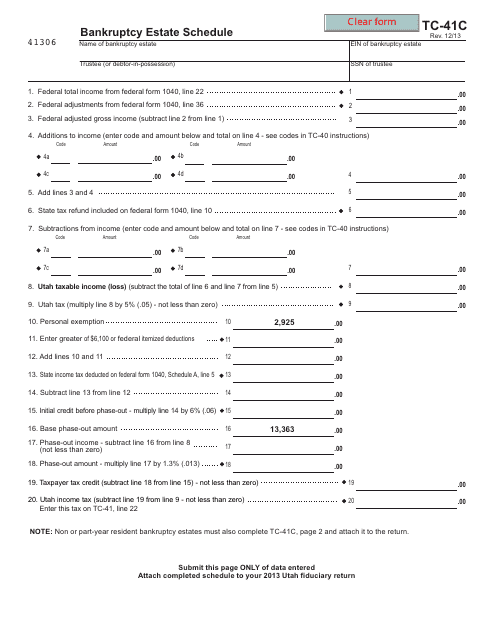

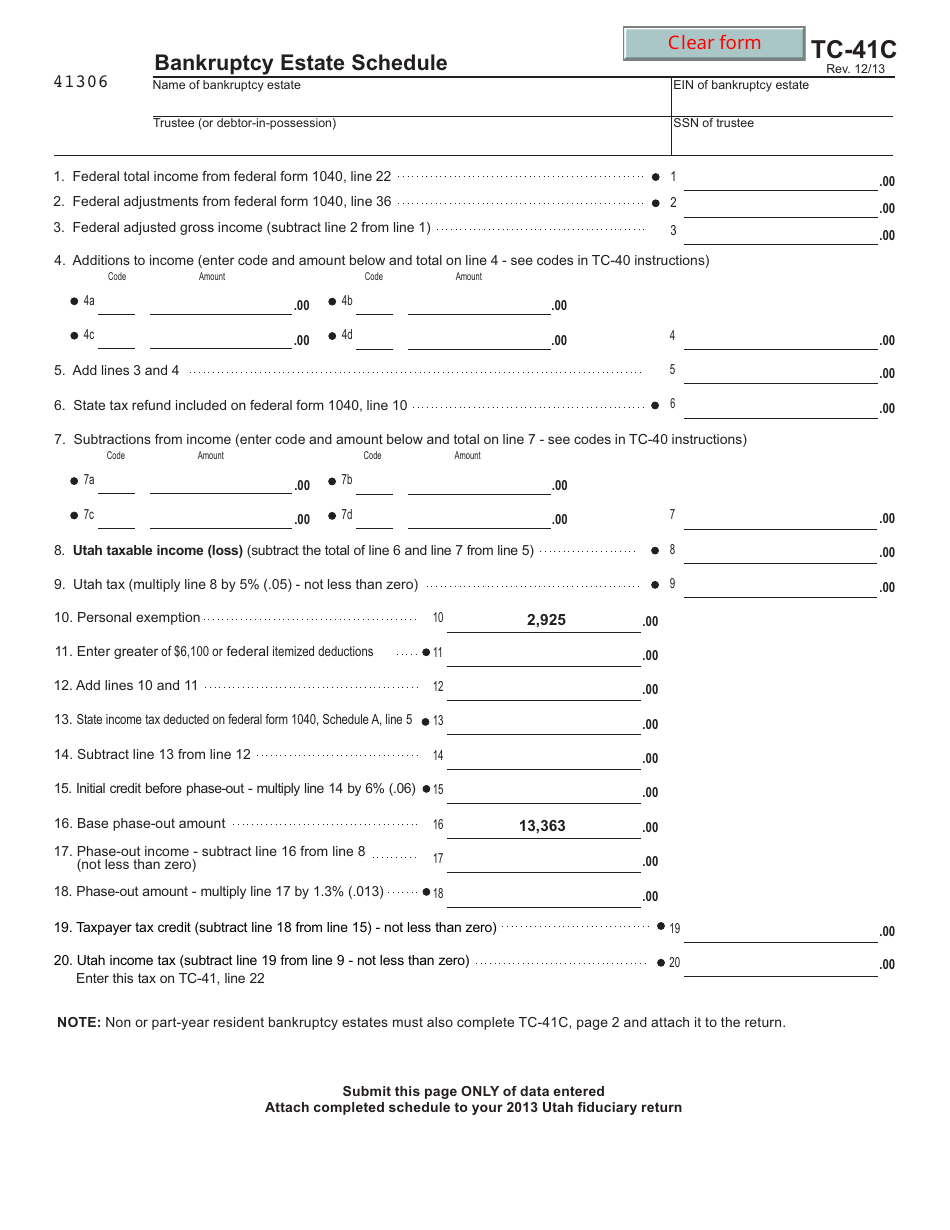

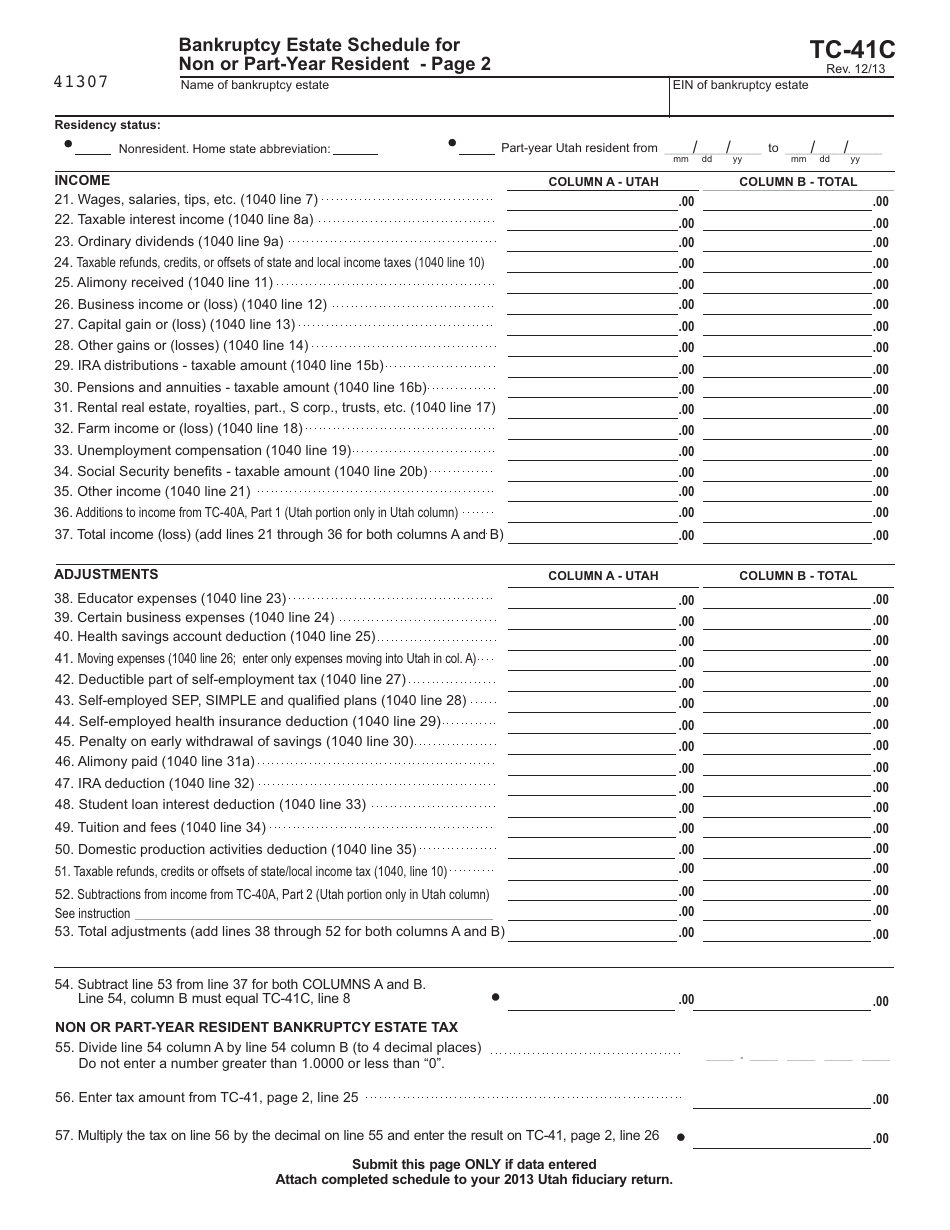

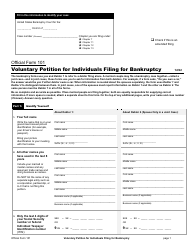

Form TC-41C Bankruptcy Estate Schedule - Utah

What Is Form TC-41C?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-41C?

A: Form TC-41C is the Bankruptcy Estate Schedule form used in Utah.

Q: What is the purpose of Form TC-41C?

A: The purpose of Form TC-41C is to document the bankruptcy estate's assets and liabilities in Utah.

Q: Who needs to fill out Form TC-41C?

A: Form TC-41C is typically filled out by the bankruptcy estate's trustee or attorney.

Q: Are there any accompanying documents required for Form TC-41C?

A: Yes, additional documentation such as financial statements and support schedules may be required when filing Form TC-41C.

Q: How should Form TC-41C be submitted?

A: Form TC-41C should be submitted by mail to the Utah State Tax Commission.

Q: Can I amend Form TC-41C if needed?

A: Yes, you can amend Form TC-41C if needed by submitting a revised version or notifying the Utah State Tax Commission.

Q: Is legal advice required to fill out Form TC-41C?

A: While legal advice is not required, consulting with a bankruptcy attorney can be helpful in ensuring the accuracy and completeness of the form.

Form Details:

- Released on December 1, 2013;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-41C by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.