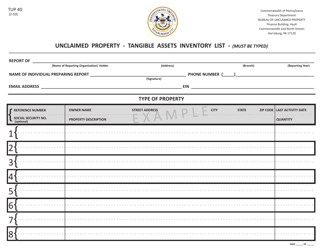

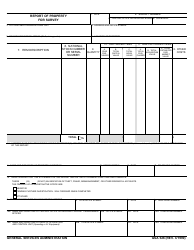

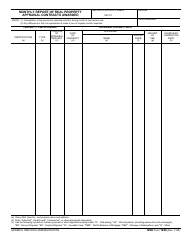

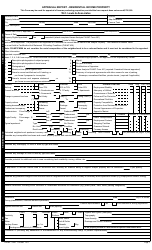

This version of the form is not currently in use and is provided for reference only. Download this version of

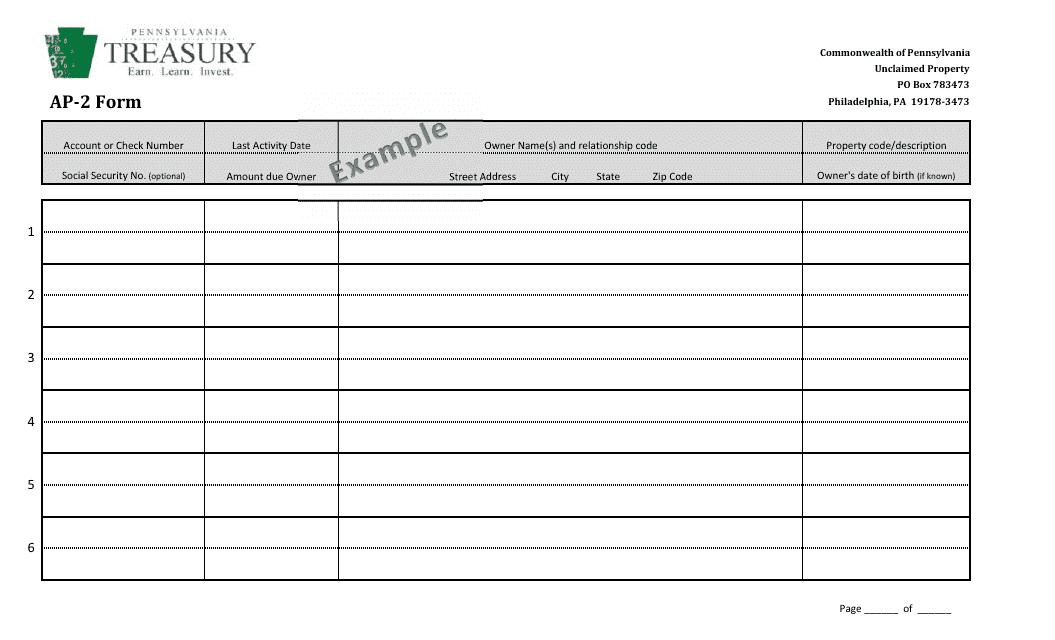

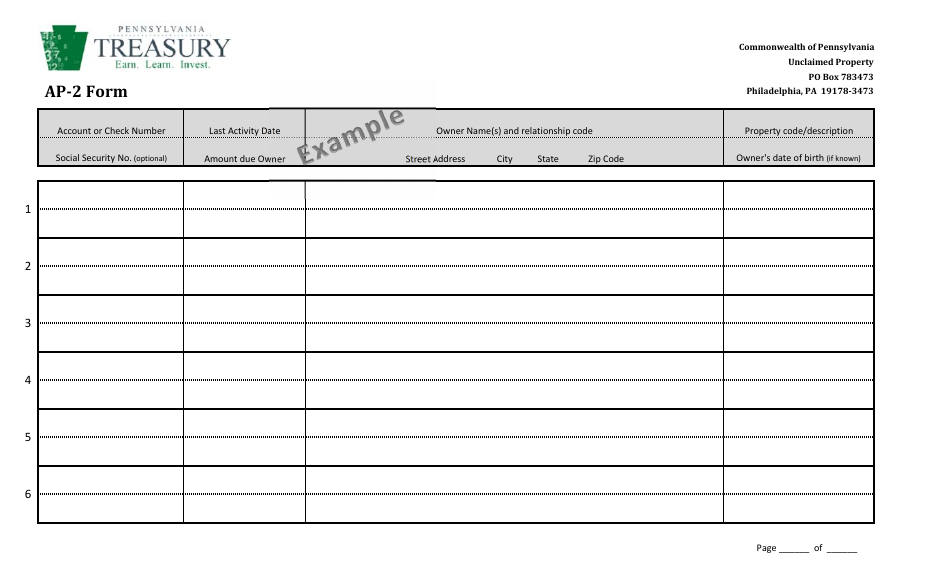

Form AP-2

for the current year.

Form AP-2 Example Report of Unclaimed Property - Pennsylvania

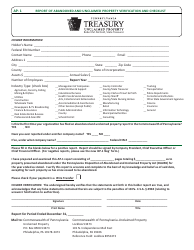

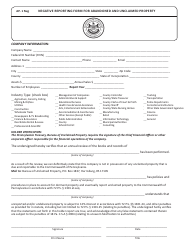

What Is Form AP-2?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

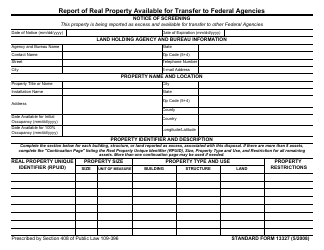

Q: What is Form AP-2?

A: Form AP-2 is a report used in Pennsylvania to report unclaimed property.

Q: Who needs to file Form AP-2?

A: Anyone holding unclaimed property in Pennsylvania is required to file Form AP-2.

Q: What is unclaimed property?

A: Unclaimed property refers to assets or funds that have been abandoned by their owner and turned over to the state.

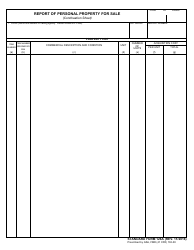

Q: What should be included in the Form AP-2 report?

A: The Form AP-2 report should include detailed information about the unclaimed property, including the description of the property and information about the owner.

Q: When is the deadline to file Form AP-2?

A: The deadline to file Form AP-2 in Pennsylvania is usually November 1st.

Q: Are there any penalties for not filing Form AP-2?

A: Yes, there may be penalties for not filing Form AP-2, including interest on overdue payments and potential legal consequences.

Q: Is there a fee for filing Form AP-2?

A: There is no fee for filing Form AP-2 in Pennsylvania.

Q: Who should I contact for more information about Form AP-2?

A: For more information about Form AP-2, you can contact the Pennsylvania Treasury Department.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-2 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.