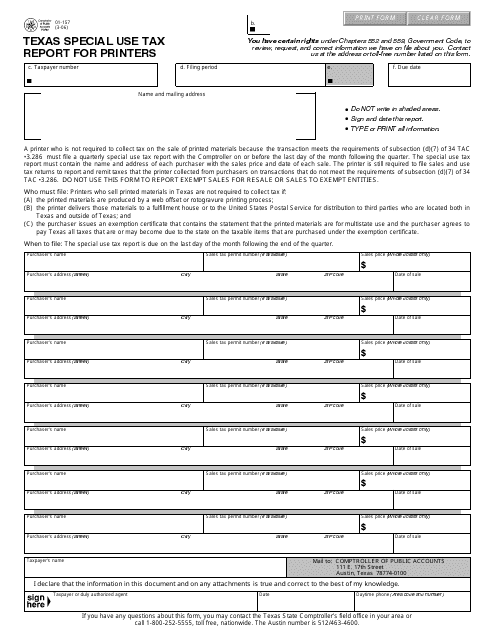

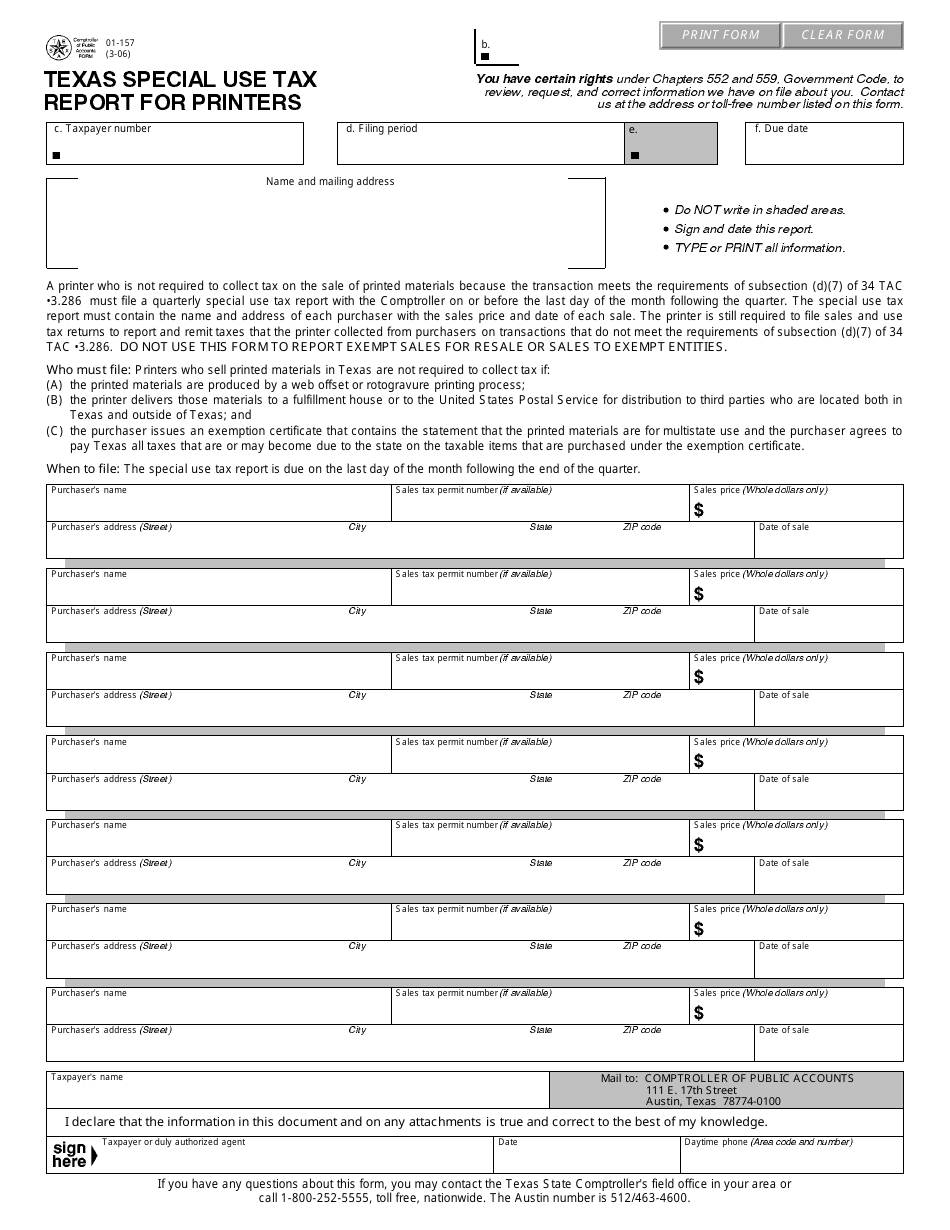

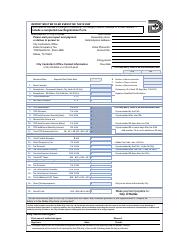

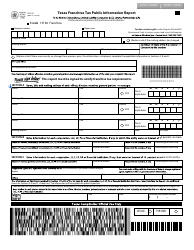

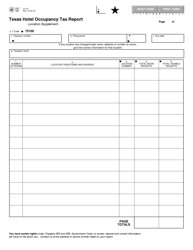

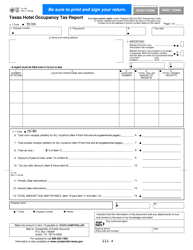

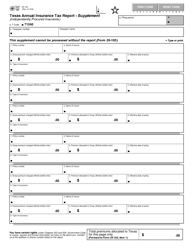

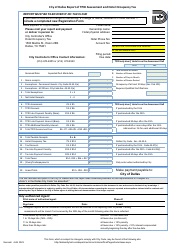

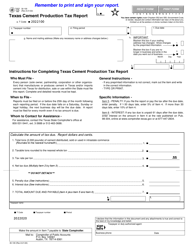

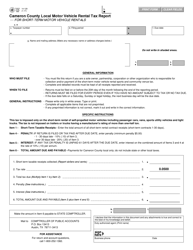

Form 01-157 Texas Special Use Tax Report for Printers - Texas

What Is Form 01-157?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

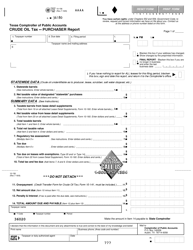

Q: What is Form 01-157?

A: Form 01-157 is the Texas Special UseTax Report for Printers.

Q: Who needs to file Form 01-157?

A: Printers in Texas need to file Form 01-157.

Q: What is the purpose of Form 01-157?

A: The purpose of Form 01-157 is to report the amount of toner used in printers in Texas.

Q: Is Form 01-157 only for printers?

A: Yes, Form 01-157 is specifically for printers.

Q: When is the deadline to file Form 01-157?

A: The deadline to file Form 01-157 is the 20th day of the month following the reporting period.

Q: Is there a penalty for late filing of Form 01-157?

A: Yes, there is a penalty for late filing of Form 01-157.

Q: Are there any exemptions to filing Form 01-157?

A: Yes, certain exemptions apply to filing Form 01-157. Refer to the instructions for more information.

Q: What should I do if I have questions about Form 01-157?

A: If you have questions about Form 01-157, you can contact the Texas Comptroller's office for assistance.

Form Details:

- Released on March 1, 2006;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 01-157 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.