This version of the form is not currently in use and is provided for reference only. Download this version of

Form EFT-1

for the current year.

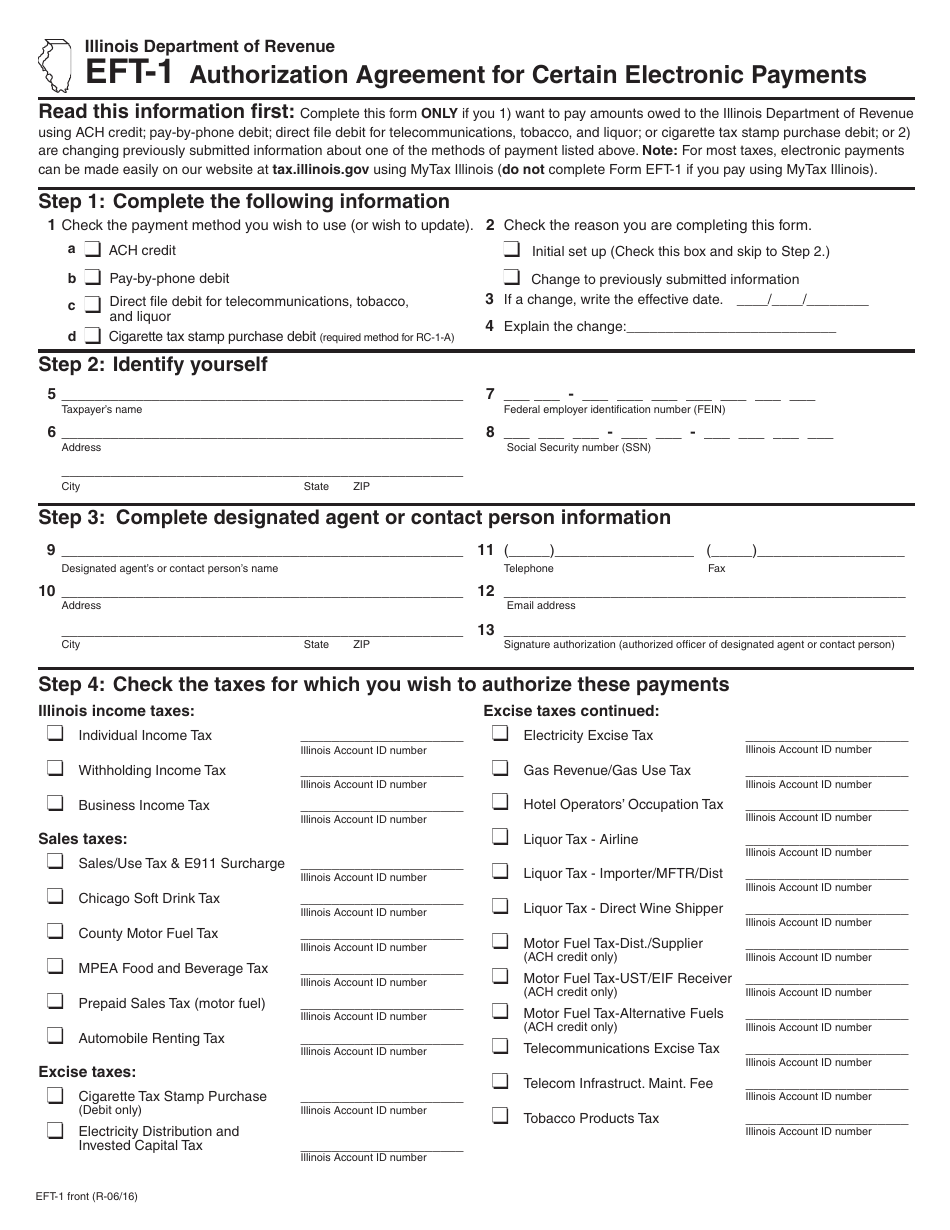

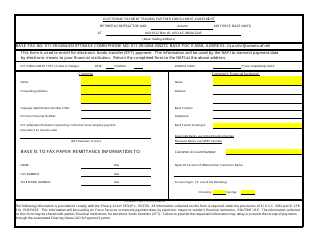

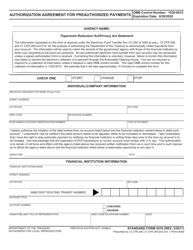

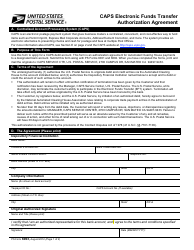

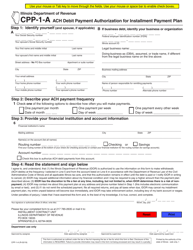

Form EFT-1 Authorization Agreement for Certain Electronic Payments - Illinois

What Is Form EFT-1?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EFT-1?

A: Form EFT-1 is an Authorization Agreement for Certain Electronic Payments.

