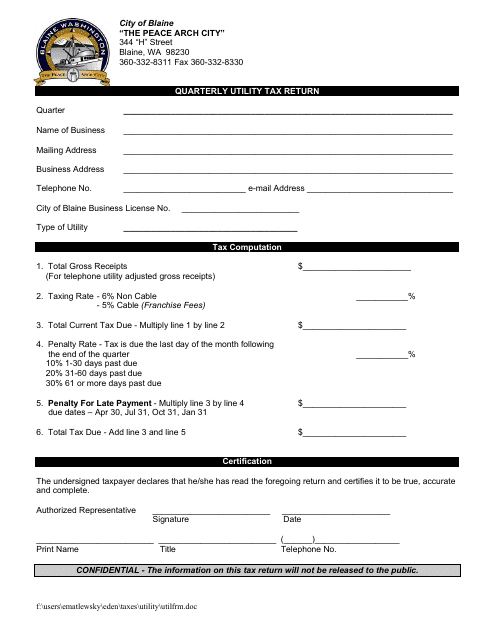

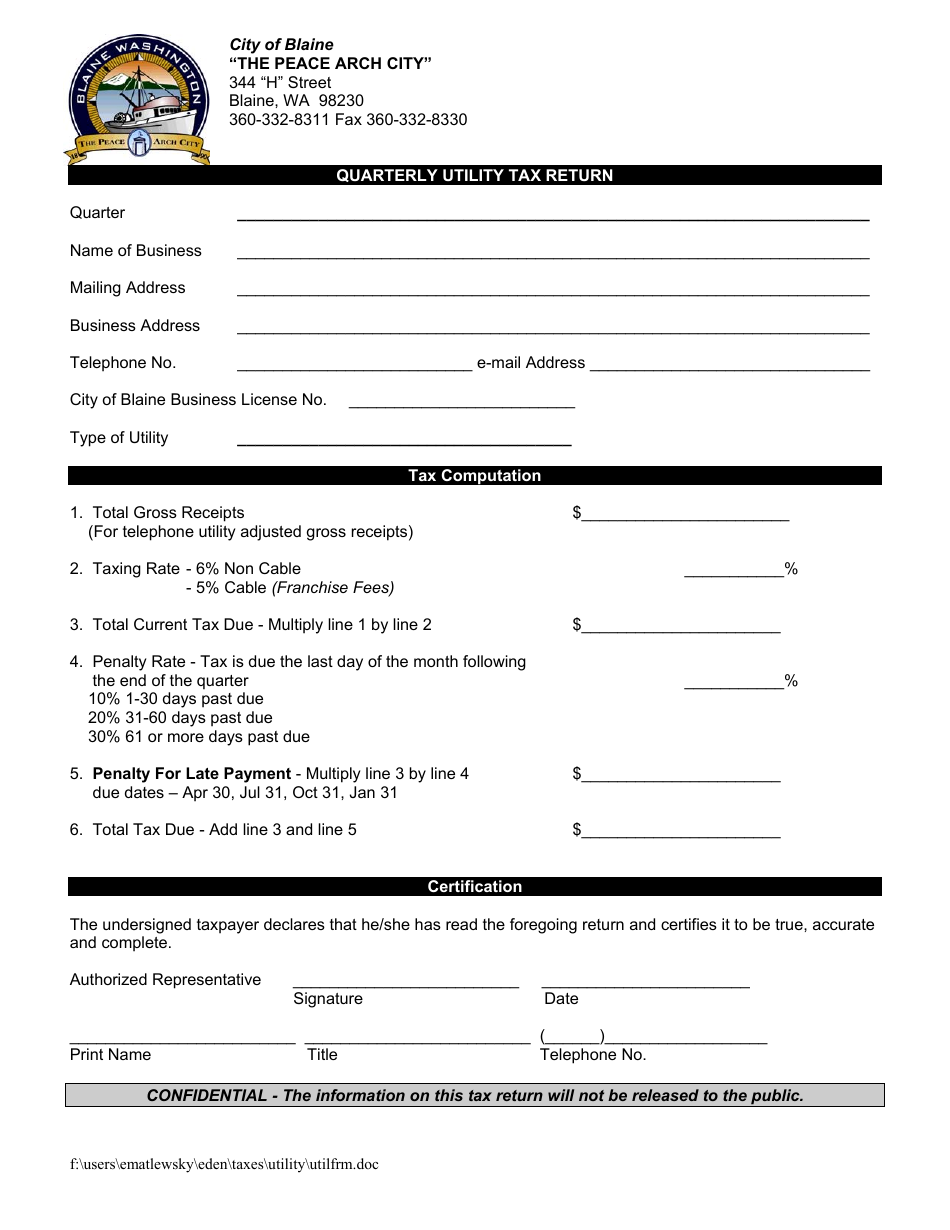

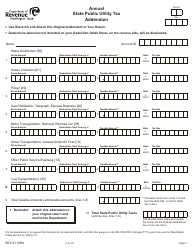

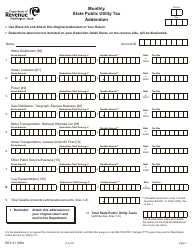

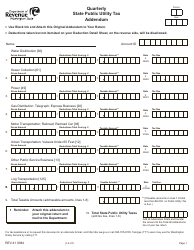

Quarterly Utility Tax Return Form - City of Blaine, Washington

Quarterly Utility Tax Return Form is a legal document that was released by the Finance Department - City of Blaine, Washington - a government authority operating within Washington. The form may be used strictly within City of Blaine.

FAQ

Q: What is the Quarterly Utility Tax Return Form?

A: The Quarterly Utility Tax Return Form is a form used to report utility taxes owed to the City of Blaine, Washington.

Q: How often is the form filed?

A: The form is filed quarterly, meaning it is submitted every three months.

Q: Who needs to file the form?

A: Any business or individual that owes utility taxes to the City of Blaine, Washington needs to file the form.

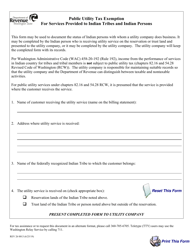

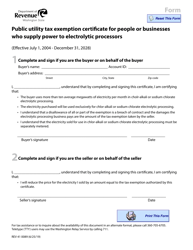

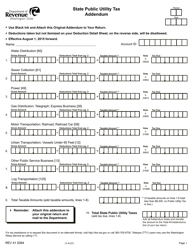

Q: What information is required on the form?

A: The form typically requires information such as the business or individual's name, address, account number, utility usage, and the amount of tax owed.

Q: When is the form due?

A: The form is typically due by certain dates specified by the City of Blaine, Washington. These due dates are usually mentioned on the form or provided by their tax department.

Q: What happens if the form is filed late or not filed at all?

A: Filing the form late or not filing it at all may result in penalties or fines imposed by the City of Blaine, Washington.

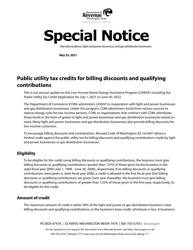

Q: Are there any exemptions or deductions available?

A: Exemptions or deductions may be available depending on the specific regulations of the City of Blaine, Washington. It is advisable to consult their tax department for more information.

Q: What should I do if I have questions or need assistance with the form?

A: If you have any questions or need assistance with the Quarterly Utility Tax Return Form, you should contact the tax department of the City of Blaine, Washington for guidance.

Form Details:

- The latest edition currently provided by the Finance Department - City of Blaine, Washington;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Finance Department - City of Blaine, Washington.