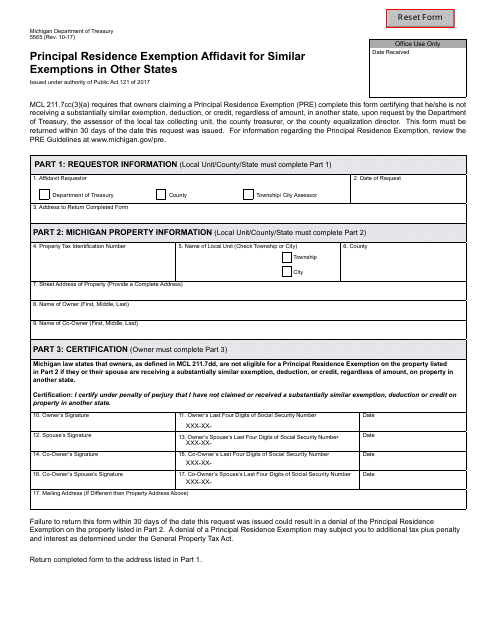

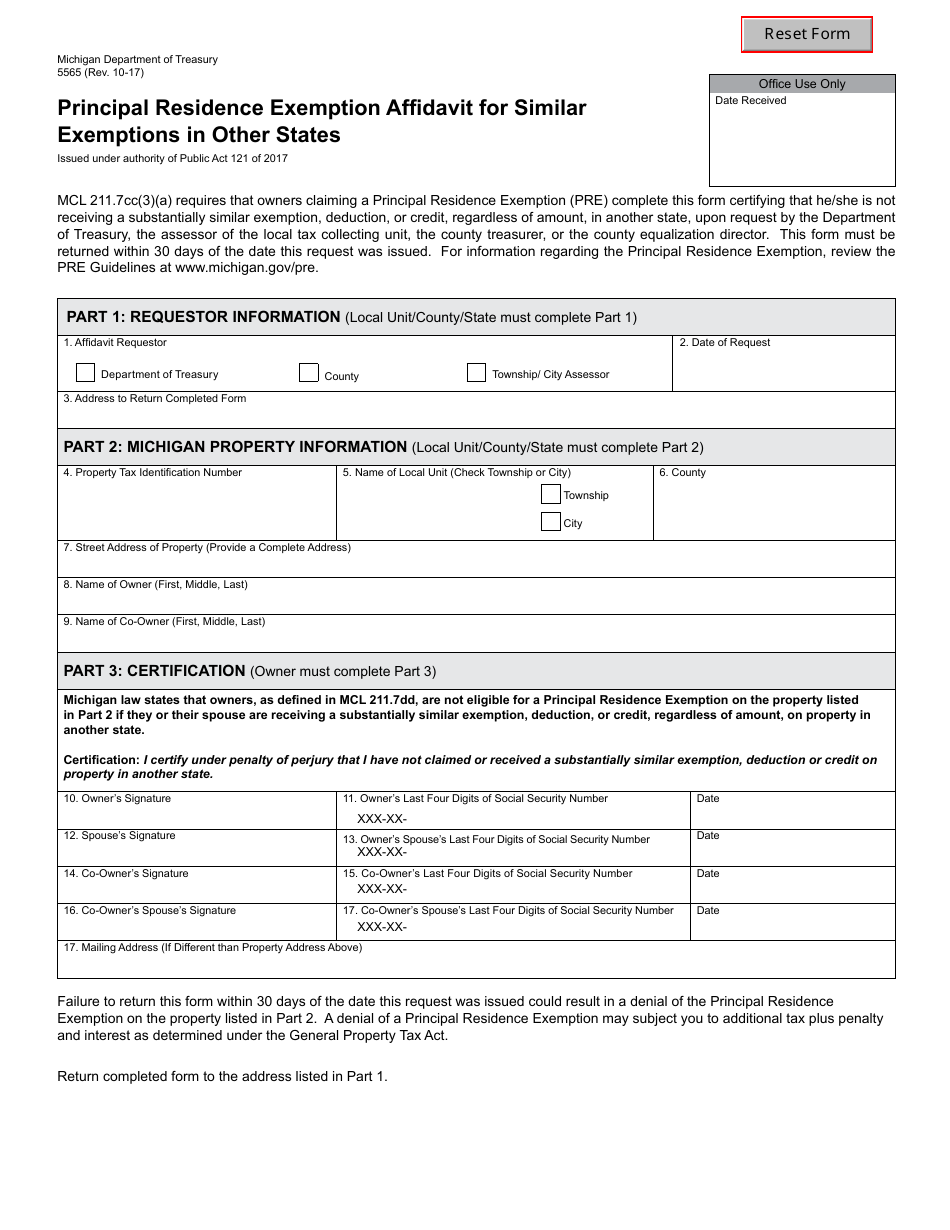

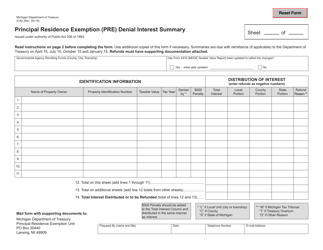

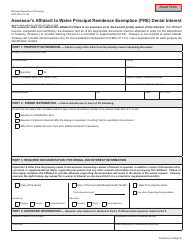

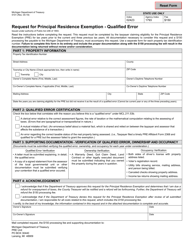

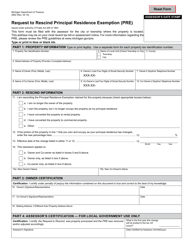

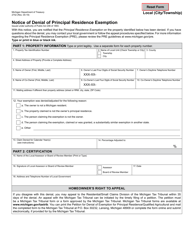

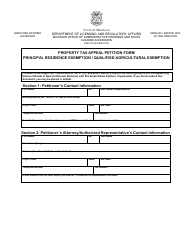

Form 5565 Principal Residence Exemption Affidavit for Similar Exemptions in Other States - Michigan

What Is Form 5565?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

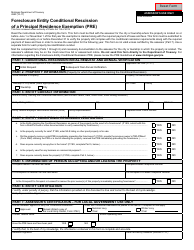

Q: What is Form 5565?

A: Form 5565 is the Principal Residence Exemption Affidavit for Similar Exemptions in Other States - Michigan.

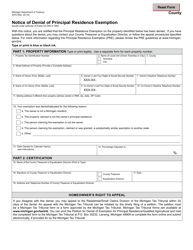

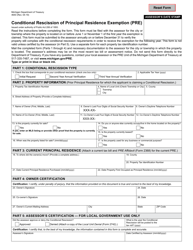

Q: What is the purpose of Form 5565?

A: The purpose of Form 5565 is to claim a principal residence exemption for a property located in another state similar to Michigan's exemption.

Q: Who should use Form 5565?

A: Property owners in Michigan who want to claim a principal residence exemption for a property located in another state should use Form 5565.

Q: Is there a deadline for filing Form 5565?

A: Yes, Form 5565 must be filed with the Michigan Department of Treasury by May 1st of the year following the year in which the exemption is claimed.

Q: Are there any fees associated with filing Form 5565?

A: No, there are no fees associated with filing Form 5565.

Q: What supporting documentation do I need to submit with Form 5565?

A: You may need to submit documentation such as a property tax statement, proof of residence in the other state, and proof of ownership or rental agreement.

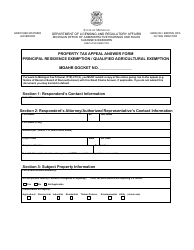

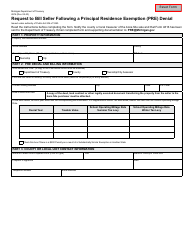

Q: Can I claim a principal residence exemption in both Michigan and another state?

A: No, you can only claim a principal residence exemption in one state.

Q: What happens if I don't file Form 5565?

A: If you don't file Form 5565, you will not be eligible for the principal residence exemption for the property located in the other state.

Q: Can I amend Form 5565 after I have filed it?

A: Yes, you can file an amended Form 5565 if there are changes to your eligibility for the principal residence exemption.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5565 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.