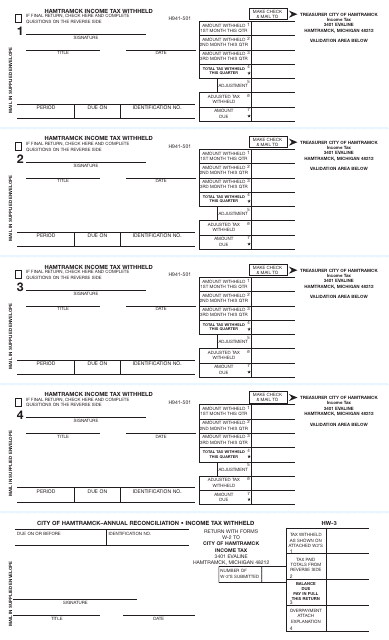

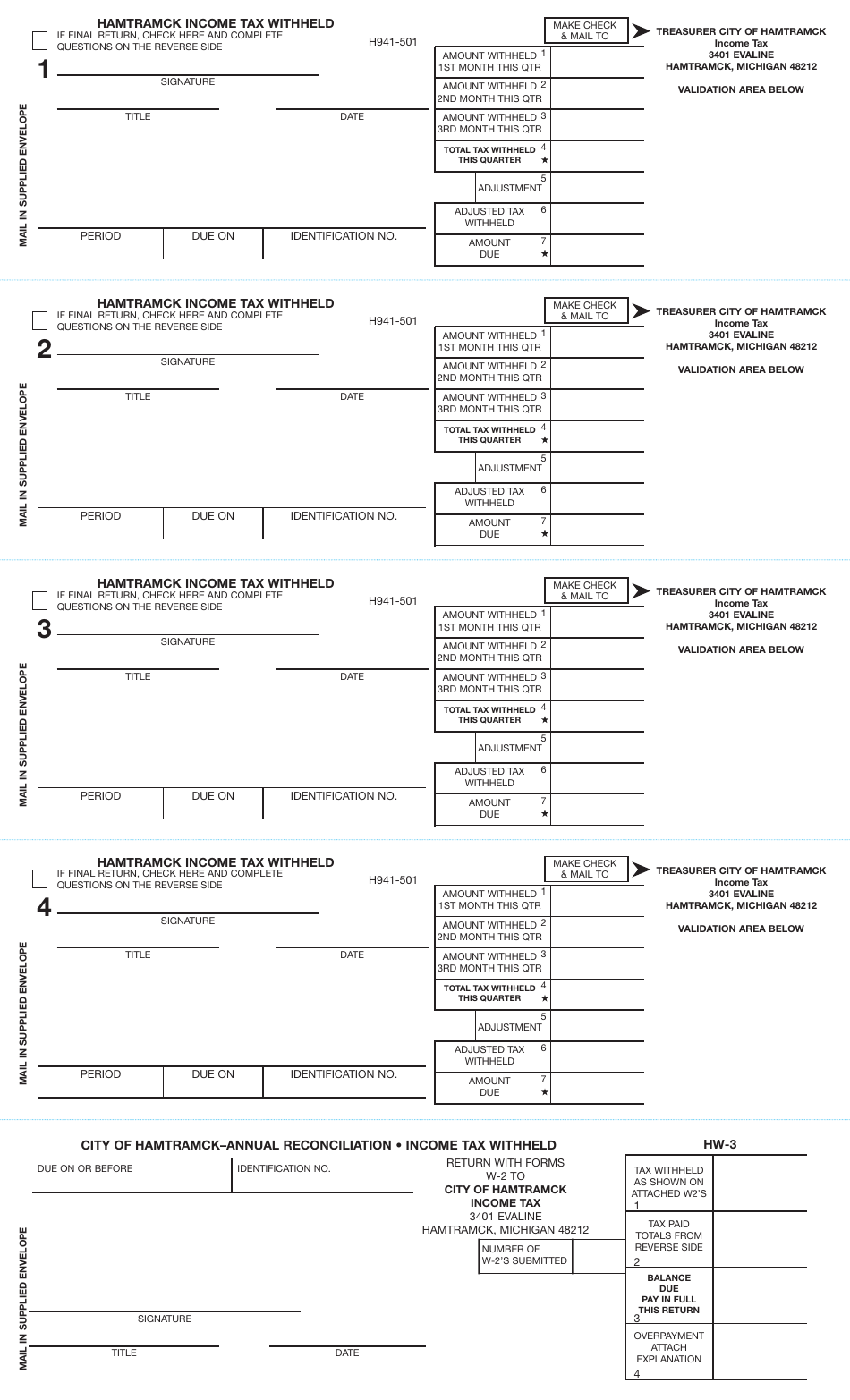

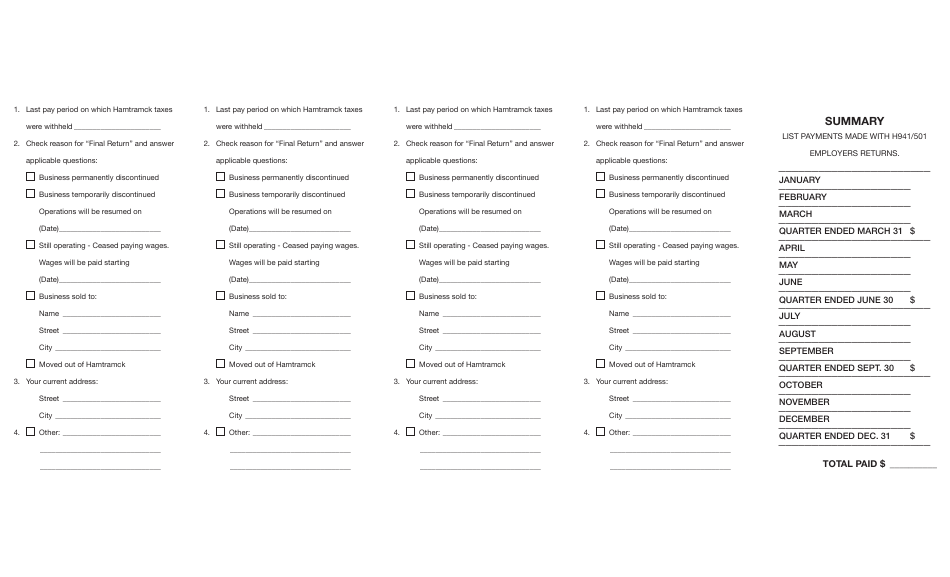

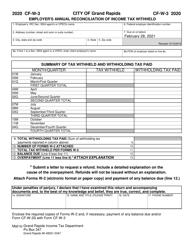

Form H941-501 Income Tax Withheld - Hamtramck, Michigan

What Is Form H941-501?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. The form may be used strictly within Hamtramck. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form H941-501?

A: Form H941-501 is a form used for reporting income tax withheld in Hamtramck, Michigan.

Q: Who needs to file Form H941-501?

A: Employers in Hamtramck, Michigan who have withheld income taxes from their employees' wages need to file this form.

Q: When is Form H941-501 due?

A: The due date for filing Form H941-501 may vary, so it's important to check the specific deadline for the tax year in which it is being filed.

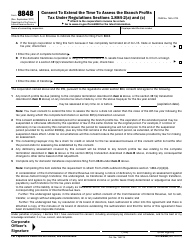

Q: How do I fill out Form H941-501?

A: You will need to provide information about your business, such as your employer identification number (EIN), the total wages paid to employees, and the income tax withheld from their wages.

Form Details:

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form H941-501 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.