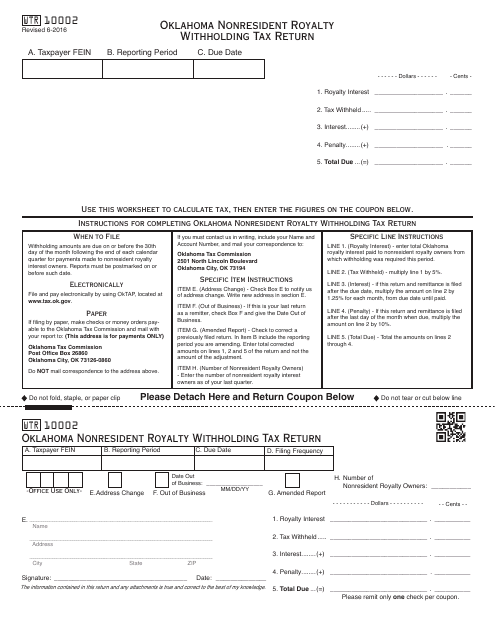

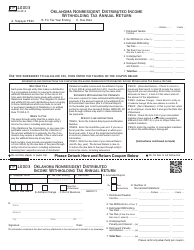

Form WTR10002 Oklahoma Nonresident Royalty Withholding Tax Return - Oklahoma

What Is Form WTR10002?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WTR10002?

A: Form WTR10002 is the Oklahoma Nonresident Royalty Withholding Tax Return.

Q: Who is required to file Form WTR10002?

A: Nonresident individuals or entities who have royalty income from Oklahoma sources are required to file Form WTR10002.

Q: What is the purpose of Form WTR10002?

A: The purpose of Form WTR10002 is to report and pay the withholding tax on royalty income earned from Oklahoma sources.

Q: How often should Form WTR10002 be filed?

A: Form WTR10002 should be filed annually, on or before the 15th day of the fourth month following the close of the taxable year.

Q: Is there a minimum threshold for filing Form WTR10002?

A: Yes, if the total amount of royalty income from Oklahoma sources is less than $1,000 in a calendar year, you are not required to file Form WTR10002.

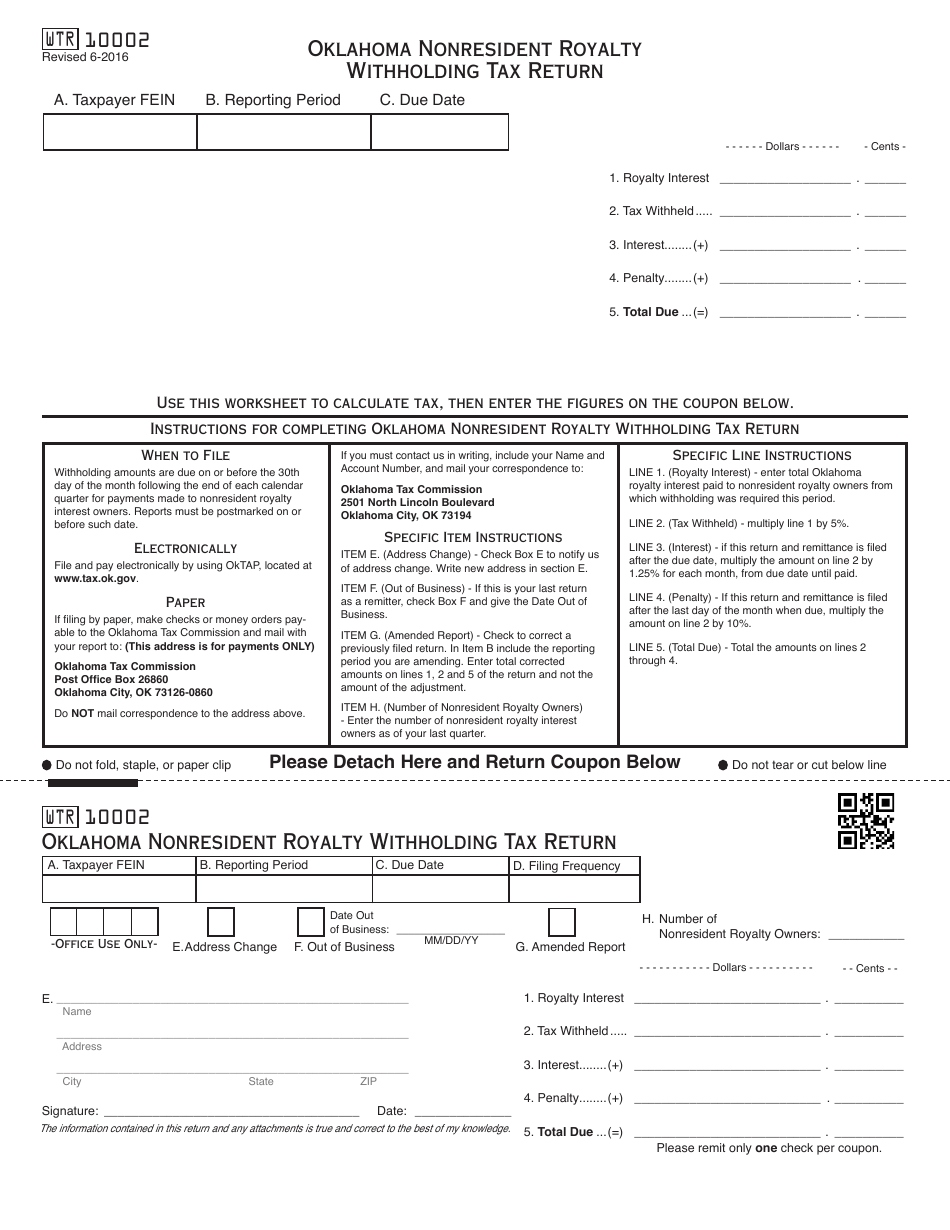

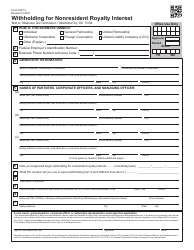

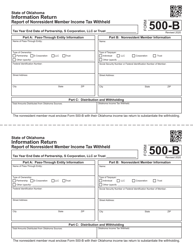

Q: What should be included with Form WTR10002?

A: You should include a copy of the federal Form 1099-MISC for each payee and any additional supporting documentation with Form WTR10002.

Q: Are there any penalties for late or incorrect filing of Form WTR10002?

A: Yes, there are penalties for late or incorrect filing of Form WTR10002, including interest charges and possible criminal penalties.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WTR10002 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.