Q: What is the purpose of Form EFT-1?

A: The purpose of Form EFT-1 is to authorize certain electronic payments.

Q: Who needs to fill out Form EFT-1?

A: Anyone who wants to authorize electronic payments in Illinois needs to fill out Form EFT-1.

Q: Is Form EFT-1 specific to Illinois?

A: Yes, Form EFT-1 is specific to Illinois.

Q: Can I use Form EFT-1 for any type of electronic payment?

A: No, Form EFT-1 is only for certain electronic payments.

Q: Is Form EFT-1 mandatory?

A: No, Form EFT-1 is not mandatory, but it is required if you want to authorize electronic payments in Illinois.

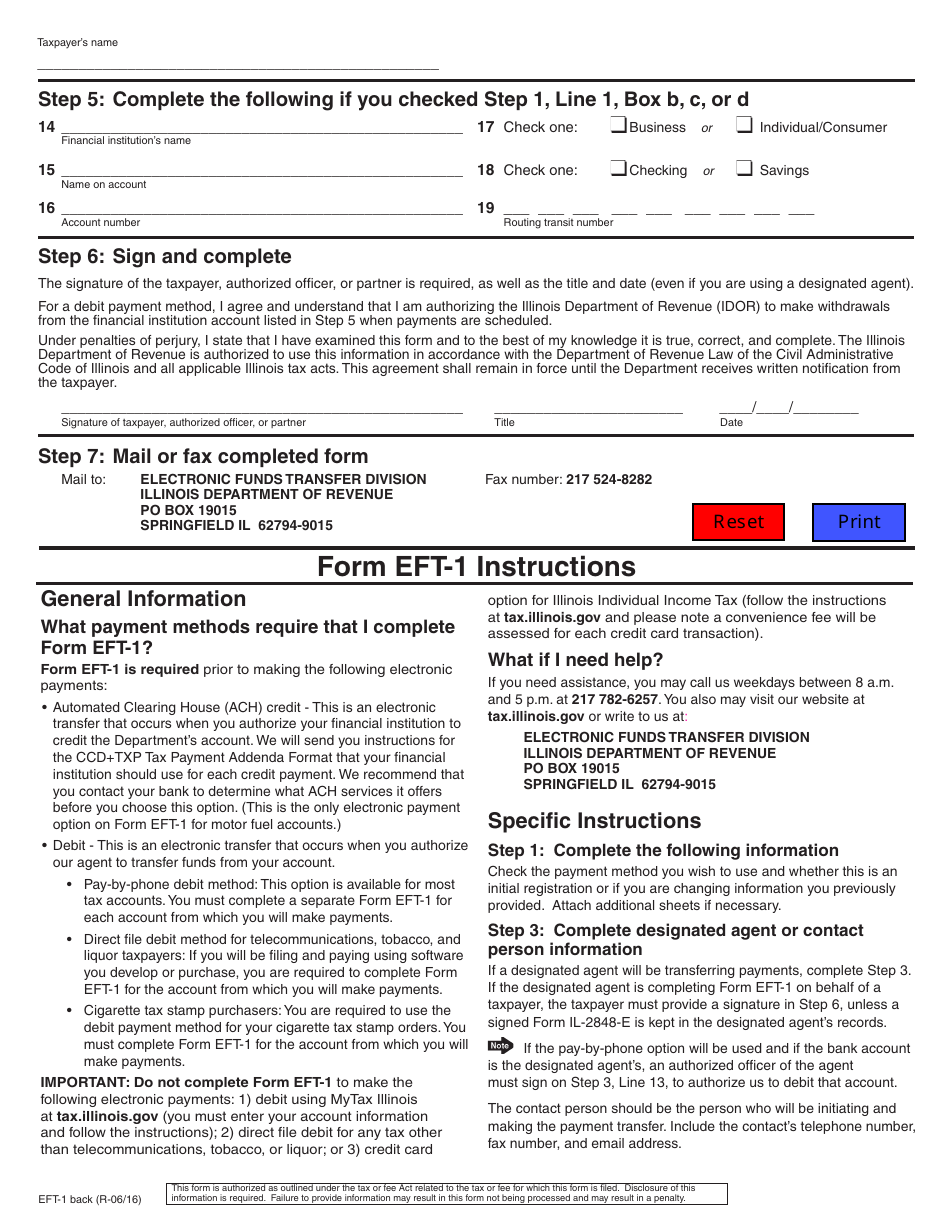

Q: What information do I need to provide on Form EFT-1?

A: You will need to provide your personal information, bank account details, and the types of payments you want to authorize.

Q: How often do I need to submit Form EFT-1?

A: You only need to submit Form EFT-1 once unless there are changes to your bank account or the types of payments you want to authorize.

Q: Can I cancel my authorization on Form EFT-1?

A: Yes, you can cancel your authorization by submitting a new Form EFT-1 with the cancellation box checked.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EFT-1 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.