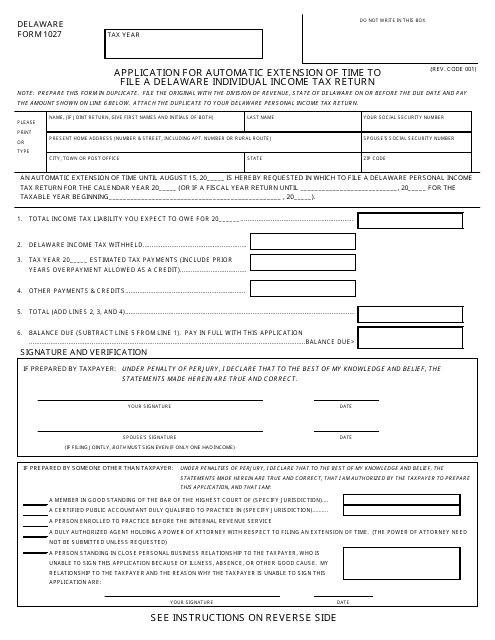

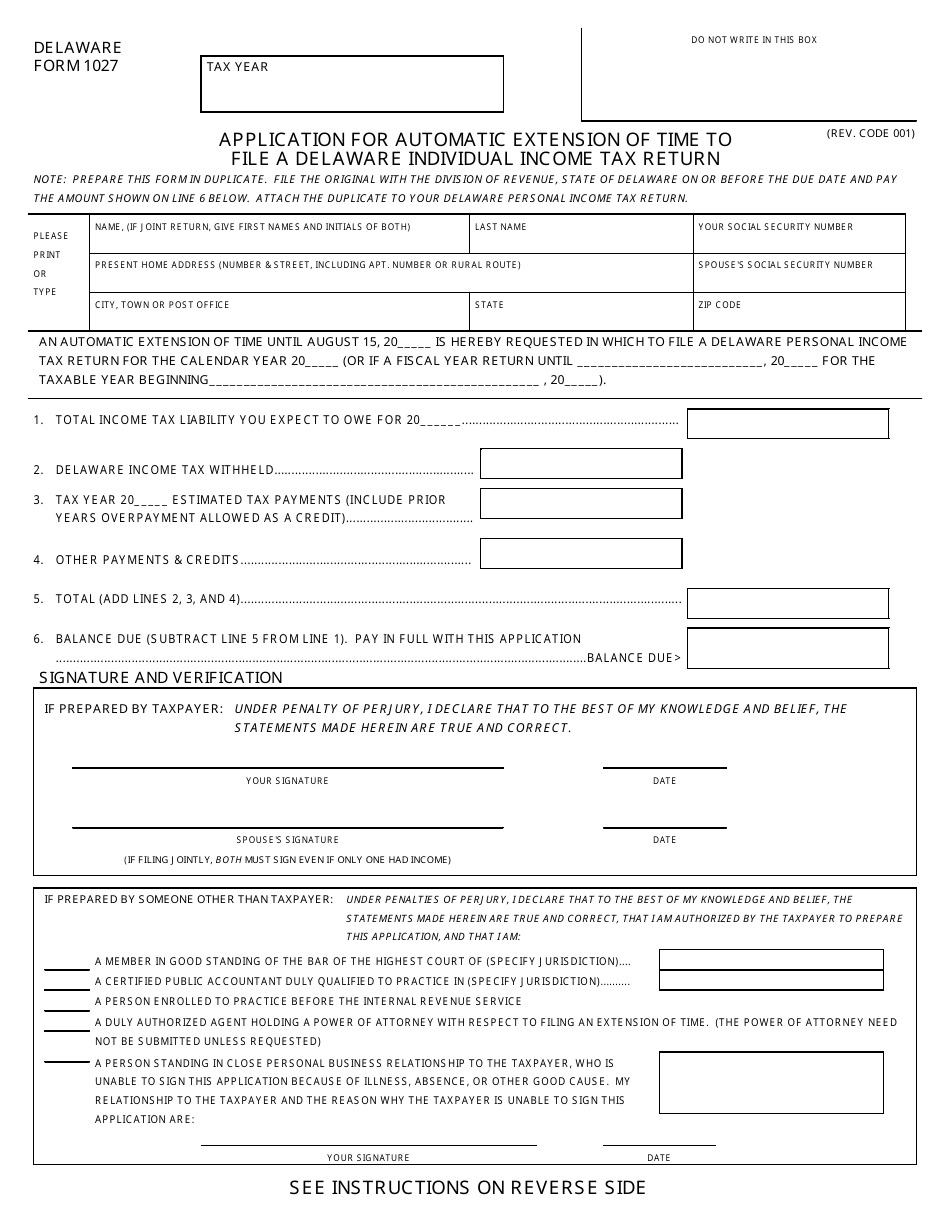

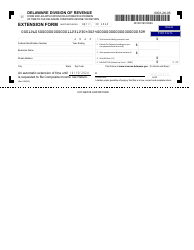

Form 1027 Application for Automatic Extension of Time to File a Delaware Individual Income Tax Return - Delaware

What Is Form 1027?

This is a legal form that was released by the Delaware Department of State - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1027?

A: Form 1027 is the Application for Automatic Extension of Time to File a Delaware Individual Income Tax Return.

Q: Who can use Form 1027?

A: Any individual who needs extra time to file their Delaware income tax return.

Q: What is the purpose of Form 1027?

A: The purpose of Form 1027 is to request an extension of time to file a Delaware individual income tax return.

Q: When is the deadline to file Form 1027?

A: Form 1027 must be filed on or before the original due date of the Delaware income tax return.

Q: How long is the extension granted by Form 1027?

A: Form 1027 grants an automatic extension of six months.

Q: Is payment required when filing Form 1027?

A: Yes, if there will be a balance due, payment must be made with the extension request.

Q: What happens if I file Form 1027 but don't pay the balance due?

A: If the balance due is not paid by the original due date, penalties and interest will be assessed.

Q: Can I file Form 1027 if I have already filed my Delaware income tax return?

A: No, Form 1027 can only be filed before the original due date of the Delaware income tax return.

Form Details:

- The latest edition provided by the Delaware Department of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1027 by clicking the link below or browse more documents and templates provided by the Delaware Department of State.