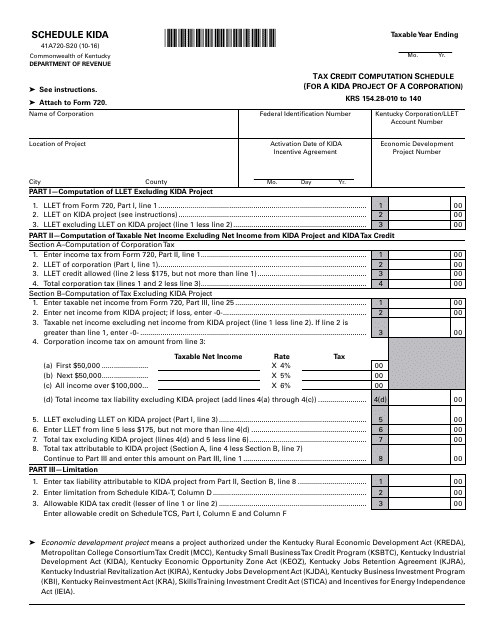

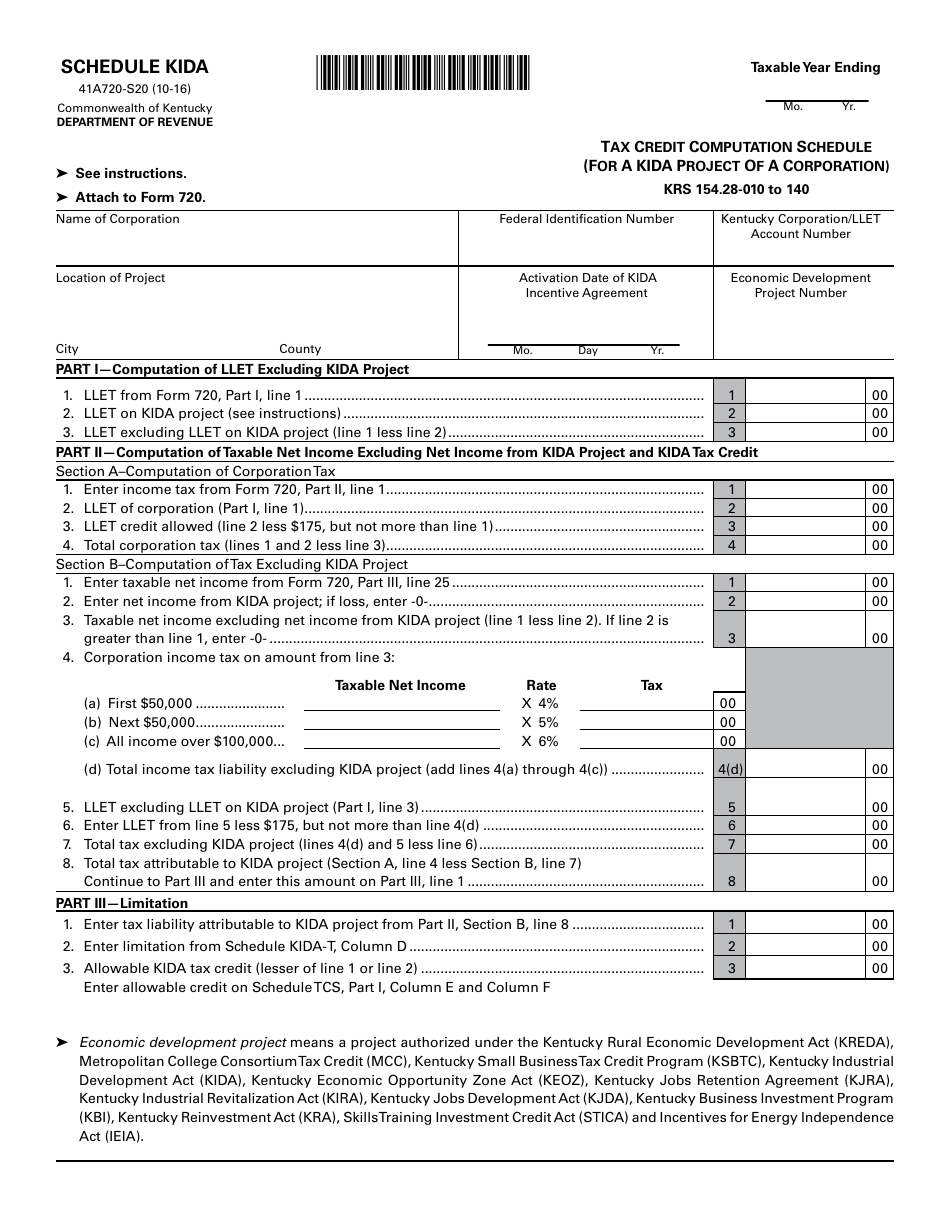

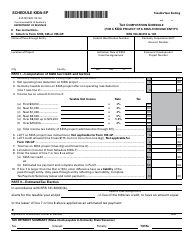

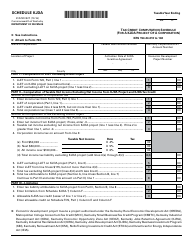

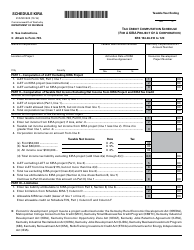

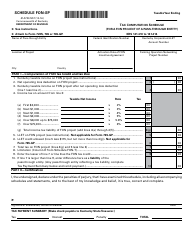

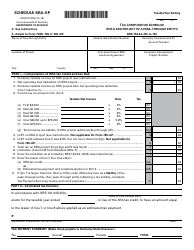

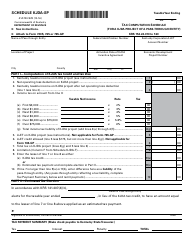

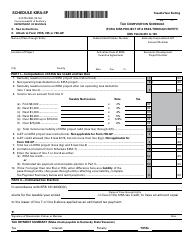

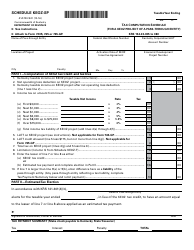

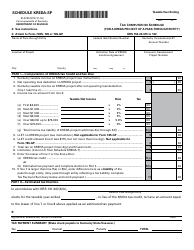

Form 41A720-S20 Schedule KIDA Tax Credit Computation Schedule (For a Kida Project of a Corporation) - Kentucky

What Is Form 41A720-S20 Schedule KIDA?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720-S20?

A: Form 41A720-S20 is the Schedule KIDA Tax Credit Computation Schedule (For a Kida Project of a Corporation) specifically for Kentucky.

Q: Who needs to file Form 41A720-S20?

A: Corporations undertaking a Kida Project in Kentucky need to file Form 41A720-S20.

Q: What is a Kida Project?

A: A Kida Project refers to a specific type of project undertaken by corporations in Kentucky that qualify for certain tax credits.

