This version of the form is not currently in use and is provided for reference only. Download this version of

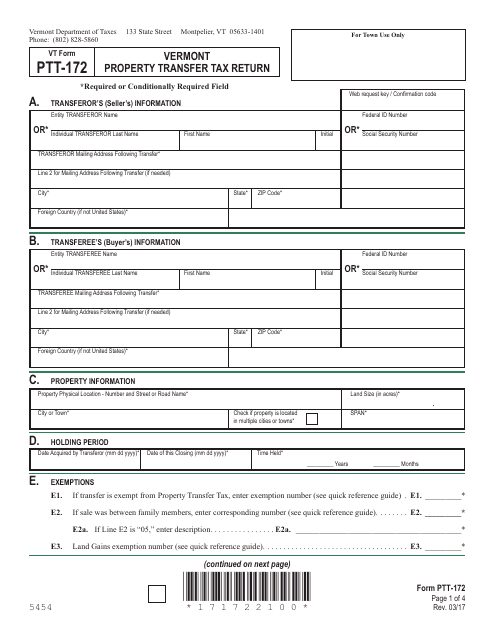

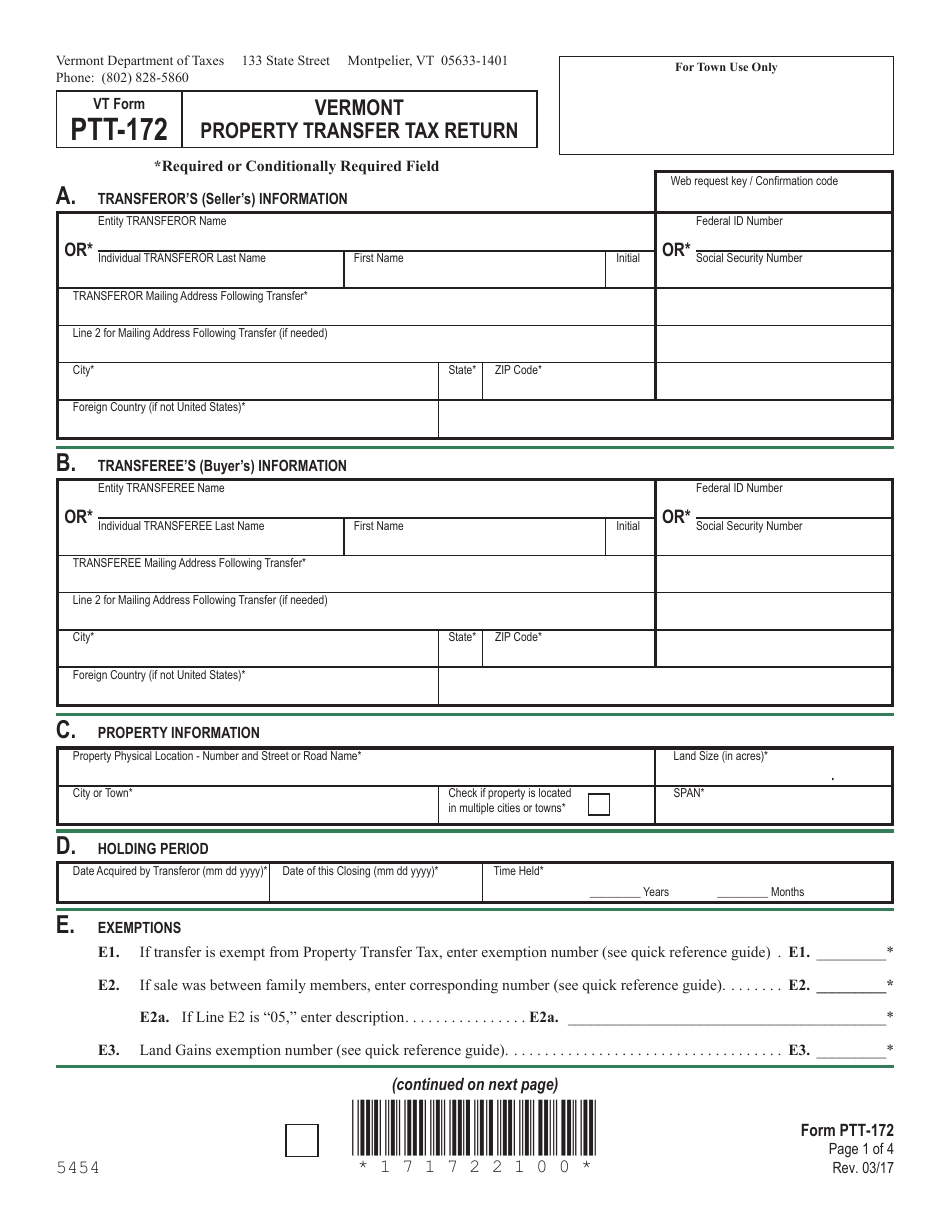

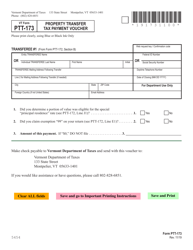

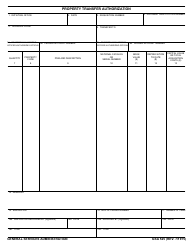

VT Form PTT-172

for the current year.

