This version of the form is not currently in use and is provided for reference only. Download this version of

Form 9

for the current year.

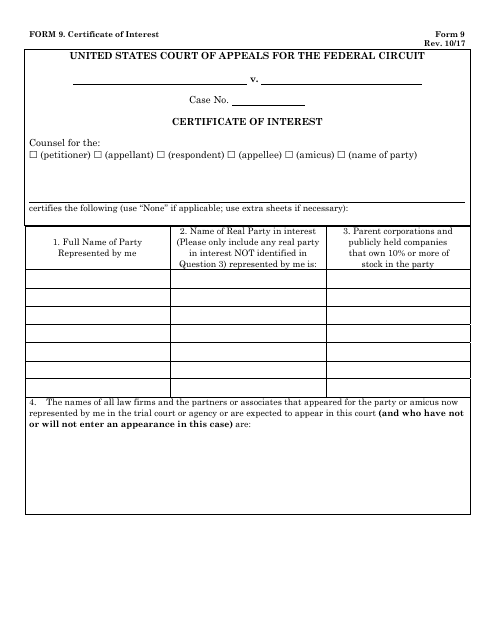

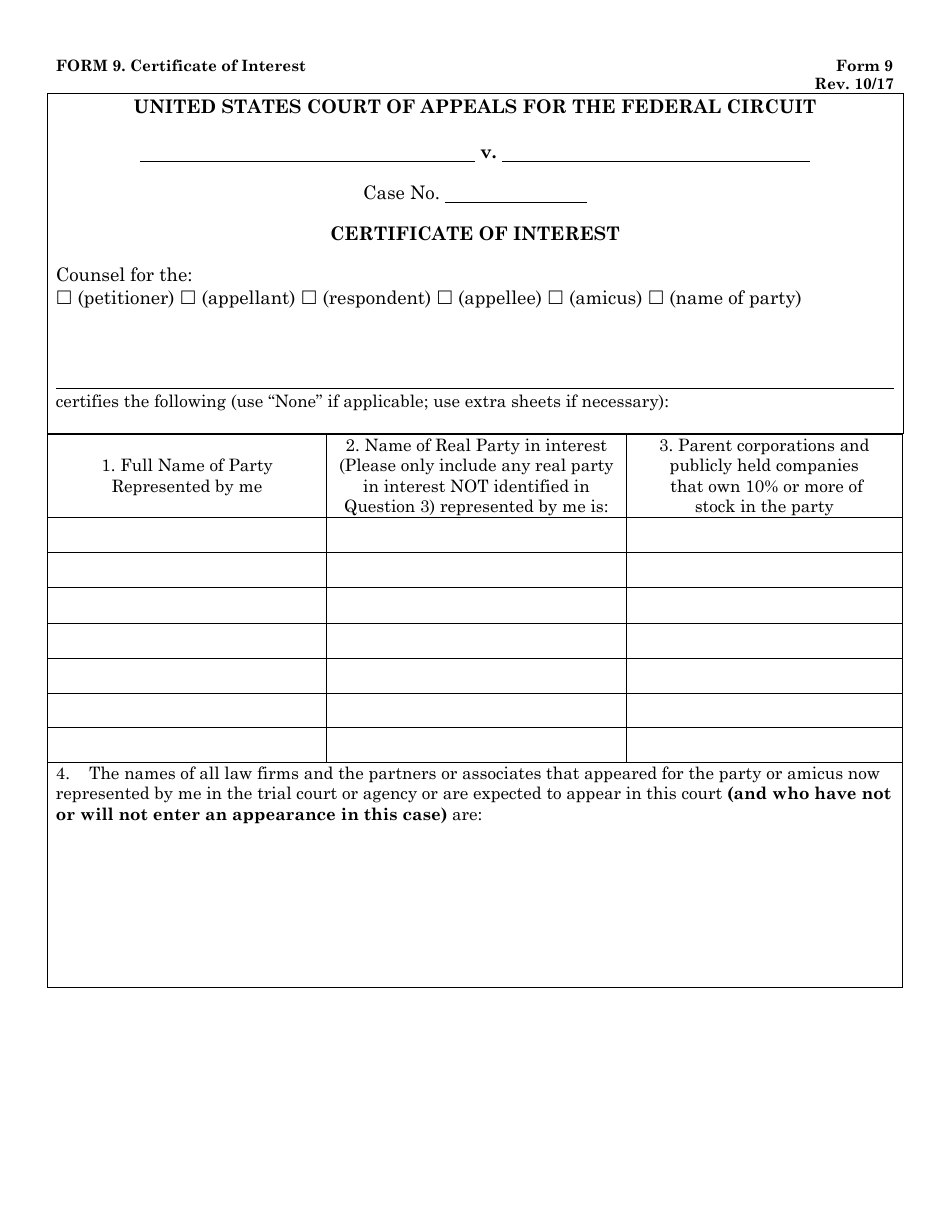

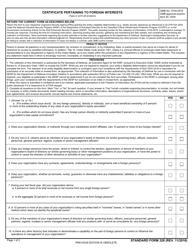

Form 9 Certificate of Interest

What Is Form 9?

This is a legal form that was released by the United States Court of Appeals for the Federal Circuit on October 1, 2017 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form 9 Certificate of Interest?

A: A Form 9 Certificate of Interest is a document that shows the amount of interest you have earned on a financial account.

Q: Who issues a Form 9 Certificate of Interest?

A: The financial institution holding your account issues the Form 9 Certificate of Interest.

Q: Why do I need a Form 9 Certificate of Interest?

A: You may need a Form 9 Certificate of Interest to report your earned interest on your tax return or for other financial purposes.

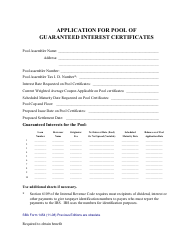

Q: What information is included in a Form 9 Certificate of Interest?

A: A Form 9 Certificate of Interest typically includes the account holder's name, account number, the amount of interest earned, and the period for which the interest was earned.

Q: How can I obtain a Form 9 Certificate of Interest?

A: You can request a Form 9 Certificate of Interest from your financial institution.

Q: Is the interest earned on my financial account taxable?

A: Yes, in most cases, the interest earned on financial accounts is taxable income.

Q: Does the Form 9 Certificate of Interest report other types of income?

A: No, the Form 9 Certificate of Interest specifically reports only the interest earned on a financial account.

Q: What should I do with the Form 9 Certificate of Interest?

A: You should keep the Form 9 Certificate of Interest for your records and provide it to the appropriate parties, such as your tax preparer, if necessary.

Form Details:

- Released on October 1, 2017;

- The latest available edition released by the United States Court of Appeals for the Federal Circuit;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 9 by clicking the link below or browse more documents and templates provided by the United States Court of Appeals for the Federal Circuit.