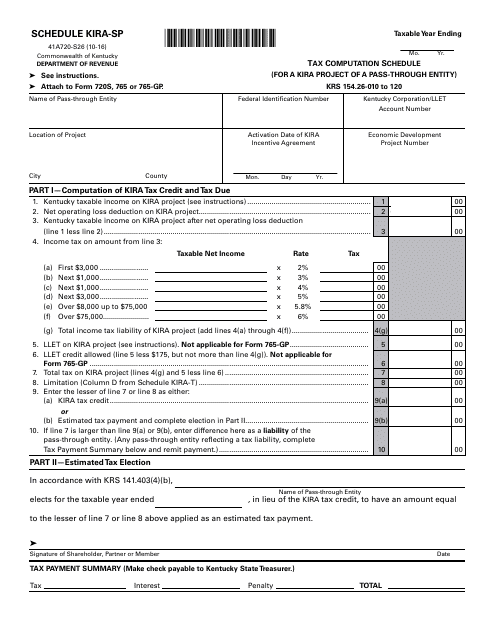

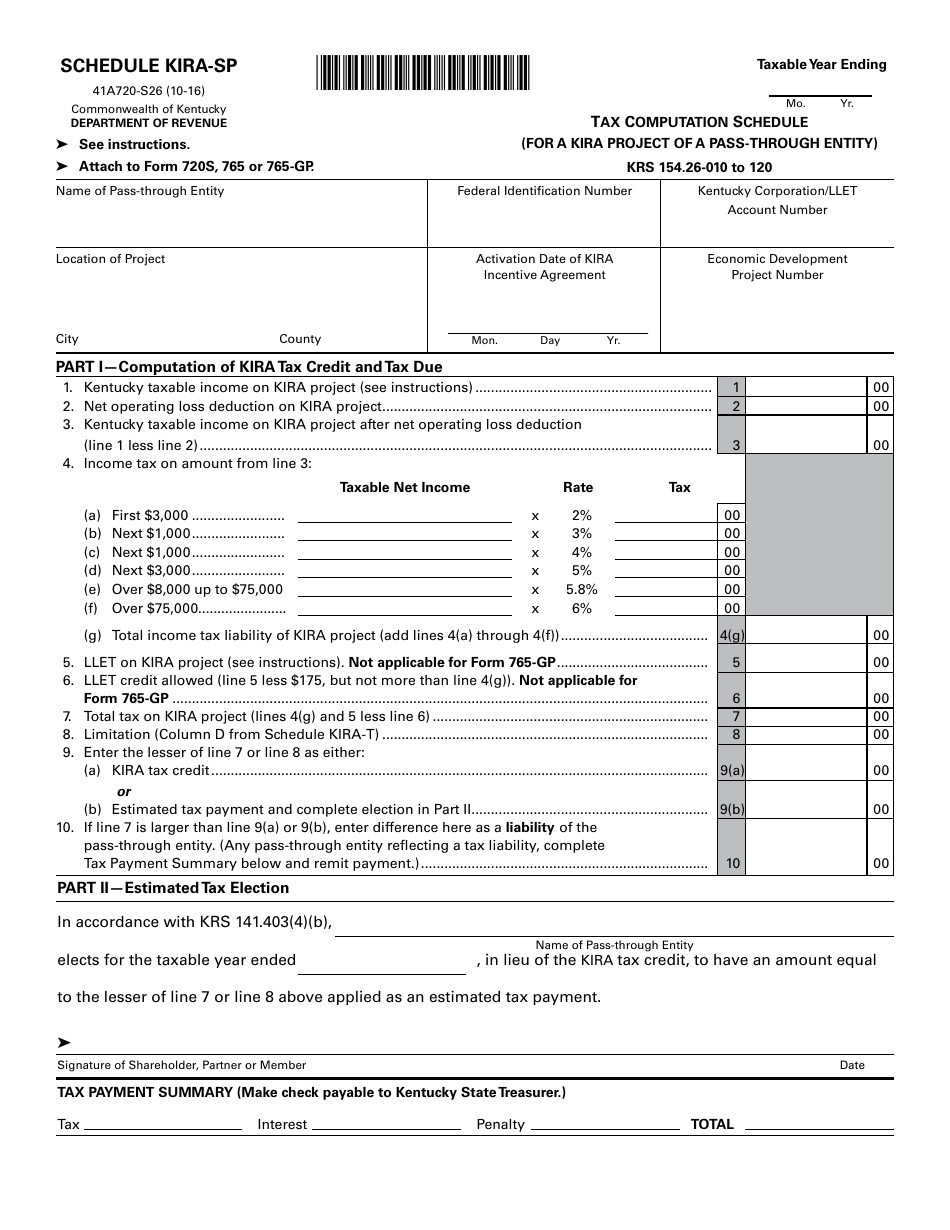

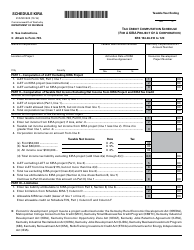

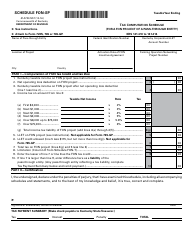

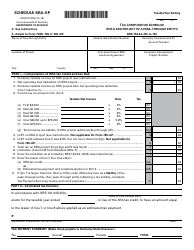

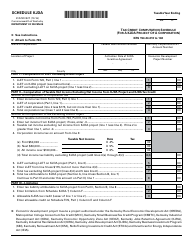

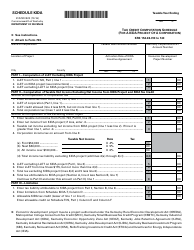

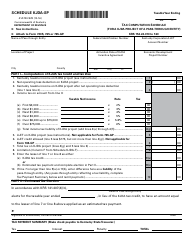

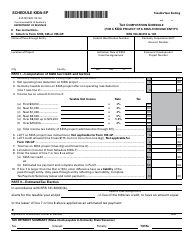

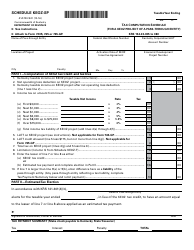

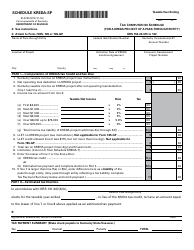

Form 41A720-S26 Schedule KIRA-SP Tax Computation Schedule (For a Kira Project of a Pass-Through Entity) - Kentucky

What Is Form 41A720-S26 Schedule KIRA-SP?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720-S26 Schedule KIRA-SP?

A: Form 41A720-S26 Schedule KIRA-SP is a tax computation schedule for a Kira Project of a Pass-Through Entity in Kentucky.

Q: Who needs to file Form 41A720-S26 Schedule KIRA-SP?

A: Pass-through entities involved in a Kira Project in Kentucky need to file this form.

Q: What is a Kira Project?

A: A Kira Project is a project that qualifies for the Kentucky Industrial Revitalization Act (KIRA) program.

Q: What is a pass-through entity?

A: A pass-through entity is a business structure where profits and losses pass through to the owners' personal income tax returns.

Q: What information is required on Form 41A720-S26 Schedule KIRA-SP?

A: The form requires detailed information about the pass-through entity and the Kira Project, including income, deductions, and tax calculations.

Q: Is there a deadline for filing Form 41A720-S26 Schedule KIRA-SP?

A: Yes, the deadline for filing this form is typically the same as the deadline for filing the pass-through entity's annual tax return.

Q: What are the consequences of not filing Form 41A720-S26 Schedule KIRA-SP?

A: Failure to file this form may result in penalties and interest on any taxes owed.

Q: Can I file Form 41A720-S26 Schedule KIRA-SP electronically?

A: Yes, the Kentucky Department of Revenue accepts electronic filing for this form.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41A720-S26 Schedule KIRA-SP by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.