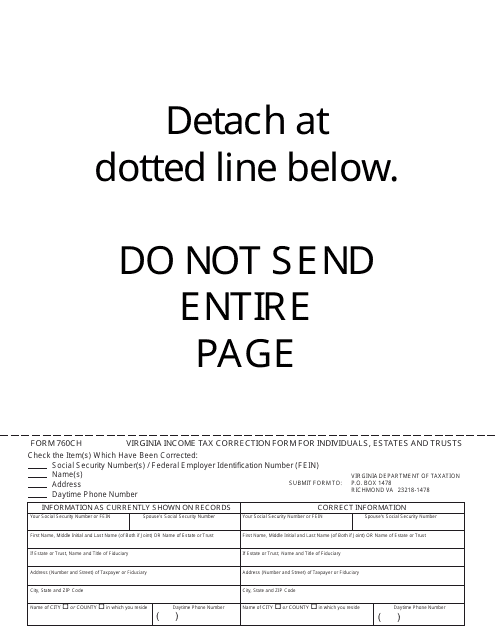

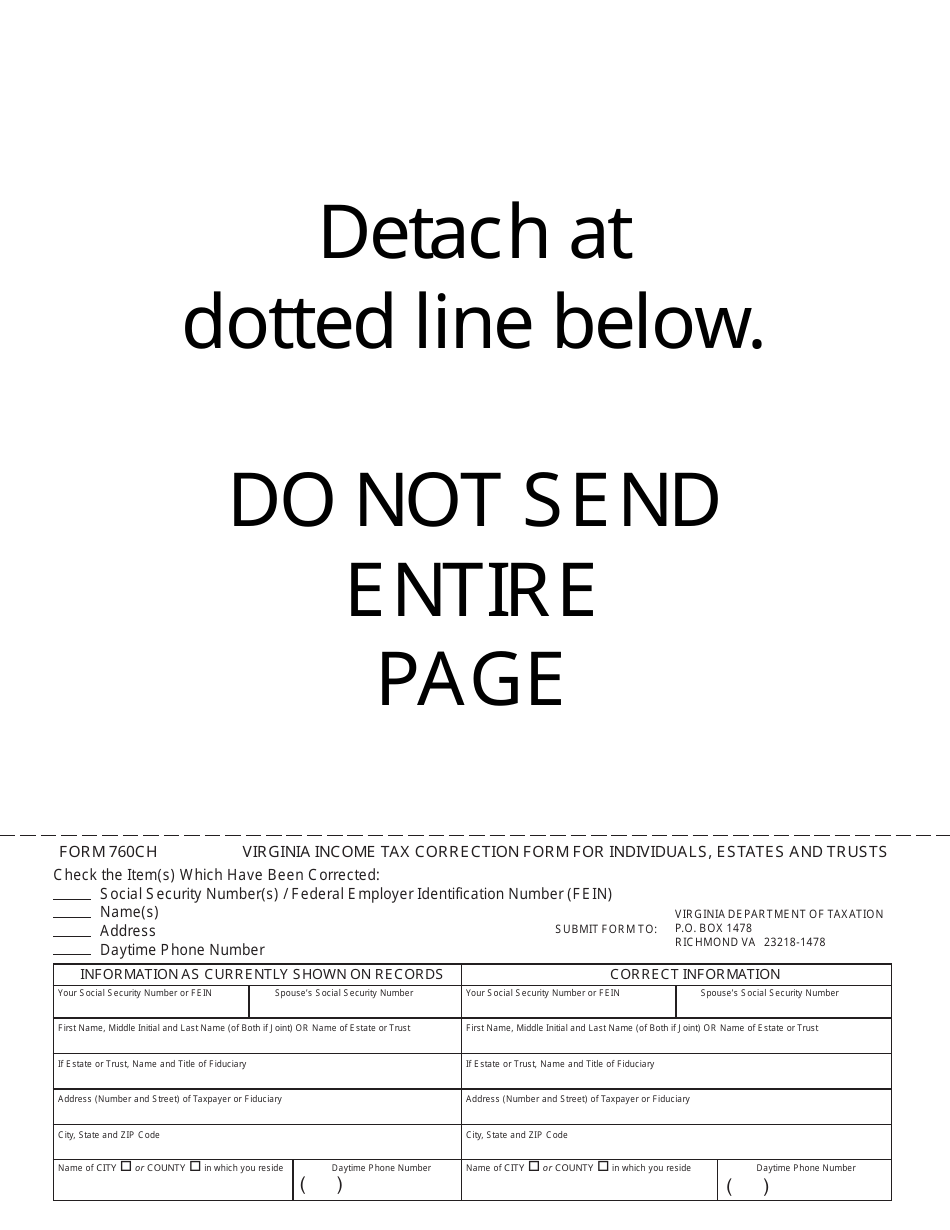

Form 760CH Virginia Income Tax Correction Form for Individuals, Estates and Trusts - Virginia

What Is Form 760CH?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 760CH?

A: Form 760CH is the Virginia Income Tax Correction form for Individuals, Estates, and Trusts.

Q: Who needs to file Form 760CH?

A: Individuals, estates, and trusts in Virginia who need to correct errors on their income tax return.

Q: What can be corrected using Form 760CH?

A: Form 760CH can be used to correct errors or make changes to your Virginia income tax return, such as reporting additional income or claiming deductions.

Q: When is the deadline to file Form 760CH?

A: The deadline to file Form 760CH is the same as the deadline for your Virginia income tax return, typically April 15th.

Q: Do I need to include any supporting documentation with Form 760CH?

A: You should include any necessary supporting documentation, such as W-2 forms or receipts, when submitting Form 760CH.

Q: What happens after I file Form 760CH?

A: After you file Form 760CH, the Virginia Department of Taxation will review your corrections and may contact you for further information or adjustments.

Q: Are there any fees associated with filing Form 760CH?

A: No, there are no fees associated with filing Form 760CH.

Q: Can I amend my Virginia income tax return using Form 760CH?

A: No, Form 760CH is specifically for correcting errors on your original return. To amend your return, you will need to file Form 760X.

Form Details:

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 760CH by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.