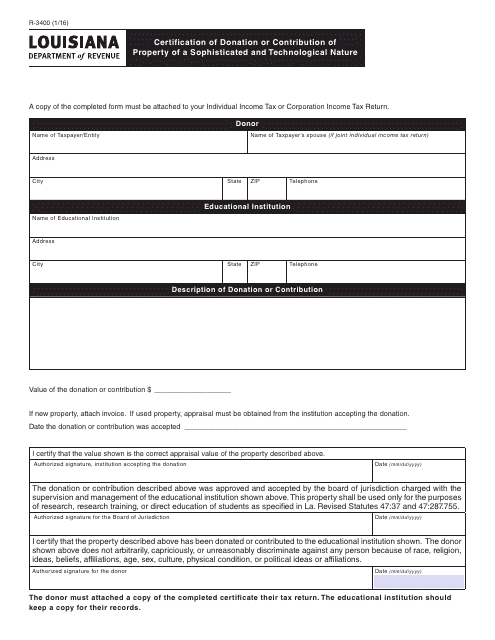

Form R-3400 Certification of Donation or Contribution of Property of a Sophisticated and Technological Nature - Louisiana

What Is Form R-3400?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-3400?

A: Form R-3400 is the Certification of Donation or Contribution of Property of a Sophisticated and Technological Nature in Louisiana.

Q: Who needs to file Form R-3400?

A: Individuals or corporations who make a donation or contribution of property of a sophisticated and technological nature in Louisiana need to file Form R-3400.

Q: What qualifies as property of a sophisticated and technological nature?

A: Property of a sophisticated and technological nature refers to property that is highly advanced in terms of technology, such as computer equipment, software, telecommunications equipment, etc.

Q: What is the purpose of Form R-3400?

A: The purpose of Form R-3400 is to certify the donation or contribution made and to claim a tax credit for such donation or contribution in Louisiana.

Q: How do I file Form R-3400?

A: To file Form R-3400, you need to complete the form with the necessary information and submit it to the Louisiana Department of Revenue.

Q: Can I claim a tax credit for my donation or contribution?

A: Yes, by filing Form R-3400 and meeting the eligibility criteria, you may be able to claim a tax credit in Louisiana for your donation or contribution.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-3400 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.