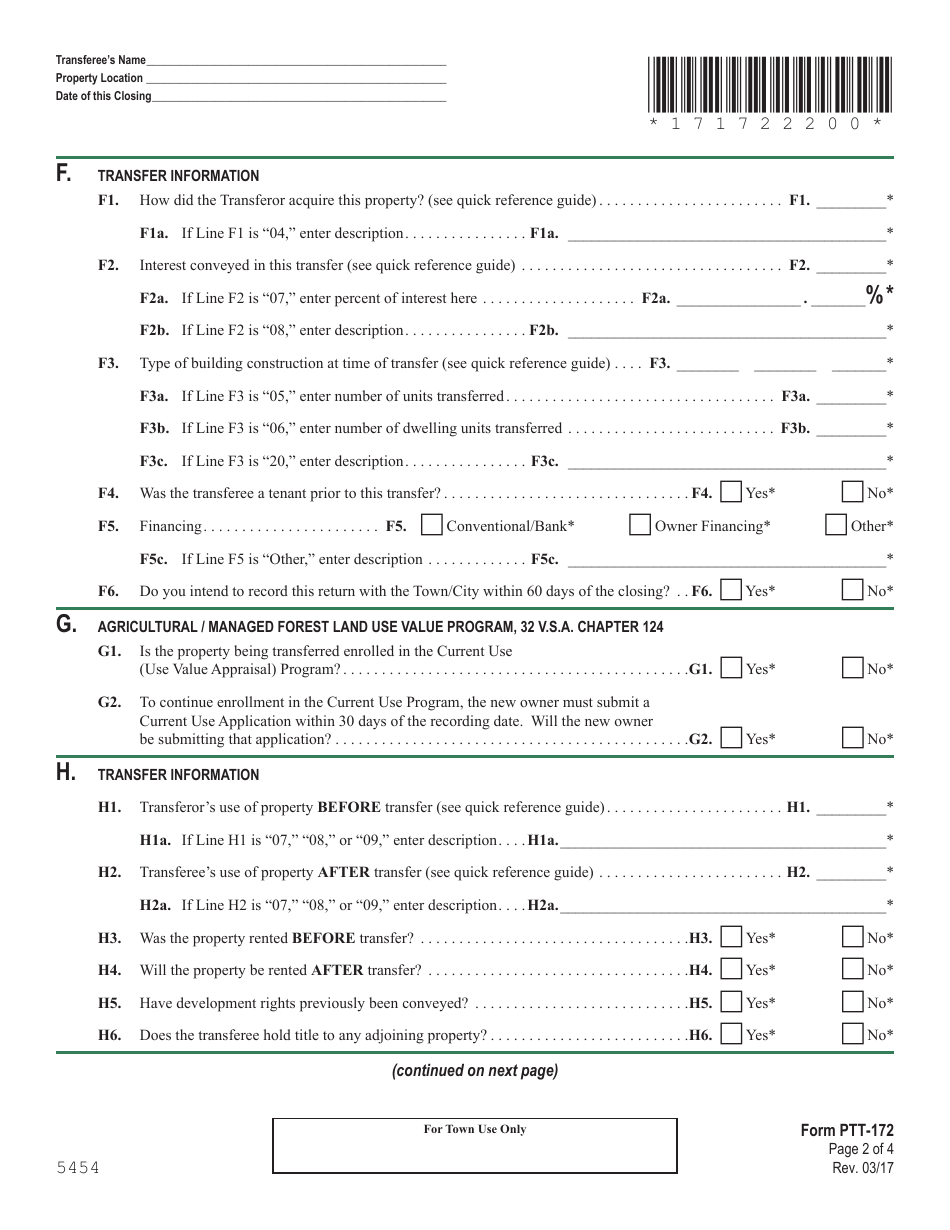

VT Form PTT-172 Vermont Property Transfer Tax Return - Vermont

What Is VT Form PTT-172?

