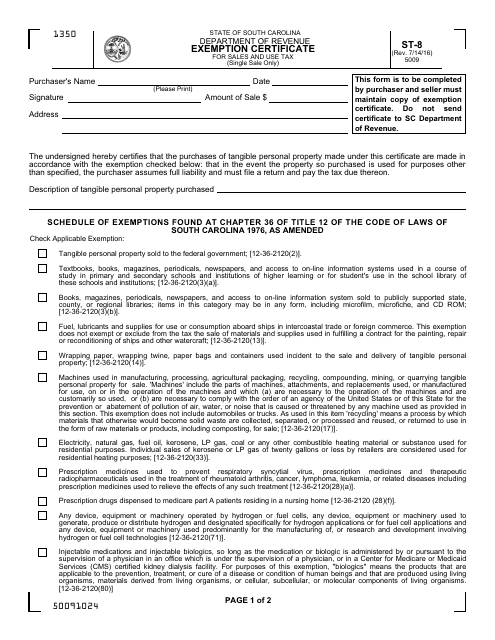

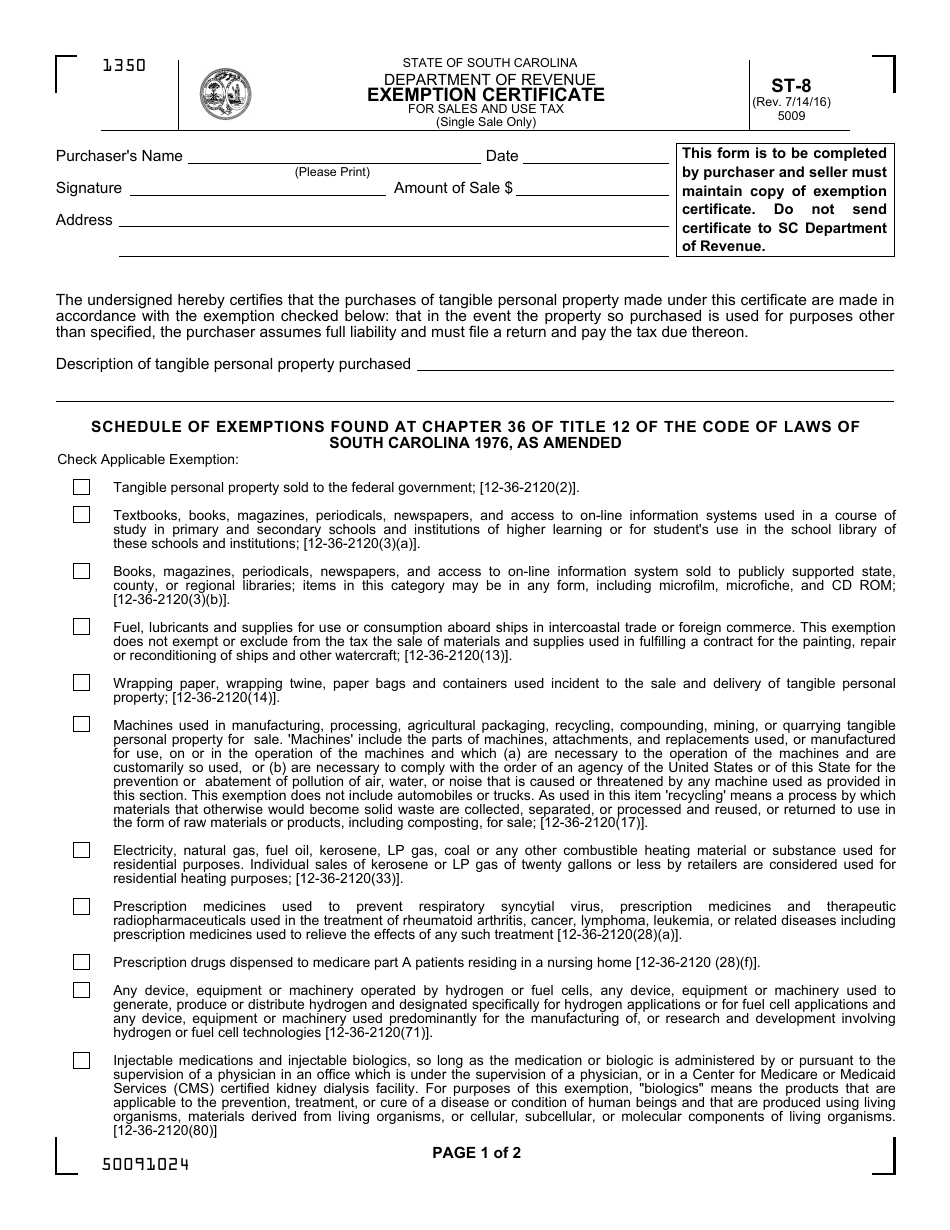

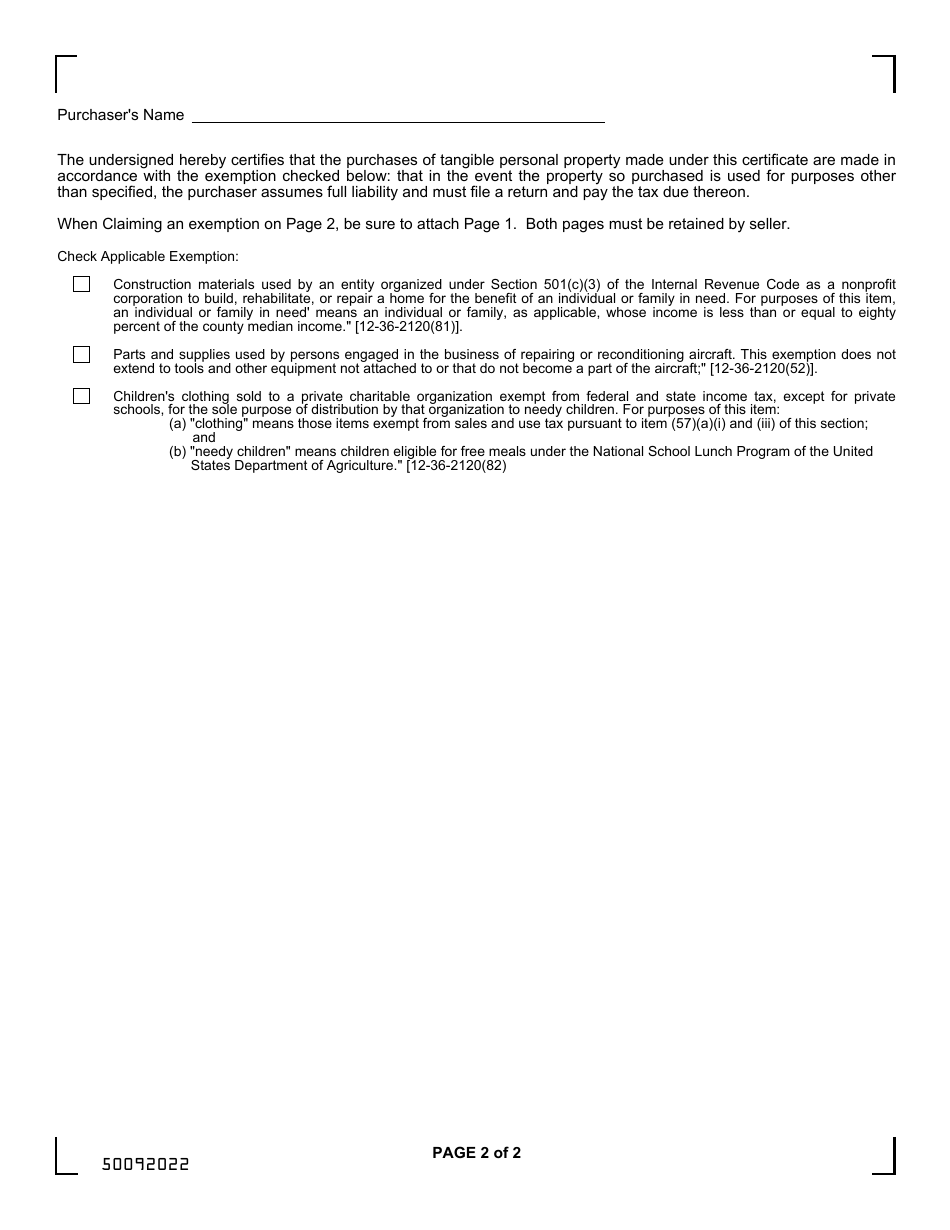

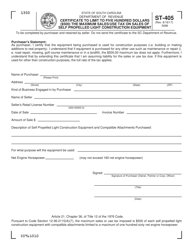

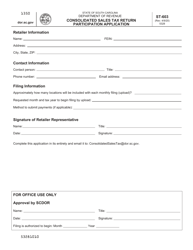

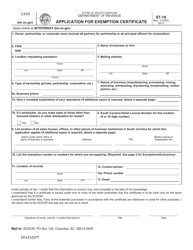

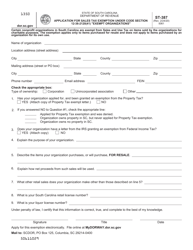

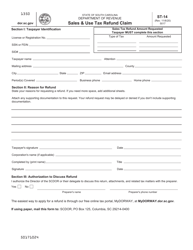

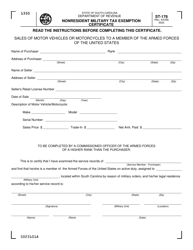

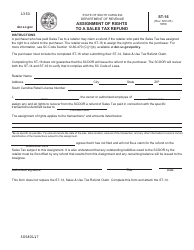

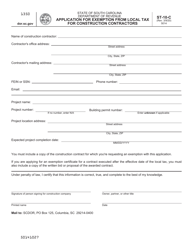

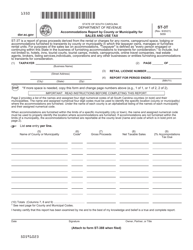

Form ST-8 Exemption Certificate for Sales and Use Tax - South Carolina

What Is Form ST-8?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-8?

A: Form ST-8 is an Exemption Certificate for Sales and Use Tax in South Carolina.

Q: What is the purpose of Form ST-8?

A: The purpose of Form ST-8 is to claim exemption from sales and use tax on certain purchases in South Carolina.

Q: Who should use Form ST-8?

A: Form ST-8 should be used by individuals or businesses seeking exemption from sales and use tax in South Carolina.

Q: What purchases can be exempted using Form ST-8?

A: Form ST-8 can be used to claim exemption on specific purchases, such as machinery, equipment, and materials used in manufacturing or production.

Q: Are there any time limitations or restrictions when using Form ST-8?

A: Yes, there may be time limitations and restrictions when using Form ST-8. It is important to review the instructions and guidelines provided by the South Carolina Department of Revenue.

Form Details:

- Released on July 14, 2016;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-8 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.