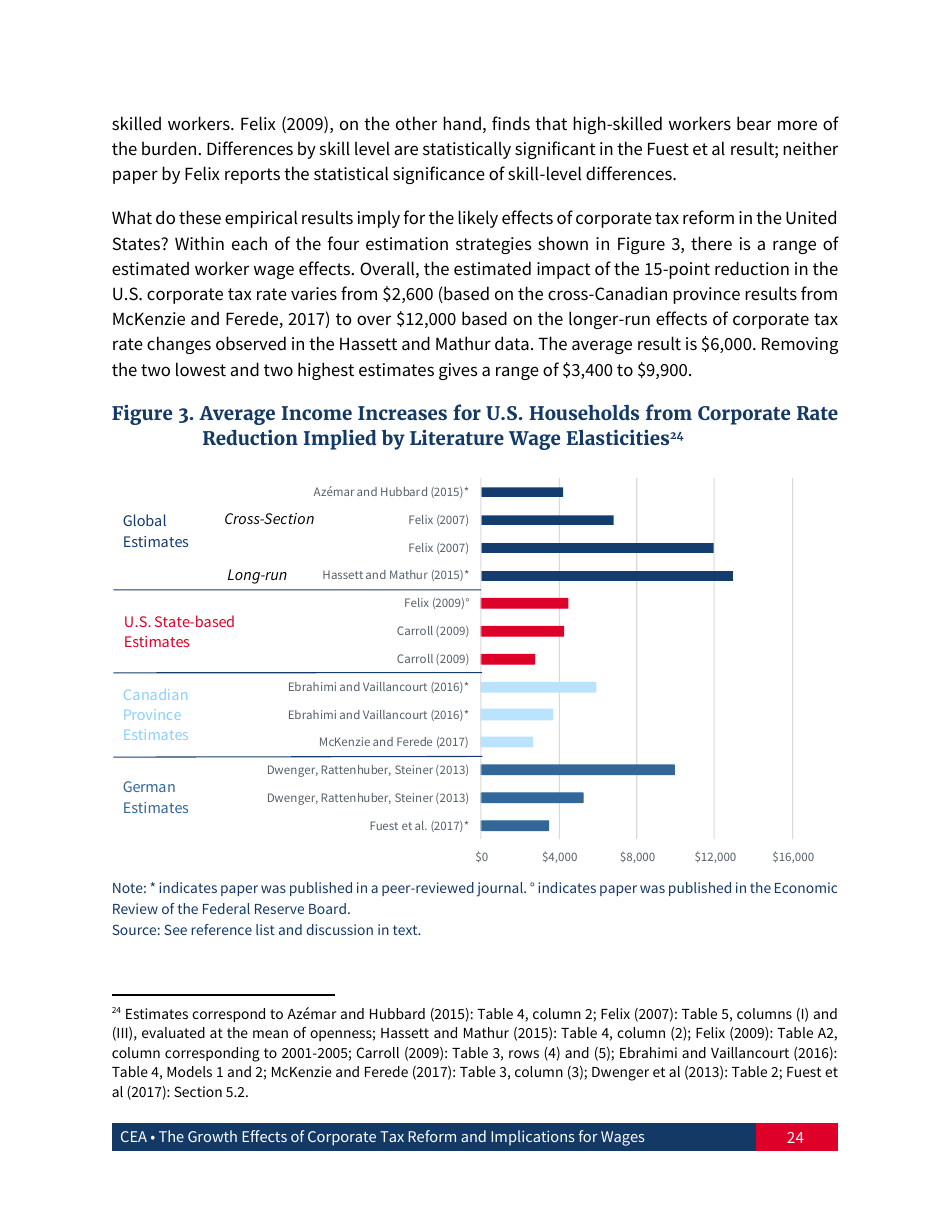

Q: What are the potential effects of corporate tax reform on wages?

A: Corporate tax reform can potentially lead to higher wages for workers as businesses may have more resources available.

Q: Why is corporate tax reform important?

A: Corporate tax reform is important as it can have significant implications for economic growth and wages.

Q: Who is affected by corporate tax reform?

A: Corporate tax reform affects businesses, corporations, and potentially workers through its impact on economic growth and wages.

Q: What are some examples of corporate tax reform?

A: Examples of corporate tax reform include changes in tax rates, deductions, and credits for businesses.

Q: Are there any risks associated with corporate tax reform?

A: Yes, there can be risks associated with corporate tax reform, such as potential revenue loss for the government.

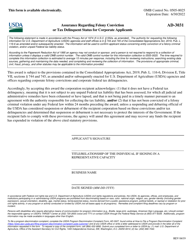

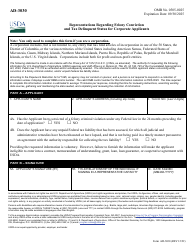

Form Details:

- The latest edition currently provided by the Executive Office of the President of the United States;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.