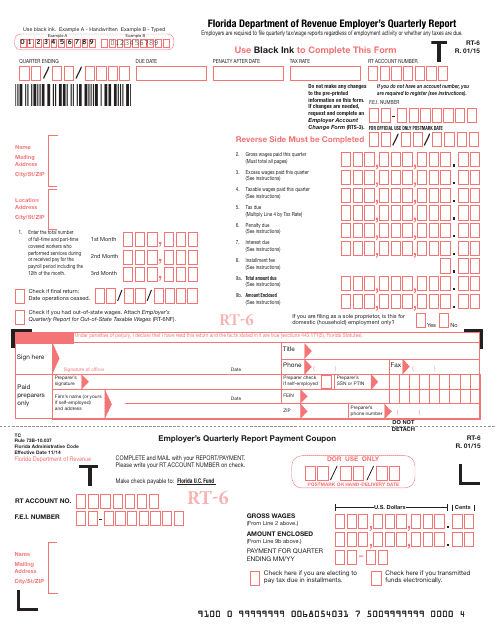

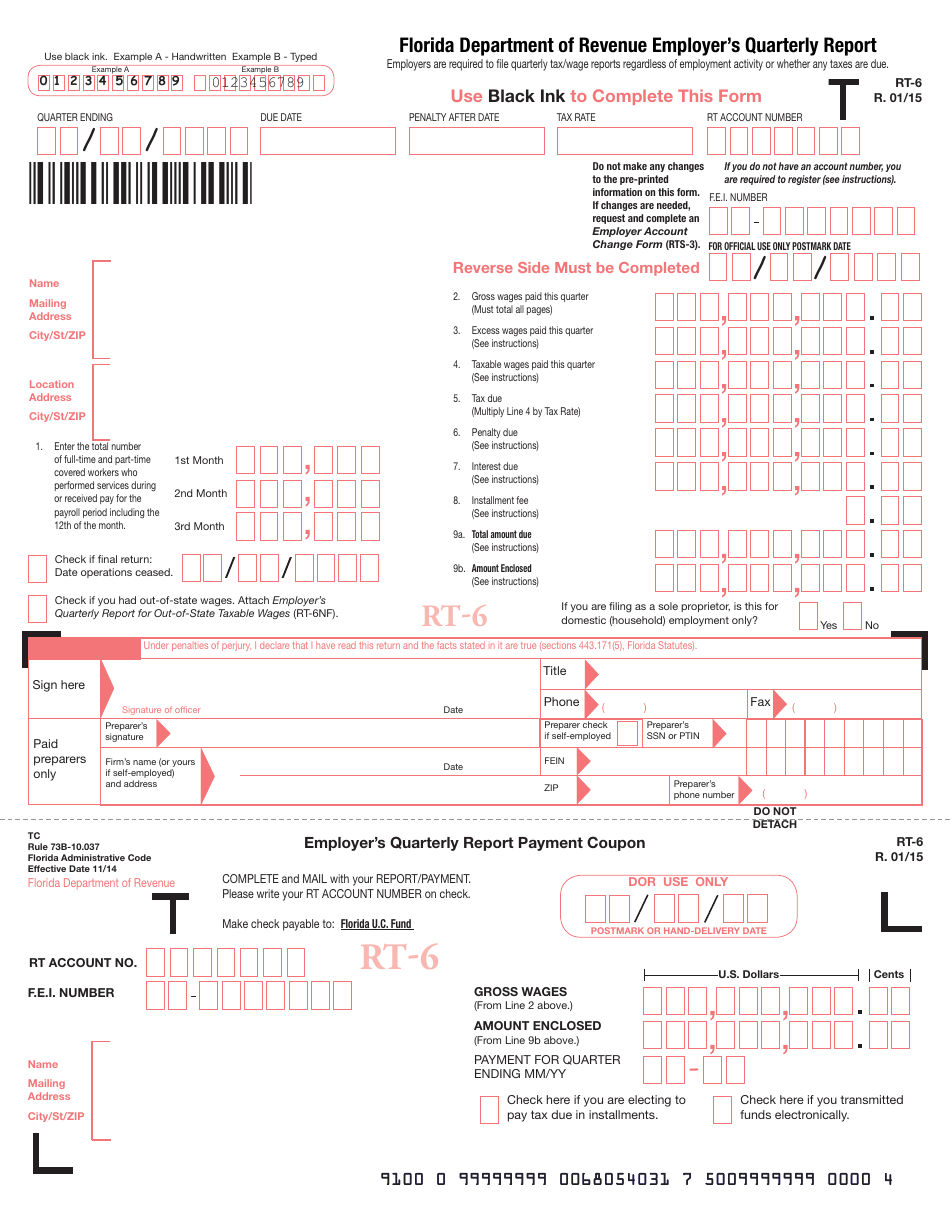

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RT-6

for the current year.

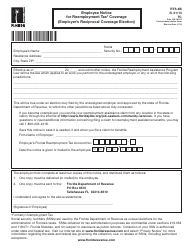

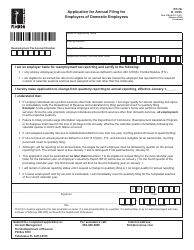

Form RT-6 Employer's Quarterly Report - Florida

What Is RT-6?

