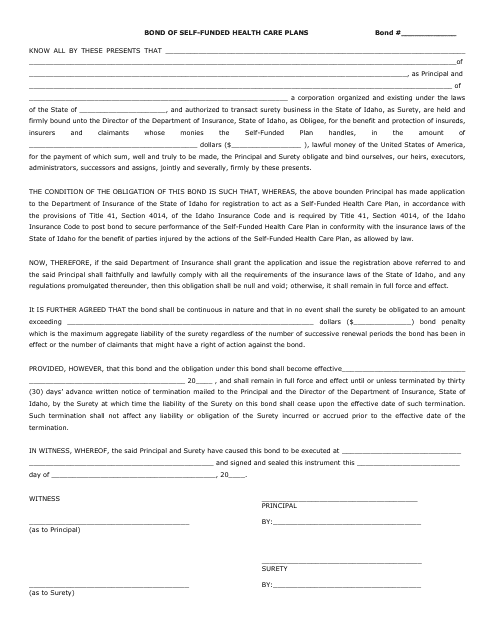

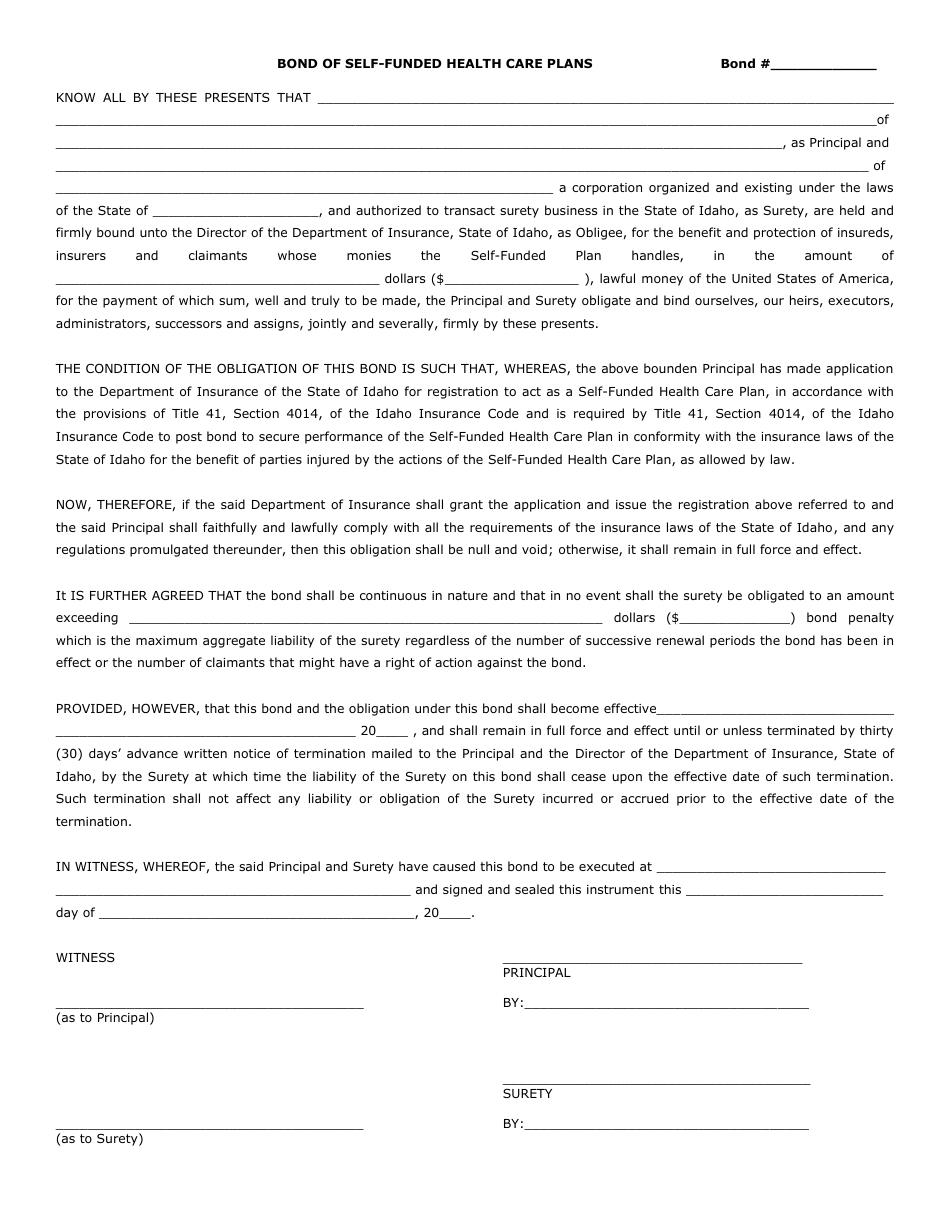

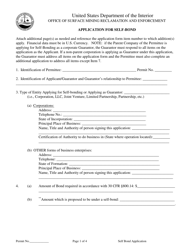

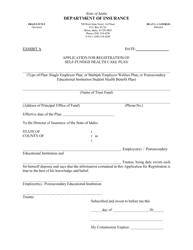

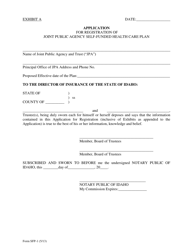

Bond of Self-funded Health Care Plans - Idaho

Bond of Self-funded Health Care Plans is a legal document that was released by the Idaho Department of Insurance - a government authority operating within Idaho.

FAQ

Q: What is a self-funded health care plan?

A: A self-funded health care plan is a type of health insurance coverage where the employer assumes the financial risk of providing health care benefits to its employees.

Q: What is the bond requirement for self-funded health care plans in Idaho?

A: Idaho requires self-funded health care plans to post a bond in order to protect plan participants and ensure the availability of funds to pay for claims.

Q: Why do self-funded health care plans need a bond?

A: The bond serves as a guarantee that the self-funded health care plan will have the necessary funds to cover claims and fulfill its obligations to plan participants.

Q: How much is the bond amount for self-funded health care plans in Idaho?

A: The bond amount for self-funded health care plans in Idaho is determined by the Director of the Department of Insurance and can vary depending on factors such as the number of participants and the plan's financial stability.

Q: Who is required to obtain a bond for a self-funded health care plan in Idaho?

