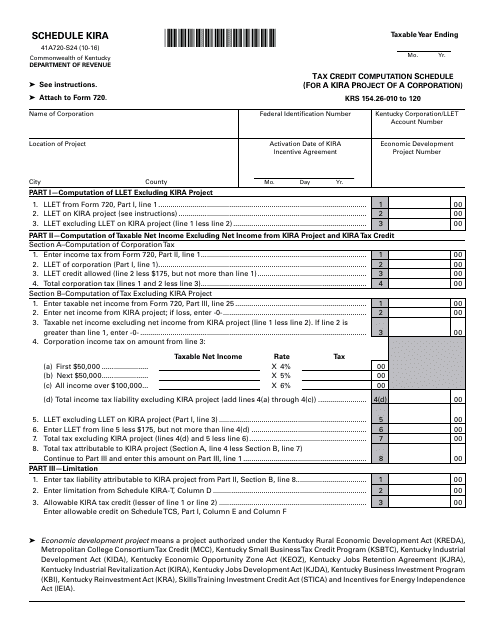

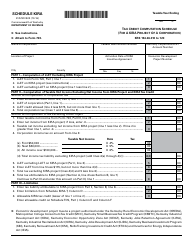

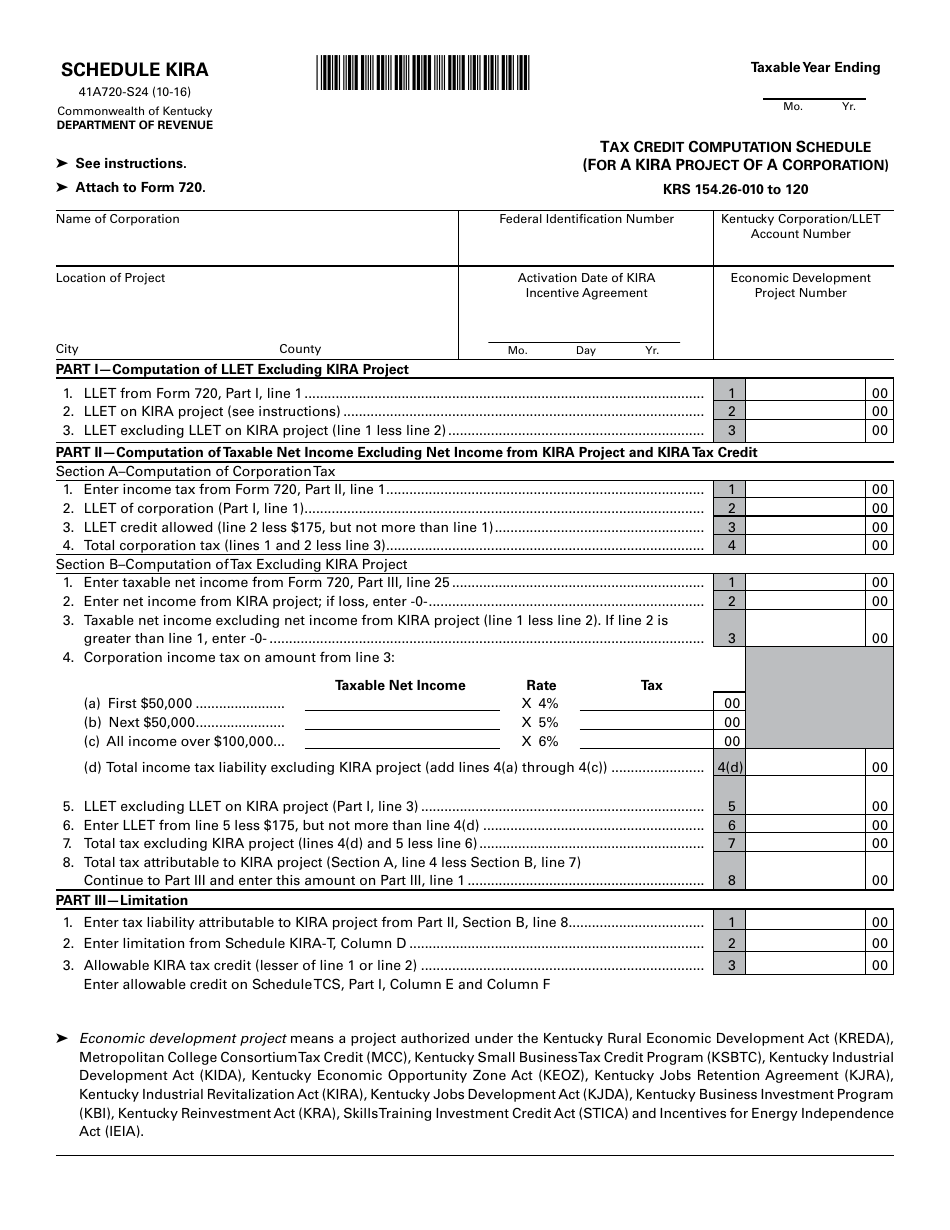

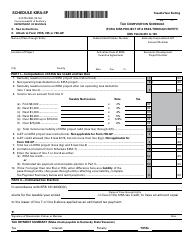

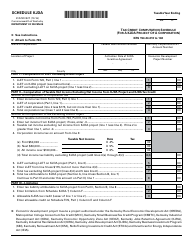

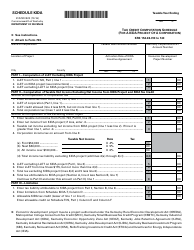

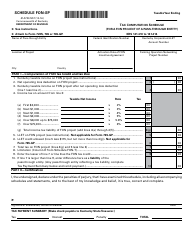

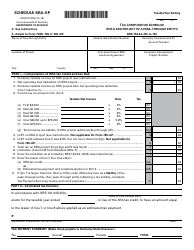

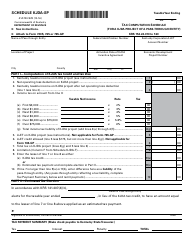

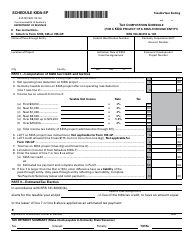

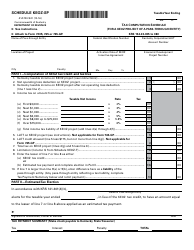

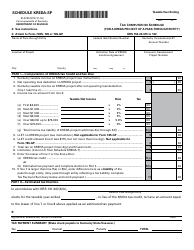

Form 41A720-S24 Schedule KIRA Tax Credit Computation Schedule (For a Kira Project of a Corporation) - Kentucky

What Is Form 41A720-S24 Schedule KIRA?