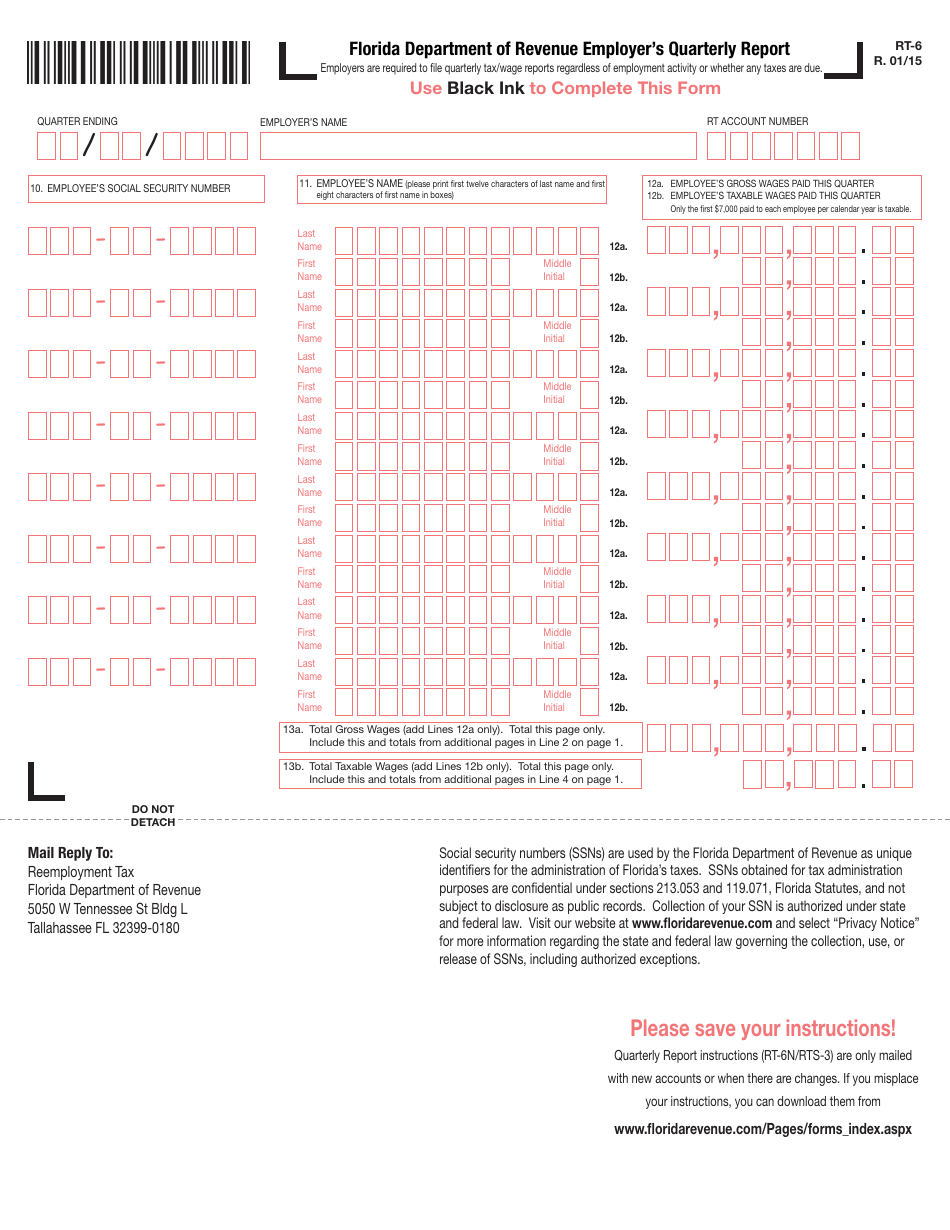

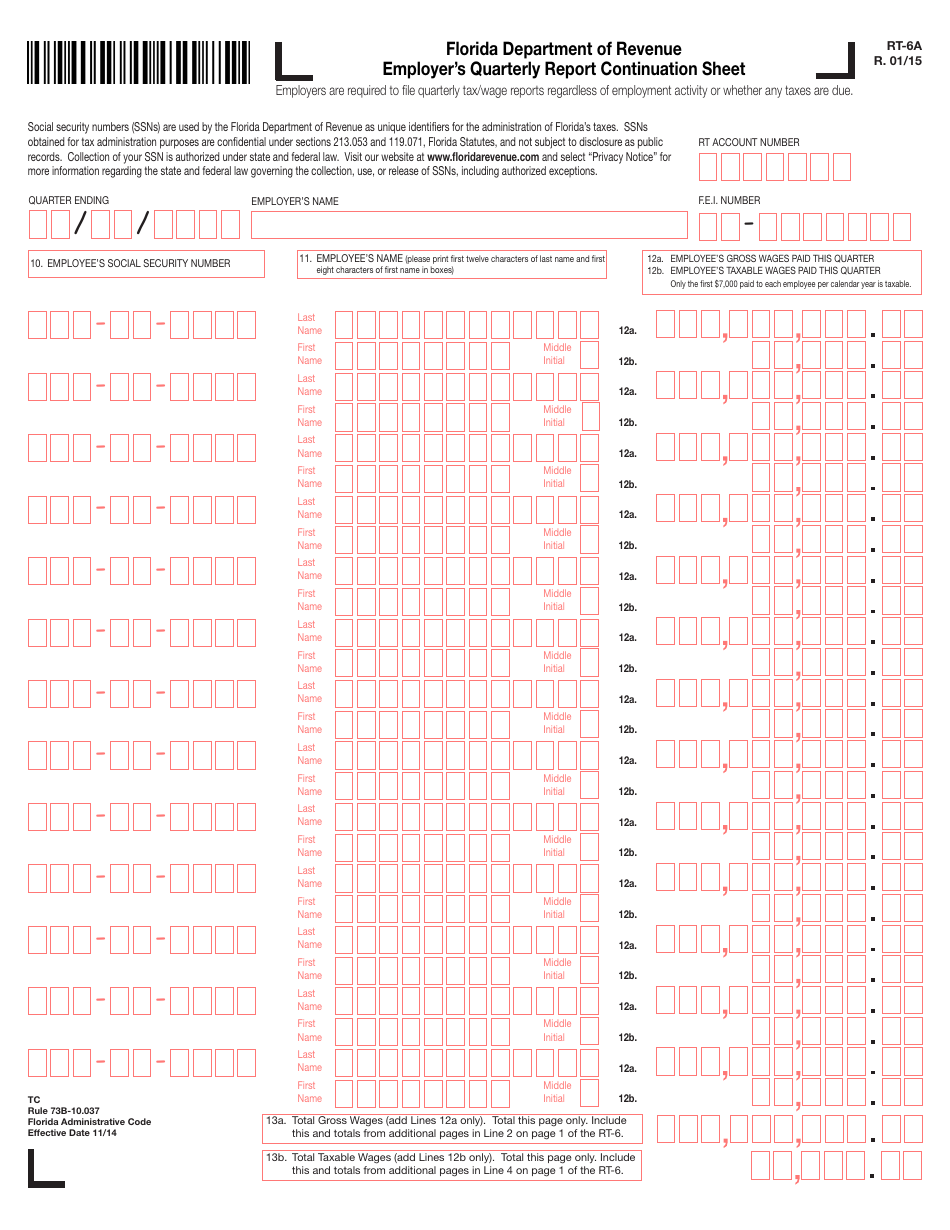

Form RT-6, Employer's Quarterly Report , is a legal document used to inform the Florida Department of Revenue (DOR) about the total number of all employees who performed services or received pay, their gross, excess, and taxable wages. Florida RT-6 Form computes the employer taxes (also known as payroll taxes) and includes tax summary details.

This form was released by the Florida DOR. The latest version of the form was issued on January 1, 2015 , with all previous editions obsolete. You can download an RT-6 fillable form through the link below. Additional department-released guidelines can be found in the instructions manual for Forms RT-6 and RT-6A.

Florida RT-6 Instructions

Before filing Form RT-6, you are required to register and receive a reemployment taxaccount number. You may do this online on the DOR website.

Include the following details in the Florida Department of Revenue employer's quarterly report:

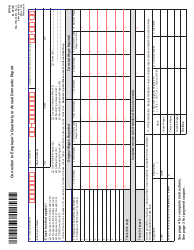

- State the total number of full-time and part-time employees who worked or received salaries during the payroll period;

