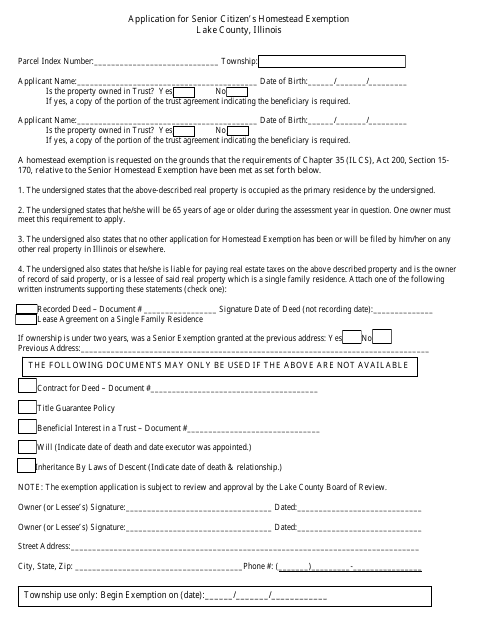

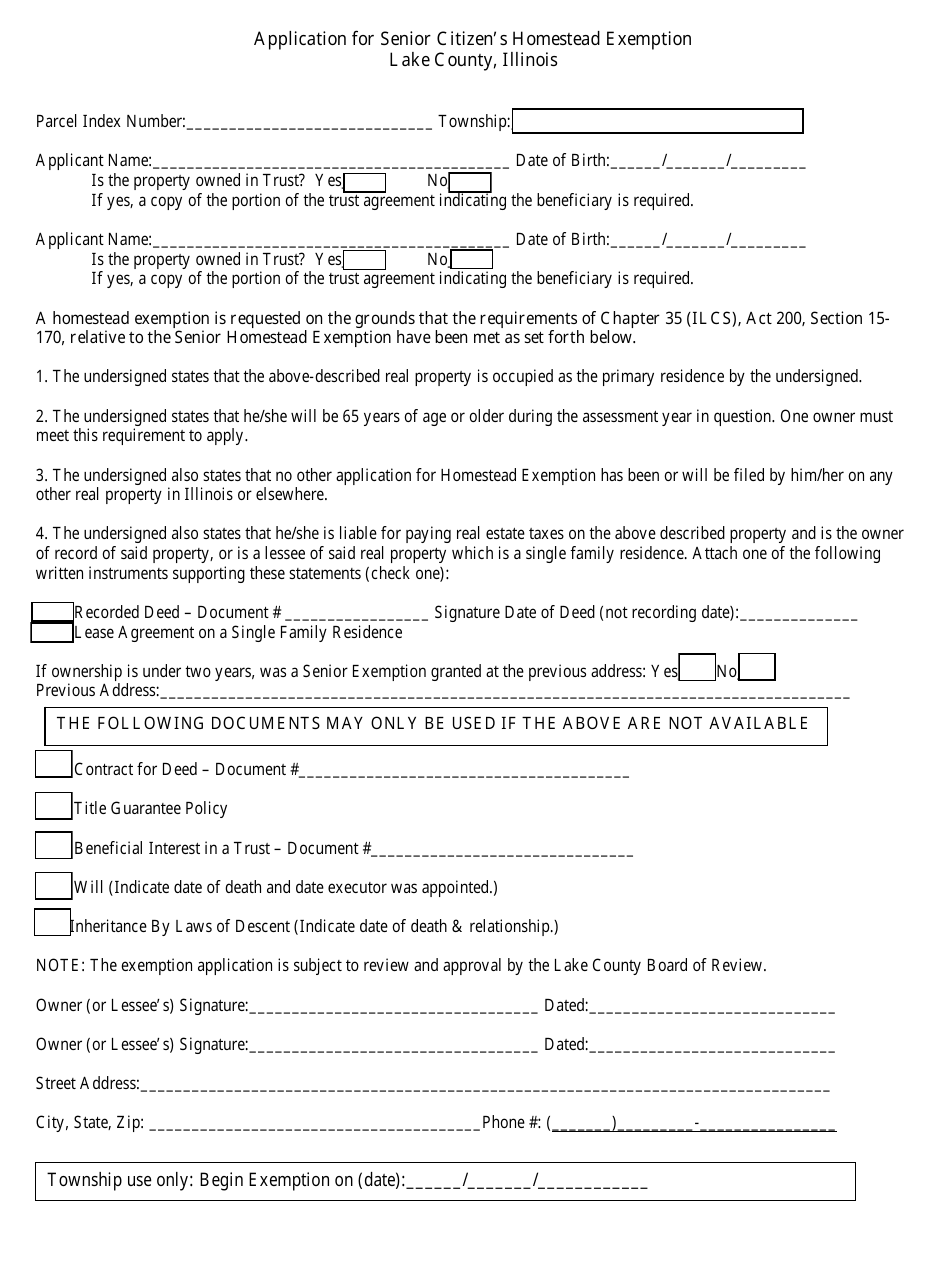

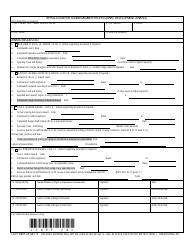

Application for Senior Citizen's Homestead Exemption - Lake County, Illinois

Application for Senior Citizen's Homestead Exemption is a legal document that was released by the Assessment Office - Lake County, Illinois - a government authority operating within Illinois. The form may be used strictly within Lake County.

FAQ

Q: What is the Senior Citizen's Homestead Exemption?

A: The Senior Citizen's Homestead Exemption is a property tax exemption for eligible senior citizens.

Q: Who is eligible for the Senior Citizen's Homestead Exemption in Lake County, Illinois?

A: To be eligible, you must be 65 years or older, own and occupy the property as your principal residence, and meet income requirements.

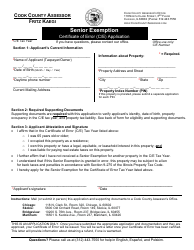

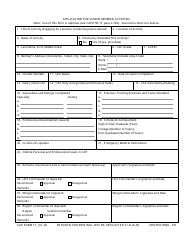

Q: How do I apply for the Senior Citizen's Homestead Exemption?

A: You can apply by submitting an application to the Lake County Assessor's Office.

Q: What documents do I need to include with my application?

A: You will need to include proof of age, proof of ownership, and proof of residency.

Q: How much is the exemption amount?

A: The exemption amount varies depending on factors such as income and assessment level. Contact the Assessor's Office for specific details.

Q: When is the deadline to apply for the Senior Citizen's Homestead Exemption?

A: The deadline to apply is typically July 1st of each year, but it is recommended to check with the Assessor's Office for the most up-to-date information.

Q: What happens if I miss the application deadline?

A: If you miss the deadline, you may still be able to apply for a prorated exemption for the remaining tax year. Contact the Assessor's Office for further instructions.

Q: Can I apply for the Senior Citizen's Homestead Exemption if I rent my property?

A: No, the exemption is only available for homeowners who own and occupy their property as their primary residence.

Q: Is there a fee to apply for the Senior Citizen's Homestead Exemption?

A: There is no fee to apply for the exemption.

Form Details:

- The latest edition currently provided by the Assessment Office - Lake County, Illinois;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Assessment Office - Lake County, Illinois.