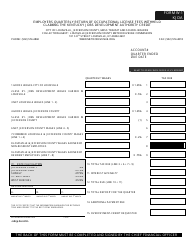

Form 41A720-S28 Schedule KJDA-T Tracking Schedule for a Kjda Project - Kentucky

What Is Form 41A720-S28 Schedule KJDA-T?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720-S28?

A: Form 41A720-S28 is a schedule used for tracking a Kjda Project in Kentucky.

Q: What is Schedule KJDA-T?

A: Schedule KJDA-T is a tracking schedule for a Kjda Project in Kentucky.

Q: What is a Kjda Project?

A: A Kjda Project is a type of project being tracked in Kentucky.

Q: Who uses Form 41A720-S28?

A: Form 41A720-S28 is used by individuals or entities involved in a Kjda Project in Kentucky.

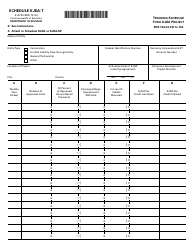

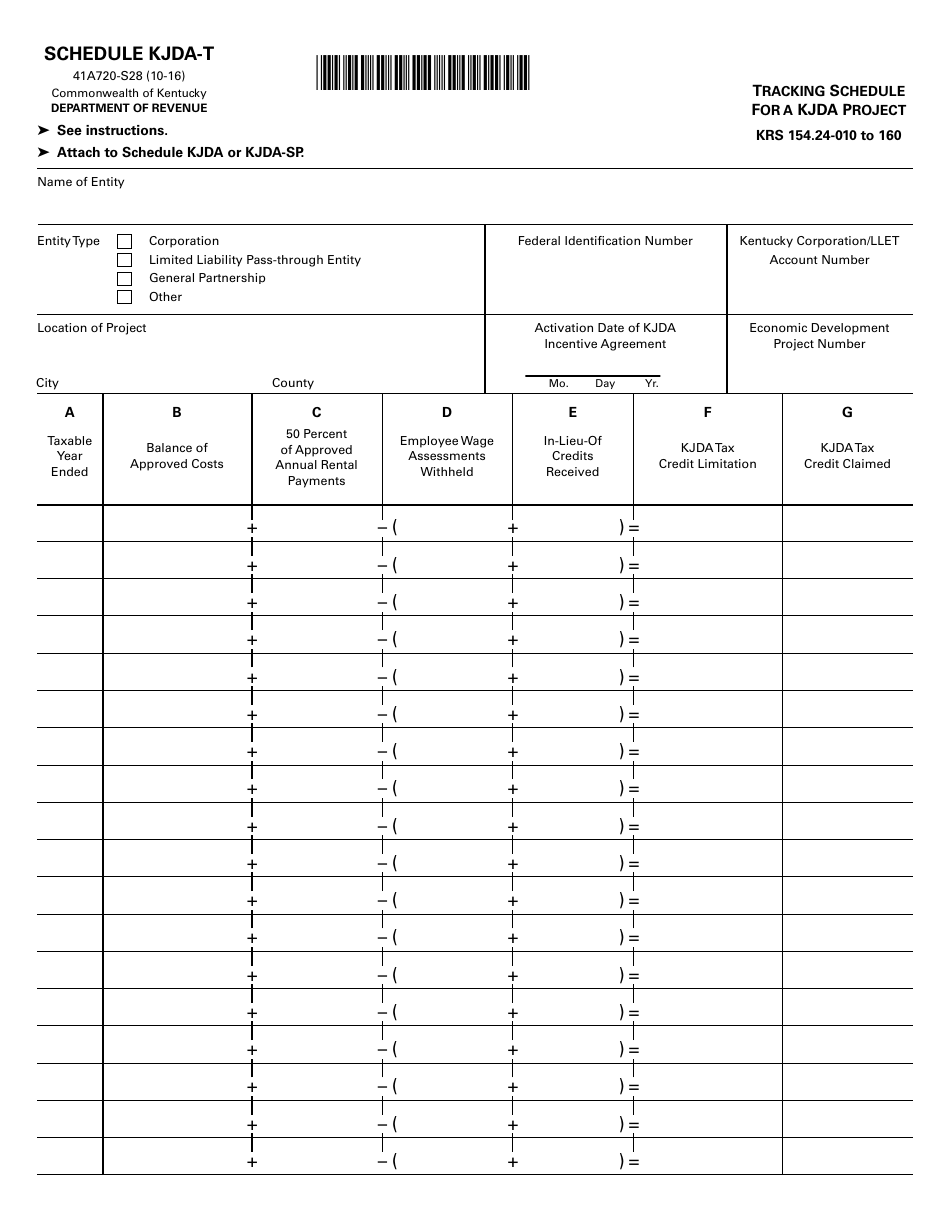

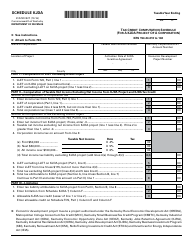

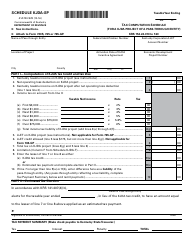

Q: What information is included in Schedule KJDA-T?

A: Schedule KJDA-T includes information relevant to tracking a Kjda Project, such as project details and financial information.

Q: Is Form 41A720-S28 specific to Kentucky?

A: Yes, Form 41A720-S28 is specific to Kentucky and is used for tracking Kjda Projects in the state.

Q: What is the purpose of tracking a Kjda Project?

A: The purpose of tracking a Kjda Project is to monitor its progress and financial status for reporting and compliance purposes.

Q: Are there any specific requirements for completing Schedule KJDA-T?

A: Yes, the Kentucky Department of Revenue may have specific requirements and instructions for completing Schedule KJDA-T. It is important to review and follow these guidelines.

Q: Can Form 41A720-S28 be used for projects in other states?

A: No, Form 41A720-S28 is specific to Kentucky and is not applicable for projects in other states.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41A720-S28 Schedule KJDA-T by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.