This version of the form is not currently in use and is provided for reference only. Download this version of

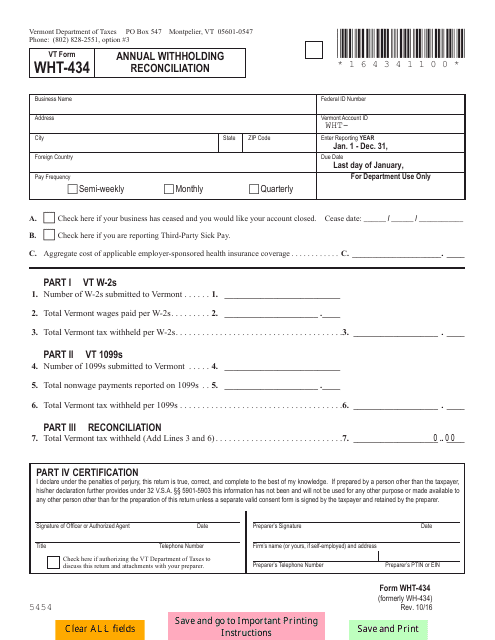

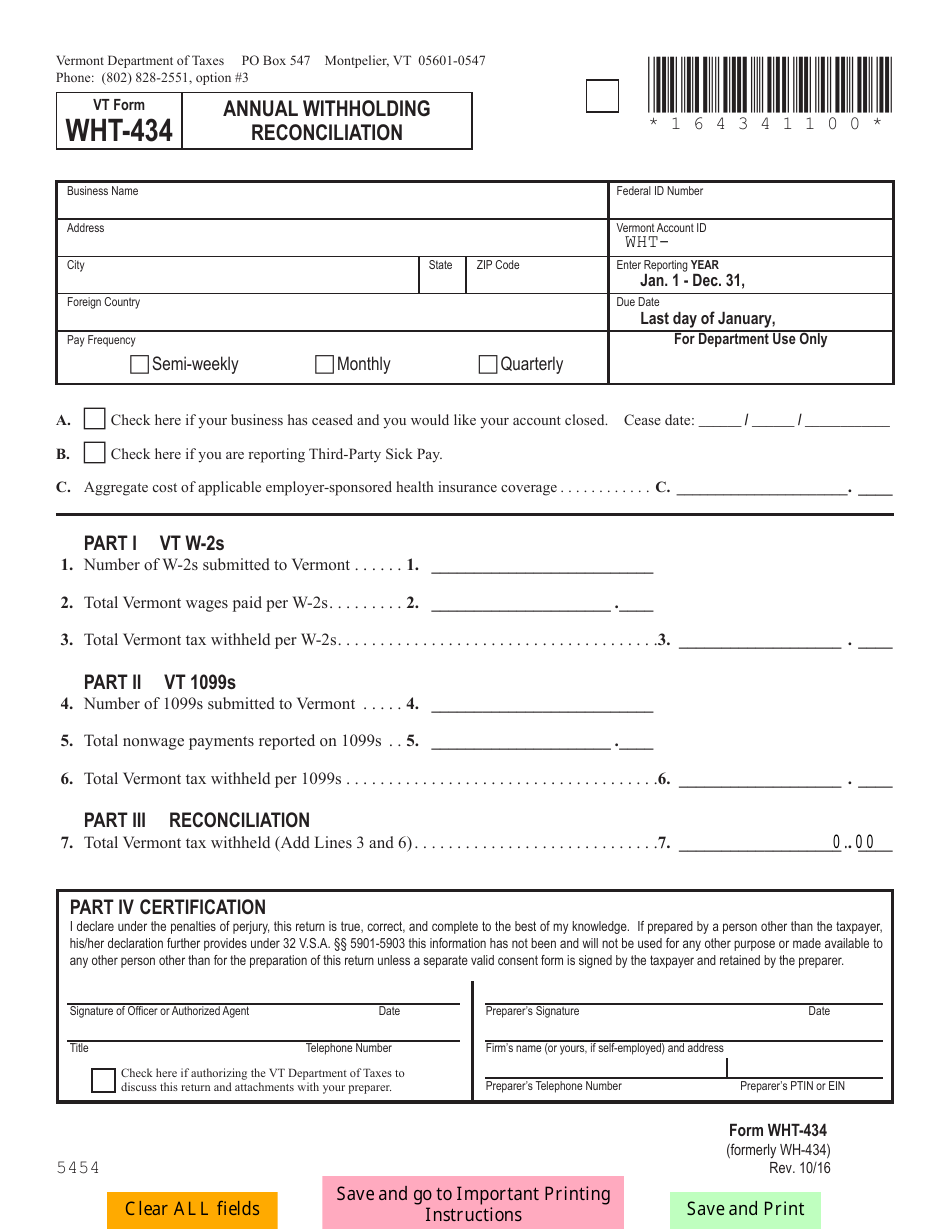

VT Form WHT-434

for the current year.

VT Form WHT-434 Annual Withholding Reconciliation - Vermont

What Is VT Form WHT-434?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form WHT-434?

A: Form WHT-434 is the Annual Withholding Reconciliation form for Vermont.

Q: Who needs to file Form WHT-434?

A: Employers in Vermont who have withheld income taxes from their employees' wages need to file Form WHT-434.

Q: What is the purpose of Form WHT-434?

A: Form WHT-434 is used to reconcile the withholding taxes that the employer has withheld from their employees' wages with the total amount of withholding taxes due to the state of Vermont.

Q: When is Form WHT-434 due?

A: Form WHT-434 is due on or before January 31st of the following year.

Q: What information do I need to complete Form WHT-434?

A: To complete Form WHT-434, you will need to provide information about your employees' wages and the amount of withholding taxes withheld from their wages throughout the year.

Q: Are there any penalties for not filing Form WHT-434?

A: Yes, there are penalties for not filing Form WHT-434 or for filing it late. It is important to file the form on time to avoid penalties.

Q: Can Form WHT-434 be filed electronically?

A: Yes, Form WHT-434 can be filed electronically through the Vermont Department of Taxes e-filing system.

Q: Is Form WHT-434 the same as Form W-2?

A: No, Form WHT-434 is not the same as Form W-2. Form WHT-434 is used to reconcile withholding taxes, while Form W-2 is used to report wages and tax withholding for each employee.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form WHT-434 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.