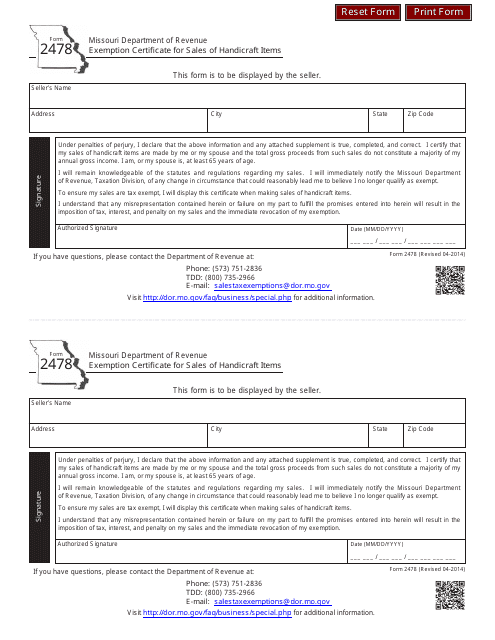

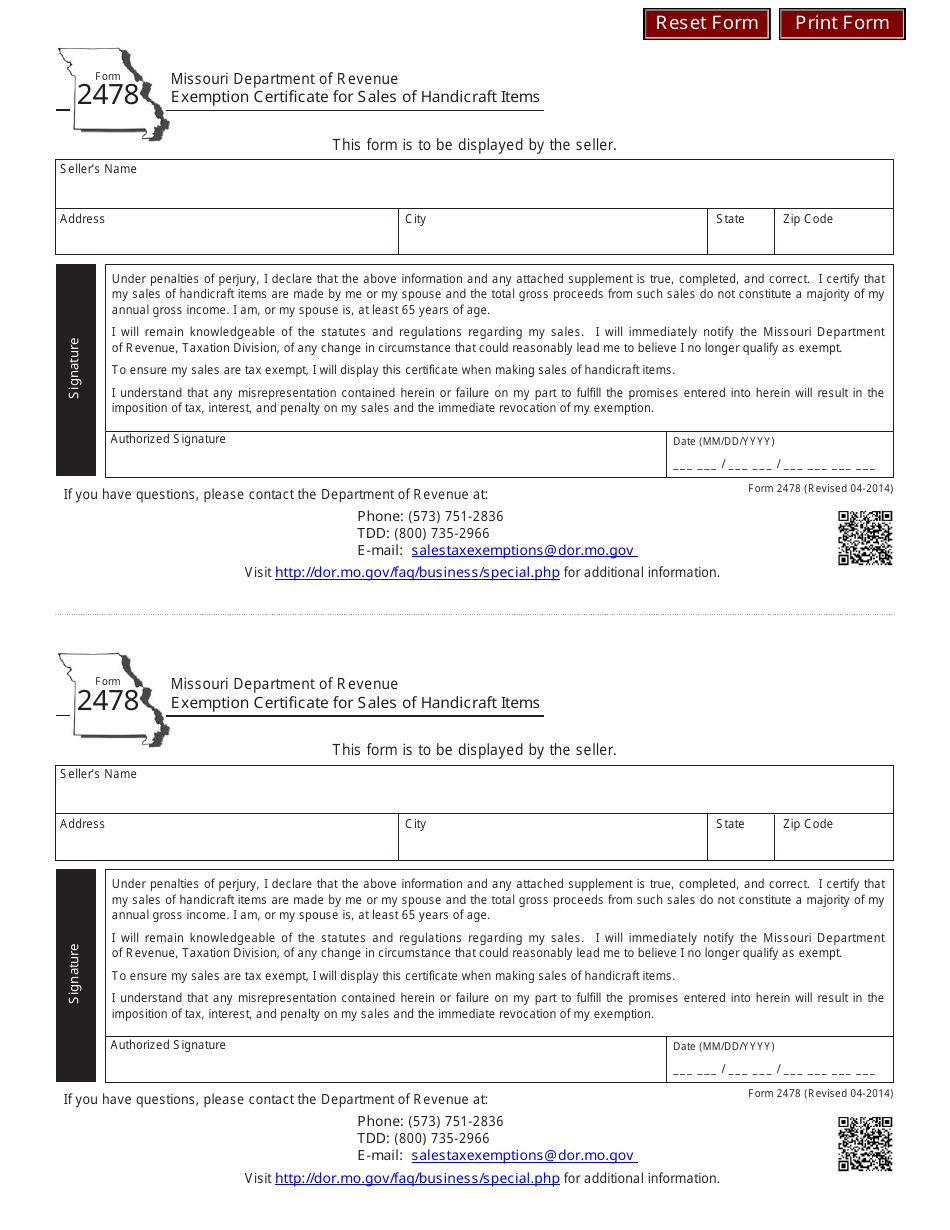

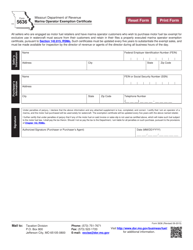

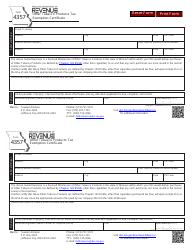

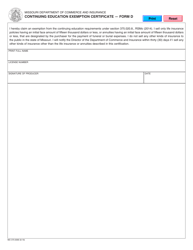

Form 2478 Exemption Certificate for Sales of Handicraft Items - Missouri

What Is Form 2478?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2478?

A: Form 2478 is an exemption certificate for sales of handicraft items in Missouri.

Q: Who needs to fill out Form 2478?

A: Sellers of handicraft items in Missouri need to fill out Form 2478.

Q: What is the purpose of Form 2478?

A: The purpose of Form 2478 is to claim an exemption from sales tax on the sale of handicraft items.

Q: What qualifies as a handicraft item?

A: Handicraft items are items made by hand or predominantly by hand, that are of a unique or limited nature and are produced in small quantities.

Q: Is the exemption on Form 2478 permanent?

A: No, the exemption on Form 2478 is only valid for one year from the date of issuance.

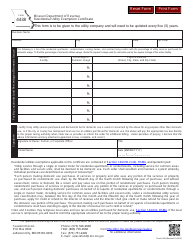

Q: Are there any penalties for incorrect or false information on Form 2478?

A: Yes, providing incorrect or false information on Form 2478 may result in penalties, including fines and criminal charges.

Q: Do I need to reapply for the exemption every year?

A: Yes, you need to reapply for the exemption by filing a new Form 2478 every year.

Q: Can I use Form 2478 for sales of non-handicraft items?

A: No, Form 2478 is specifically for sales of handicraft items only. Sales of non-handicraft items may require a different exemption certificate.

Q: Are sales of handicraft items always exempt from sales tax?

A: No, sales of handicraft items are only exempt from sales tax if the seller has a valid exemption certificate, such as Form 2478.

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2478 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.