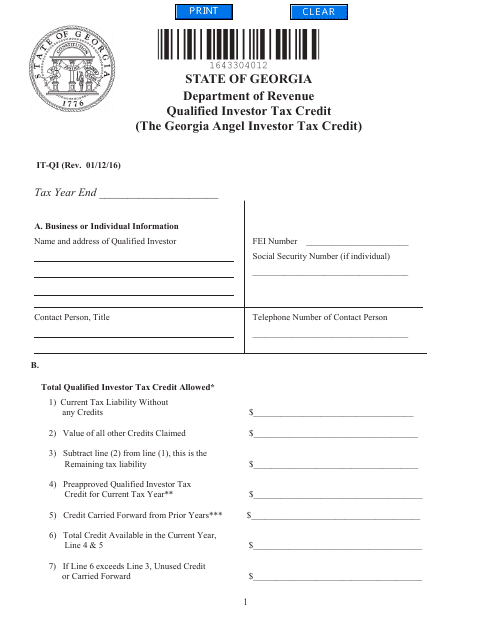

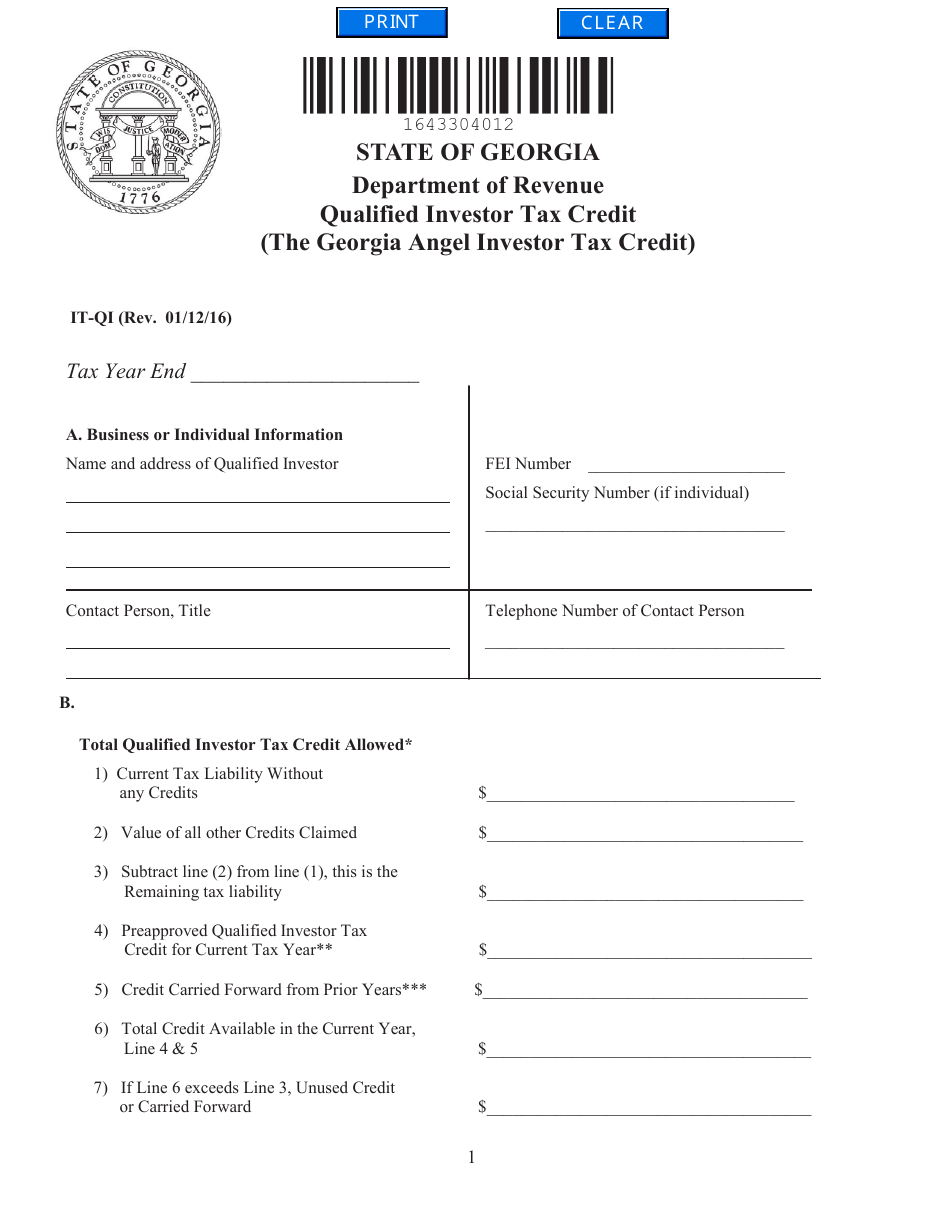

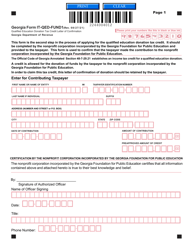

Form IT-QI Qualified Investor Tax Credit - Georgia (United States)

What Is Form IT-QI?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form IT-QI?