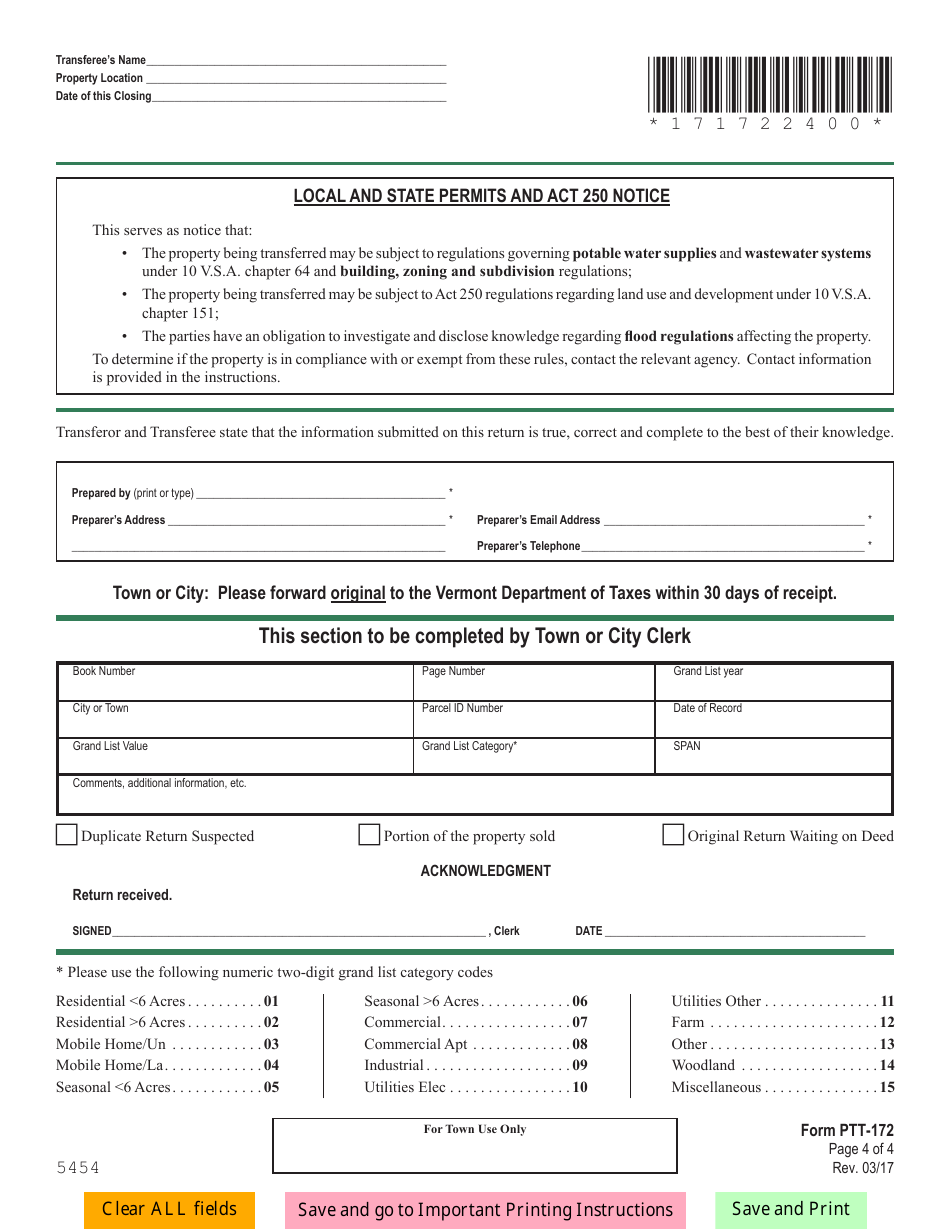

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is VT Form PTT-172?

A: VT Form PTT-172 is the Vermont Property Transfer Tax Return.

Q: What is the purpose of VT Form PTT-172?