A: Any employer or organization that offers self-funded health care coverage in Idaho is required to obtain a bond.

Q: Are there any exemptions to the bond requirement for self-funded health care plans in Idaho?

A: There are certain exemptions to the bond requirement, such as government entities, religious organizations, and plans that are already regulated by federal law.

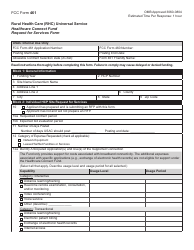

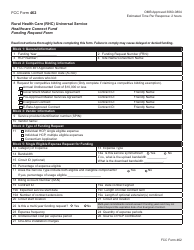

Q: How can employers obtain a bond for their self-funded health care plans in Idaho?

A: Employers can obtain a bond for their self-funded health care plans by contacting a licensed surety bond company that offers the specific type of bond required by Idaho law.

Q: What happens if a self-funded health care plan fails to obtain or maintain the required bond?

A: Failure to obtain or maintain the required bond for a self-funded health care plan in Idaho can result in penalties, fines, and potentially the suspension or revocation of the plan's authorization to operate.

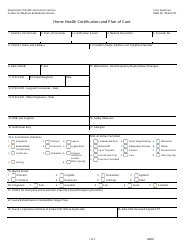

Q: Is a bond the only requirement for self-funded health care plans in Idaho?

A: No, in addition to the bond requirement, self-funded health care plans in Idaho are also subject to other regulations, such as filing periodic reports and maintaining certain financial reserves.

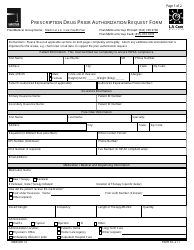

Form Details:

- The latest edition currently provided by the Idaho Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Idaho Department of Insurance.