A: Form IT-QI is a tax form used in Georgia, United States.

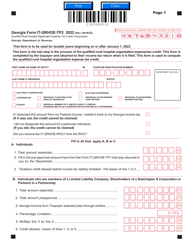

Q: What is the Qualified Investor Tax Credit?

A: The Qualified Investor Tax Credit is a tax incentive program in Georgia.

Q: Who is eligible for the Qualified Investor Tax Credit?

A: Eligible parties include individuals, corporations, or limited liability companies that invest in certain businesses in Georgia.

Q: How does the Qualified Investor Tax Credit work?

A: Investors can claim a tax credit against their Georgia income tax liability, based on a percentage of their investment in eligible businesses.

Q: What businesses qualify for the Qualified Investor Tax Credit?

A: Eligible businesses include high-technology companies, headquarters facilities, telecommunications services, tourism projects, and certain other industries.

Q: How much is the tax credit?

A: The tax credit is equal to 35% of the investment made in an eligible business.

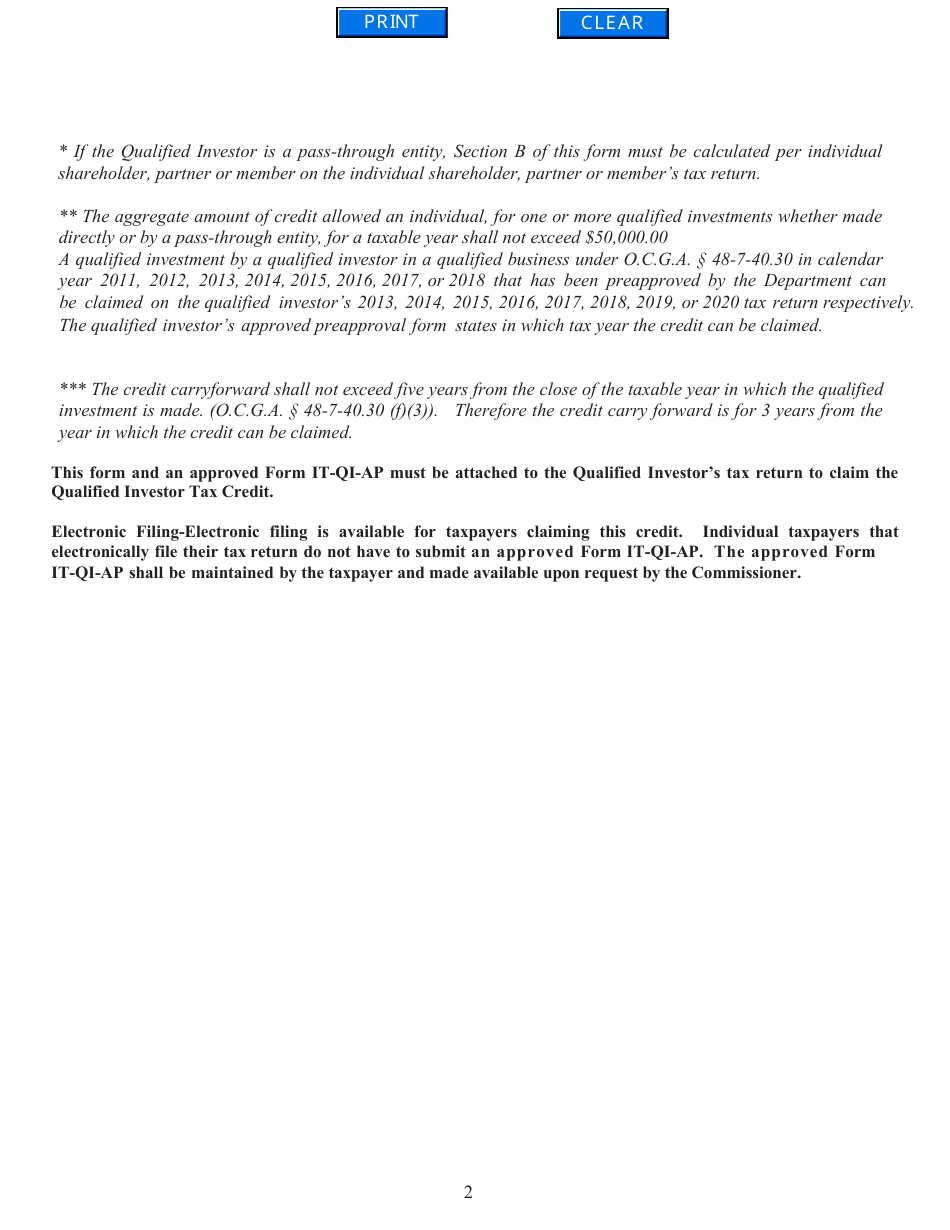

Q: Are there any limitations or restrictions on the tax credit?

A: Yes, there are various limitations and restrictions, such as a maximum annual credit cap and a minimum investment threshold.

Form Details:

- Released on January 12, 2016;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-QI by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.