This version of the form is not currently in use and is provided for reference only. Download this version of

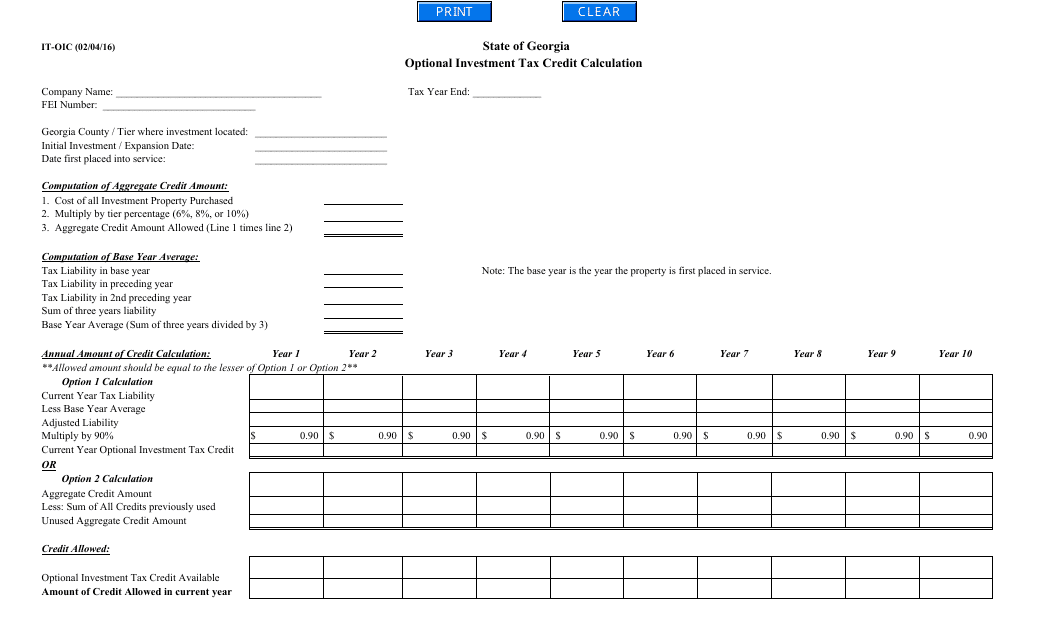

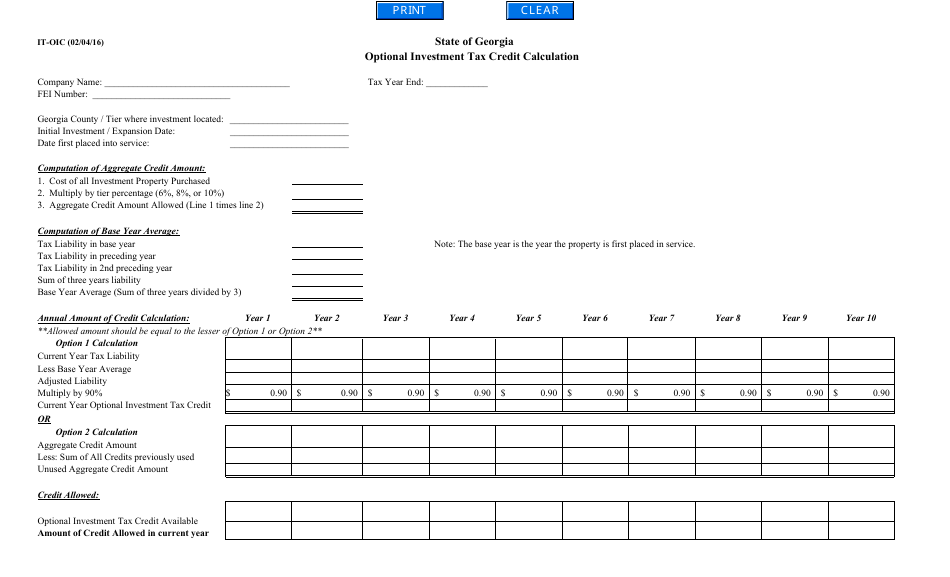

Form IT-OIC

for the current year.

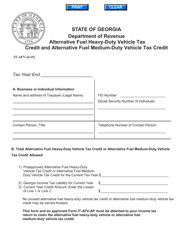

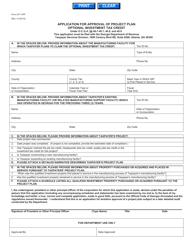

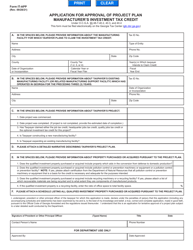

Form IT-OIC Optional Investment Tax Credit Calculation - Georgia (United States)

What Is Form IT-OIC?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-OIC?

A: Form IT-OIC is the Optional Investment Tax Credit Calculation form used in Georgia.

Q: What is the purpose of Form IT-OIC?

A: The purpose of Form IT-OIC is to calculate the Optional Investment Tax Credit in Georgia.

Q: Who needs to file Form IT-OIC?

A: Anyone claiming the Optional Investment Tax Credit in Georgia needs to file Form IT-OIC.

Q: What information do I need to fill out Form IT-OIC?

A: You will need information about your investments and the amount of optional investment tax credit you are claiming.

Q: When is the deadline to file Form IT-OIC?

A: The deadline to file Form IT-OIC in Georgia is the same as the deadline for filing your state income tax return.

Q: Are there any penalties for not filing Form IT-OIC?

A: Yes, if you do not file Form IT-OIC and you are eligible for the Optional Investment Tax Credit, you may face penalties or miss out on potential tax savings.

Q: Can I claim the Optional Investment Tax Credit if I didn't file Form IT-OIC?

A: No, you must file Form IT-OIC in order to claim the Optional Investment Tax Credit in Georgia.

Q: Can I e-file Form IT-OIC?

A: Yes, you can e-file Form IT-OIC if you are using approved tax software or working with a professional tax preparer.

Q: Can I make corrections to Form IT-OIC after filing?

A: Yes, if you need to make corrections to Form IT-OIC after filing, you can file an amended return using Form IT-AMX.

Form Details:

- Released on February 4, 2016;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-OIC by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.