- Enter the total gross wages paid - the amount before any taxes and deductions. Include salaries, bonuses, commissions, sick and vacation pay, and any remuneration paid without using cash;

- Indicate the excess wages - they exceed $7,000 per employee in a calendar year;

- Write down the taxable wages paid this quarter (gross wages minus excess wages). Only the first $7,000 paid to the employee is taxable;

- State the due tax by multiplying taxable wages by the tax rate;

- If the report is late, compute the penalty of $25 for each month;

- If you did not pay tax on time, you owe interest on tax due. To see the current interest rates, visit the DOR website;

- If you choose to pay quarterly taxes in installments, enter $5;

- State the total amount of taxes due;

- Write down the employer's name and reemployment tax (RT) account number;

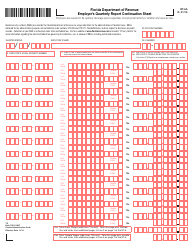

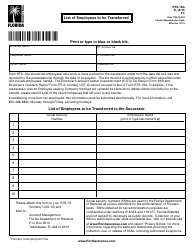

- Provide the employees' personal details - their social security numbers, full names, gross and taxable wages;

- Certify that the facts stated in the form are true and accurate. Add your contact information and sign the document.

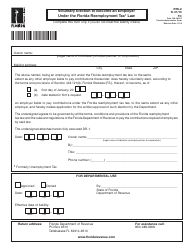

The report covers employment during a single calendar quarter. The report is due on the first day of the month following the end of each calendar quarter:

| Quarter: | Due by: |

| January - March | April 30 |

| April - June | July 31 |

| July - September | October 31 |

| October - December | January 31 |

It is possible to report this information either electronically or on paper. If you wish to send a paper report, mail the RT-6 Form to: Reemployment Tax, Florida Department of Revenue, 5050 W. Tennessee St. Bldg L, Tallahassee, FL 32399-0180

How to Pay RT-6 Online

The fastest and most efficient way to file a Florida RT-6 Form is online. You need to register on the DOR website at floridarevenue.com.

The DOR will then send you a User ID, PIN or Password, and instructions for filing and paying the reemployment tax. If you use this method, you will no longer receive paper reports from the DOR, and if you choose to pay RT-6 online, do not send a paper report.