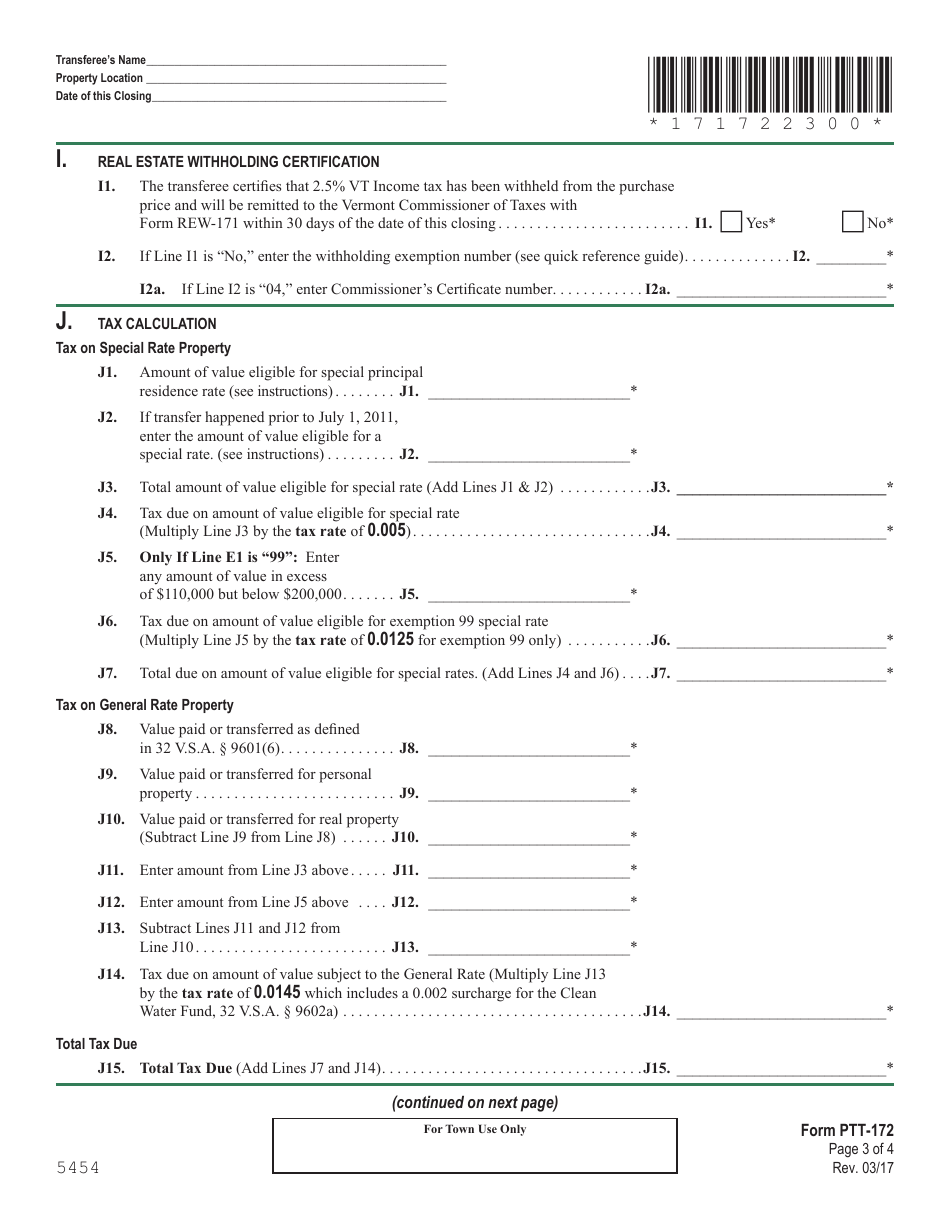

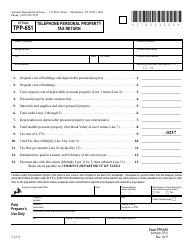

A: VT Form PTT-172 is used to report and pay the property transfer tax in the state of Vermont.

Q: When is VT Form PTT-172 due?

A: VT Form PTT-172 must be filed and the tax must be paid within 15 days after the date of transfer.

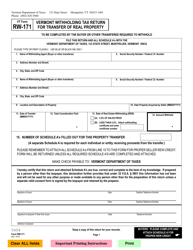

Q: Who needs to file VT Form PTT-172?

A: The buyer or transferee of real property in Vermont is responsible for filing VT Form PTT-172.

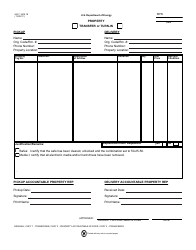

Q: What information is required on VT Form PTT-172?

A: VT Form PTT-172 requires information such as the property address, purchase price, and the buyer's information.

Q: Is there a fee for filing VT Form PTT-172?

A: Yes, there is a property transfer tax fee based on the purchase price of the property.

Q: What happens if I fail to file VT Form PTT-172?

A: Failing to file VT Form PTT-172 or pay the property transfer tax can result in penalties and interest charges.

Q: Can I claim exemptions on VT Form PTT-172?

A: Yes, there are certain exemptions available for certain types of transfers, such as transfers between family members or certain government entities.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form PTT-172 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.