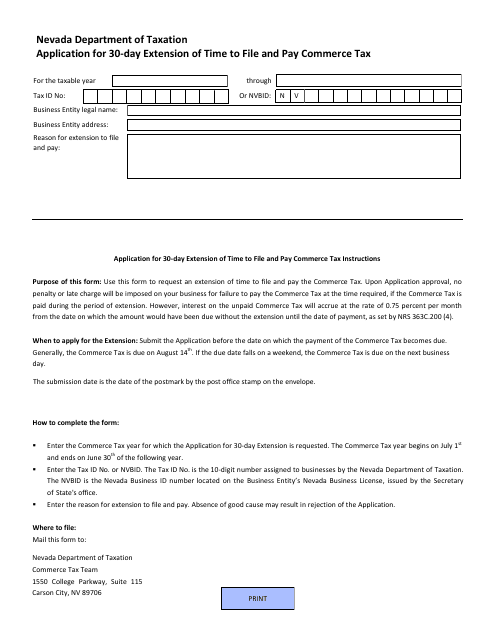

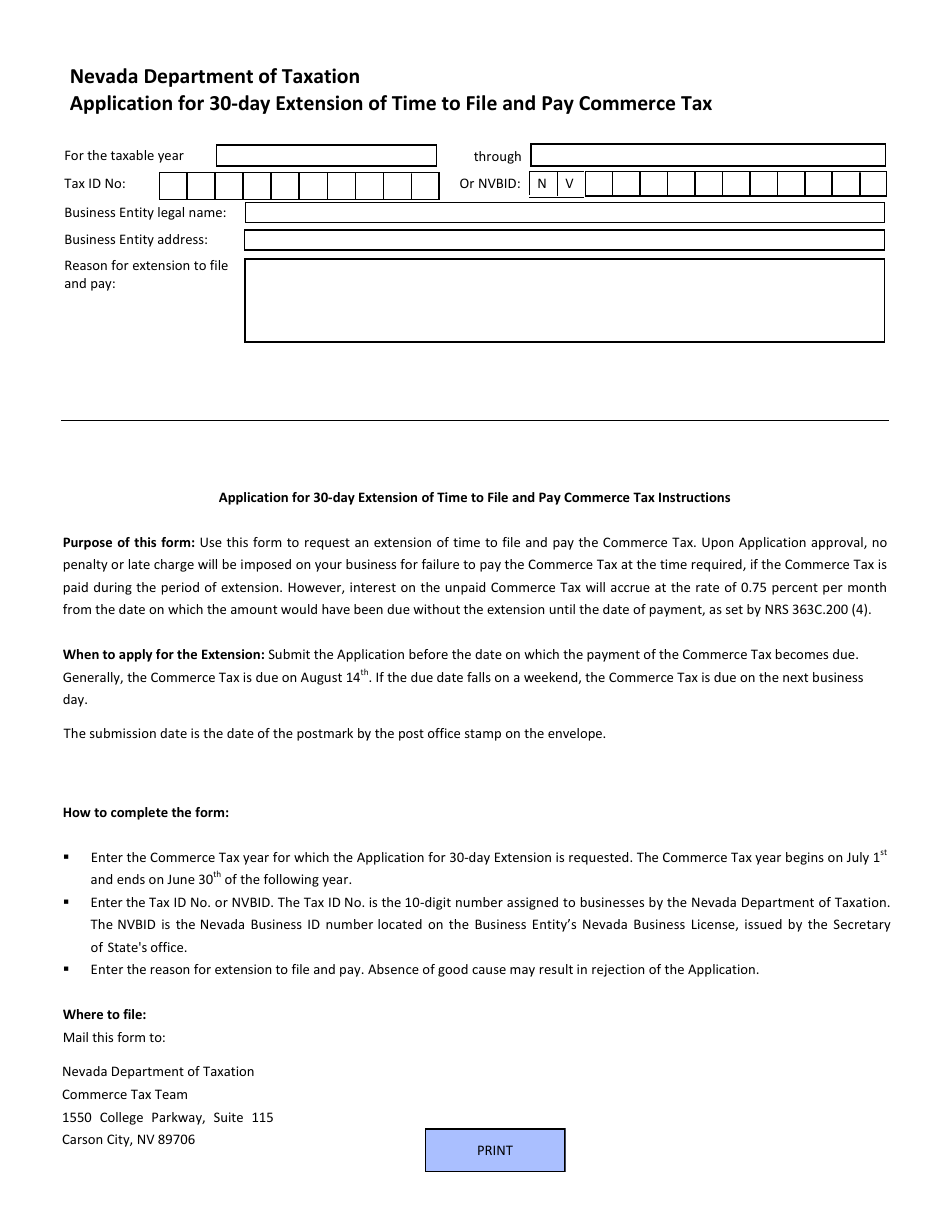

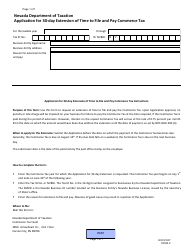

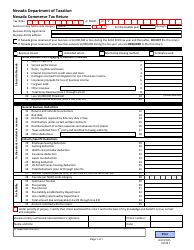

Application for 30-day Extension of Time to File and Pay Commerce Tax - Nevada

Application for 30-day Extension of Time to File and Pay Commerce Tax is a legal document that was released by the Nevada Department of Transportation - a government authority operating within Nevada.

FAQ

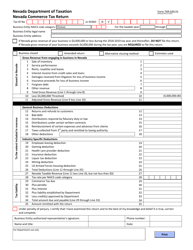

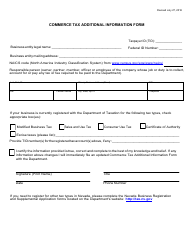

Q: What is the Commerce Tax in Nevada?

A: The Commerce Tax is a tax on businesses operating in Nevada.

Q: When is the deadline to file and pay the Commerce Tax in Nevada?

A: The deadline to file and pay the Commerce Tax in Nevada is typically on or before August 14th of each year.

Q: How can I apply for a 30-day extension of time to file and pay the Commerce Tax in Nevada?

A: You can apply for a 30-day extension by submitting an Application for 30-day Extension of Time to File and Pay Commerce Tax in Nevada.

Q: What is the purpose of the Application for 30-day Extension of Time to File and Pay Commerce Tax in Nevada?

A: The purpose of the application is to request an additional 30 days to file and pay the Commerce Tax in Nevada.

Form Details:

- The latest edition currently provided by the Nevada Department of Transportation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Transportation.