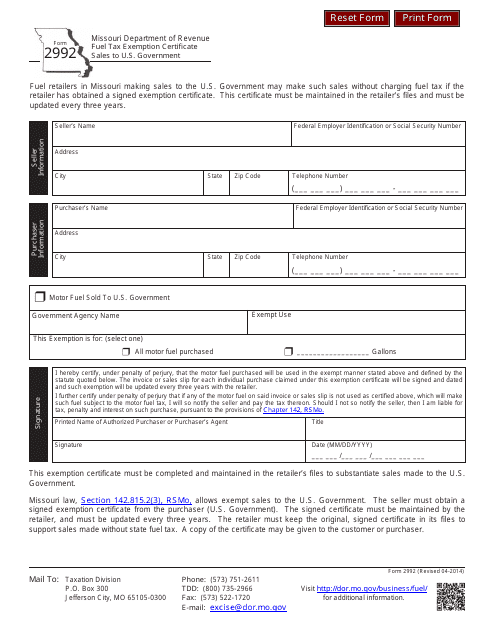

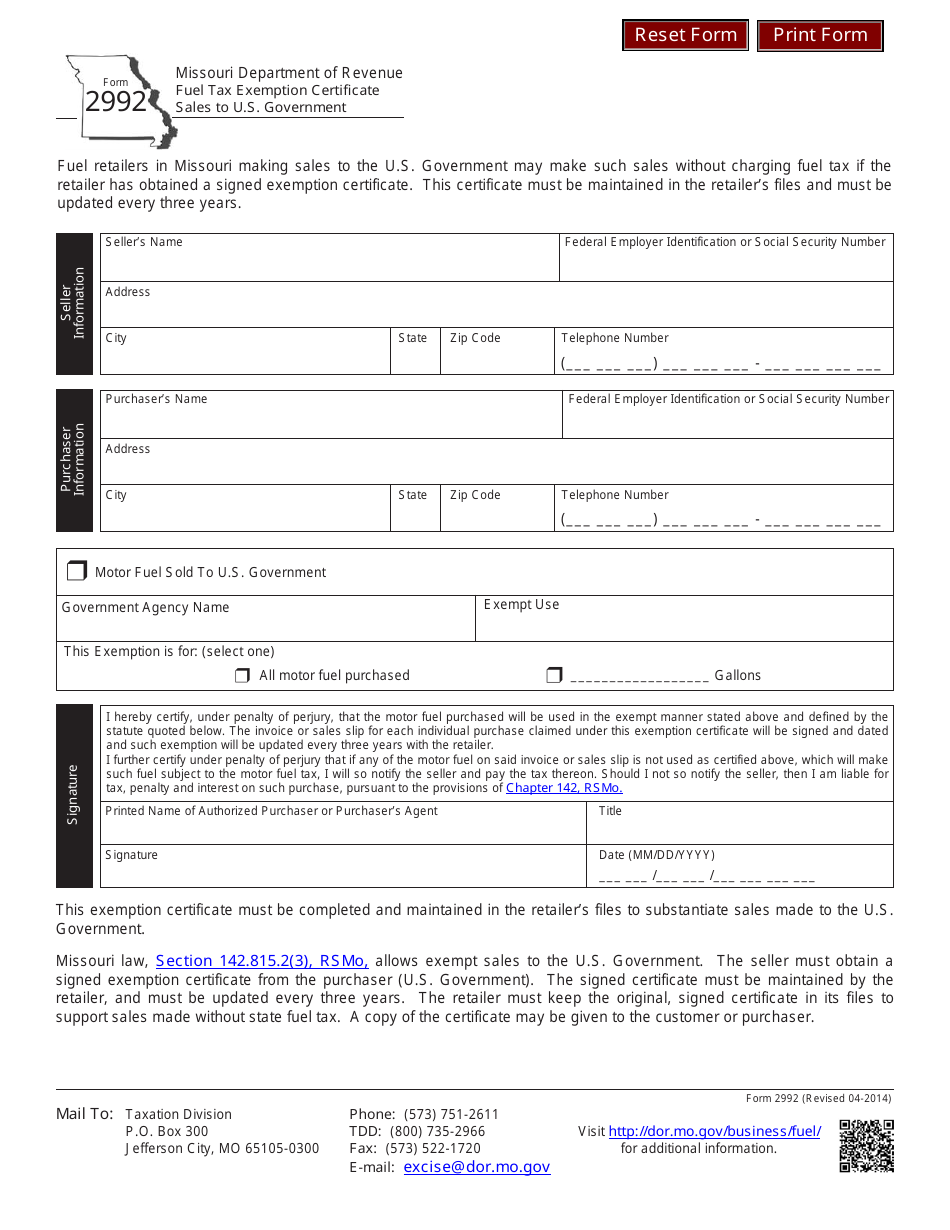

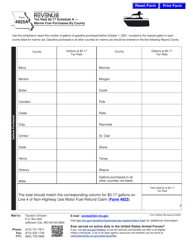

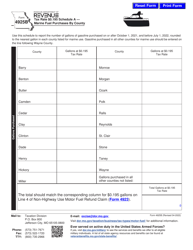

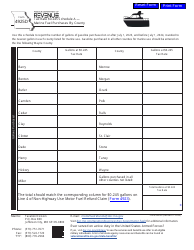

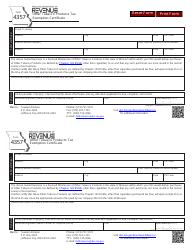

Form 2992 Fuel Tax Exemption Certificate - Sales to U.S. Government - Missouri

What Is Form 2992?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2992?

A: Form 2992 is the Fuel Tax Exemption Certificate for Sales to U.S. Government in Missouri.

Q: What is the purpose of Form 2992?

A: The purpose of Form 2992 is to document the exemption of fuel taxes for sales made to the U.S. Government in Missouri.

Q: Who is eligible for the fuel tax exemption?

A: The U.S. Government is eligible for the fuel tax exemption in Missouri.

Q: Do I need to fill out Form 2992 for sales to the U.S. Government?

A: Yes, you need to fill out Form 2992 for sales made to the U.S. Government in Missouri to claim the fuel tax exemption.

Q: Are there any specific requirements for Form 2992?

A: Yes, there are specific requirements for completing Form 2992. It is recommended to refer to the instructions provided with the form.

Q: Is there a deadline for submitting Form 2992?

A: There is no specific deadline mentioned for submitting Form 2992. However, it is advisable to file the form in a timely manner.

Q: Can I use Form 2992 for sales outside of Missouri?

A: No, Form 2992 is specifically for sales made to the U.S. Government in Missouri. For sales outside of Missouri, you may need to consult the respective state's regulations.

Form Details:

- Released on April 15, 2014;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2992 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.