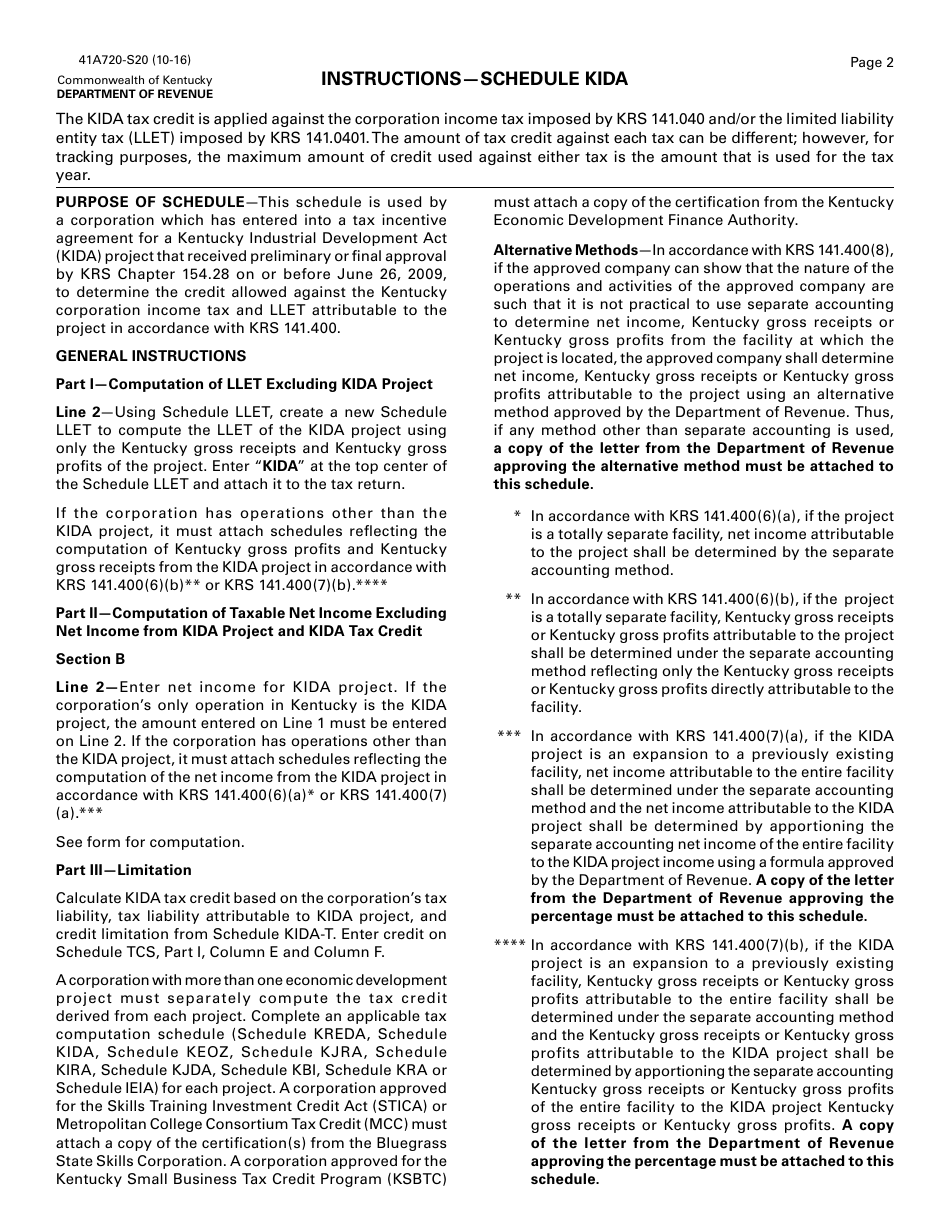

Q: What information is required on Schedule KIDA?

A: Schedule KIDA requires information related to the Kida Project's eligible costs, tax credits, and any carryforward amounts.

Q: What is the purpose of Schedule KIDA?

A: Schedule KIDA is used to calculate the tax credits associated with a Kida Project in Kentucky.

Q: Do I need to submit any supporting documents with Form 41A720-S20?

A: Yes, you may be required to attach additional documentation to support the information provided on Schedule KIDA.

Q: When is the deadline for filing Form 41A720-S20?

A: The deadline for filing Form 41A720-S20 is usually the same as the corporate income tax return due date, which is the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for late filing of Form 41A720-S20?

A: Yes, late filing may result in penalties and interest charges. It is important to submit the form by the due date.

Q: Can I amend Form 41A720-S20?

A: Yes, if you need to make changes or corrections to the originally filed Schedule KIDA, you can file an amended form with the updated information.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41A720-S20 Schedule KIDA by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.