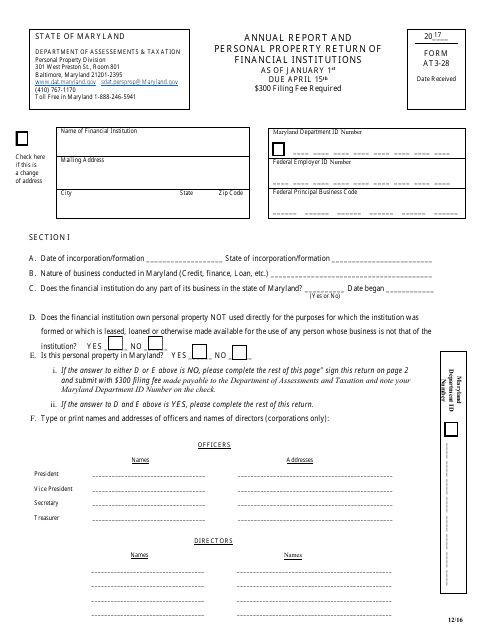

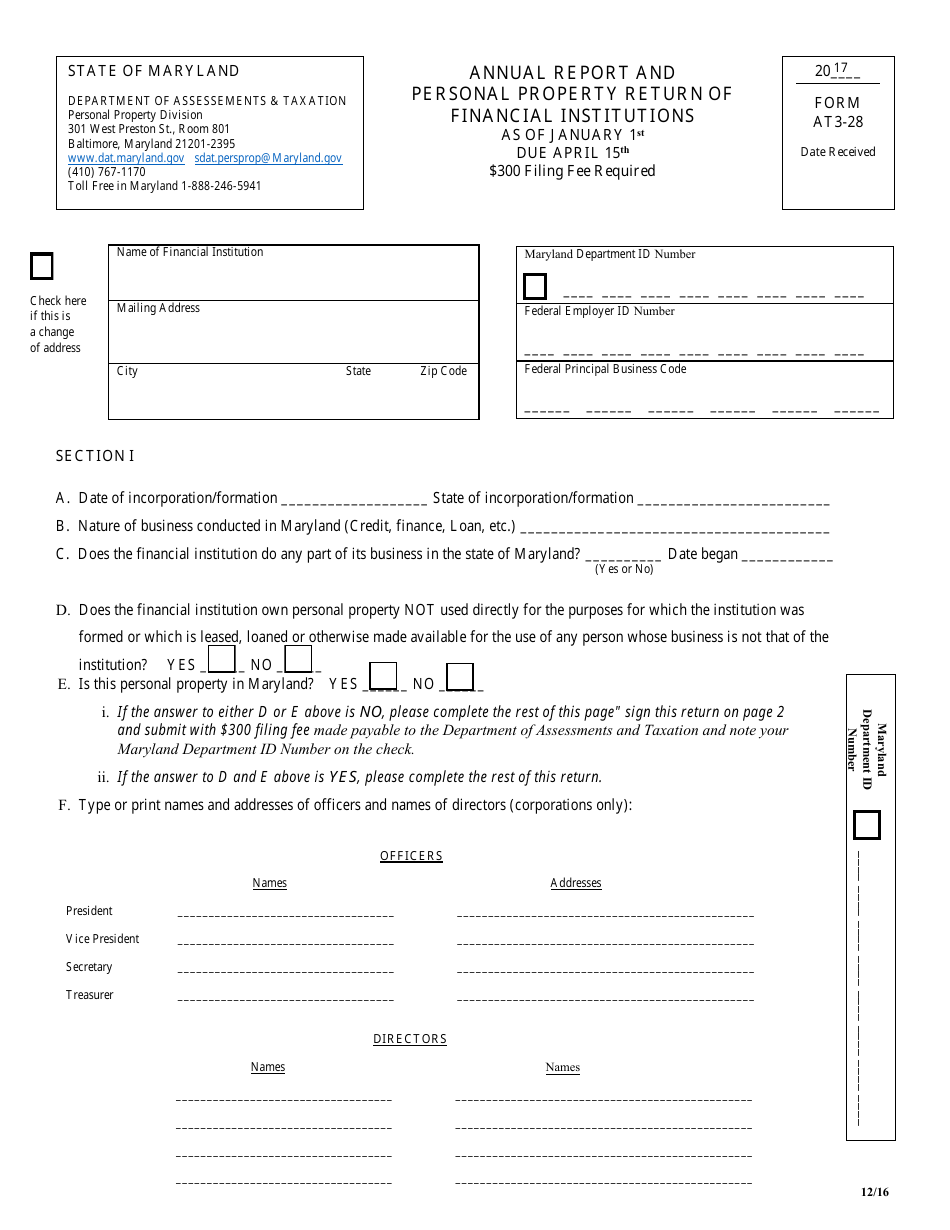

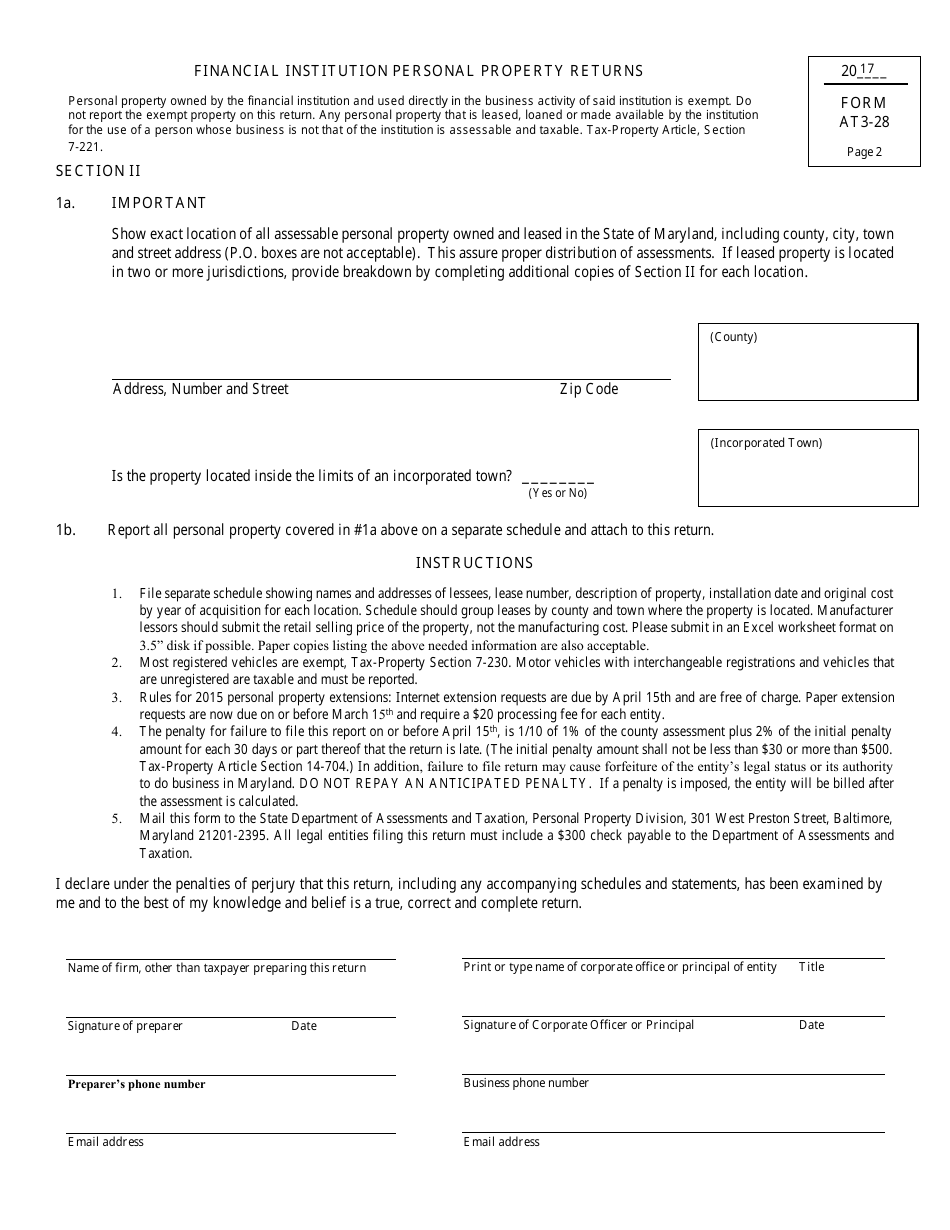

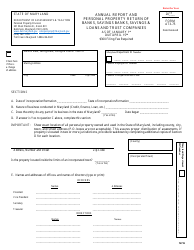

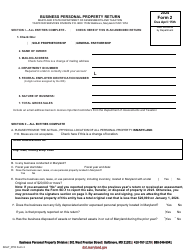

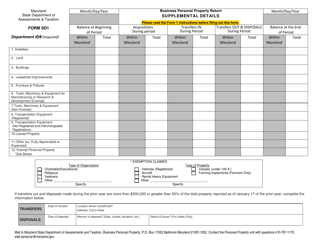

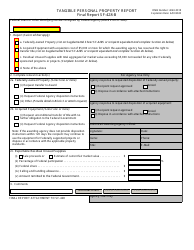

Form AT3-28 Annual Report and Personal Property Return of Financial Institutions - Maryland

What Is Form AT3-28?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AT3-28?

A: Form AT3-28 is the Annual Report and Personal Property Return of Financial Institutions in Maryland.

Q: Who needs to file Form AT3-28?

A: Financial institutions operating in Maryland need to file Form AT3-28.

Q: What is the purpose of Form AT3-28?

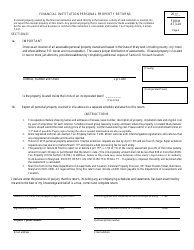

A: The purpose of Form AT3-28 is to report personal property owned by financial institutions in Maryland.

Q: When is Form AT3-28 due?

A: Form AT3-28 is due by April 15th each year for the preceding calendar year.

Q: Are there any penalties for late filing of Form AT3-28?

A: Yes, there are penalties for late filing of Form AT3-28. It is important to file the form on time to avoid penalties.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AT3-28 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.