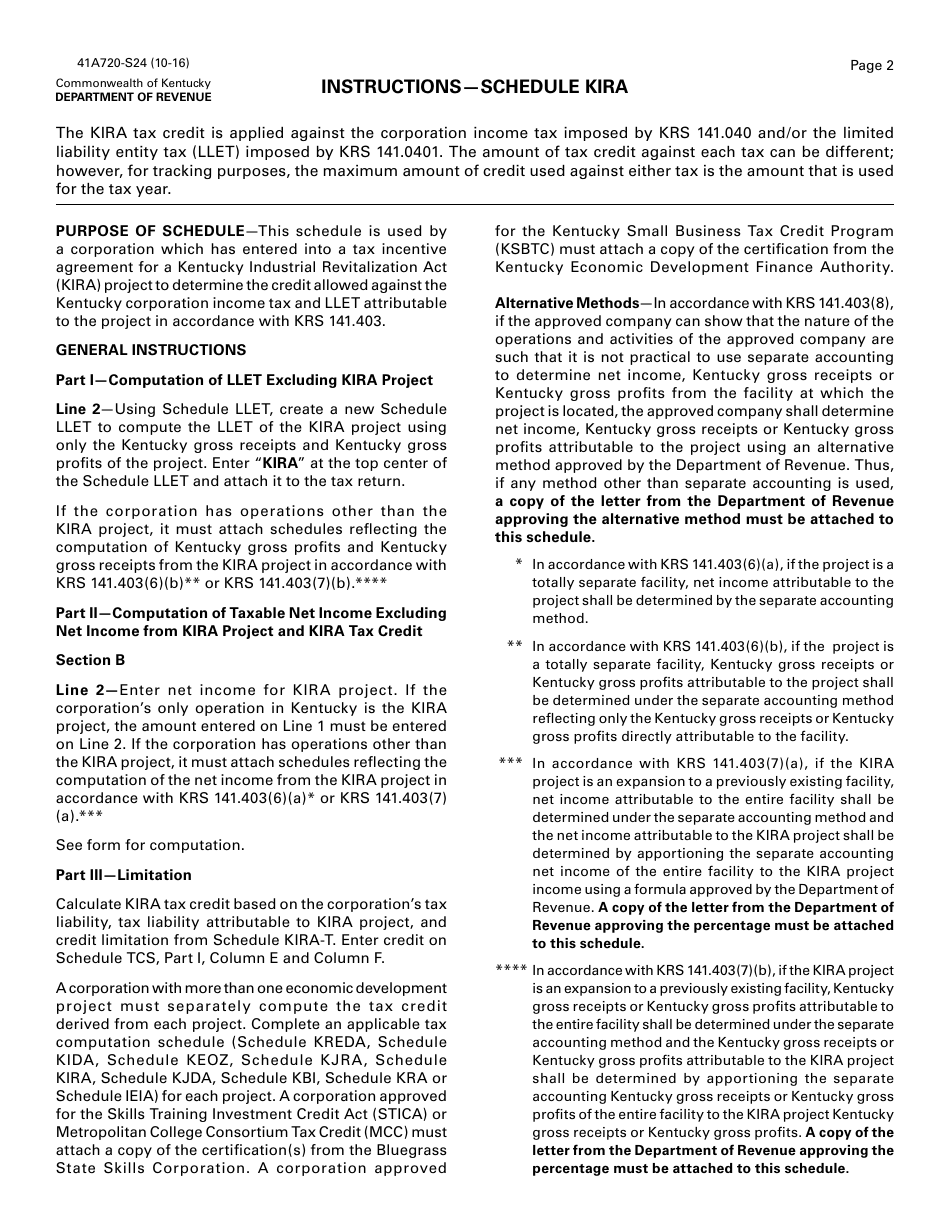

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720-S24?

A: Form 41A720-S24 is a Schedule KIRA Tax Credit Computation Schedule specifically designed for corporations participating in a Kira Project in Kentucky.

Q: What is a Kira Project?

A: A Kira Project refers to a qualifying project that promotes economic development in Kentucky.

Q: Who is eligible to use Form 41A720-S24?

A: Corporations that are participating in a Kira Project in Kentucky can use this form.

Q: What is the purpose of Form 41A720-S24?

A: The purpose of this form is to calculate the tax credits that a corporation may be eligible for under the Kentucky Incentives for Renewable Energy Act (KIRA).

Q: What does this form require?

A: This form requires the corporation to provide information regarding the Kira Project, including the amount and type of eligible expenditures.

Q: When should Form 41A720-S24 be filed?

A: This form should be filed along with the corporation's annual tax return for the applicable tax year.

Q: Are there any filing fees associated with Form 41A720-S24?

A: No, there are no specific filing fees associated with this form. However, regular tax return filing fees may apply.

Q: What is the deadline for filing Form 41A720-S24?

A: The deadline for filing this form is the same as the filing deadline for the corporation's annual tax return, which is generally April 15th.

Q: Can more than one Form 41A720-S24 be filed for a Kira Project?

A: No, only one Form 41A720-S24 should be filed for each Kira Project that a corporation is participating in.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41A720-S24 Schedule KIRA by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.