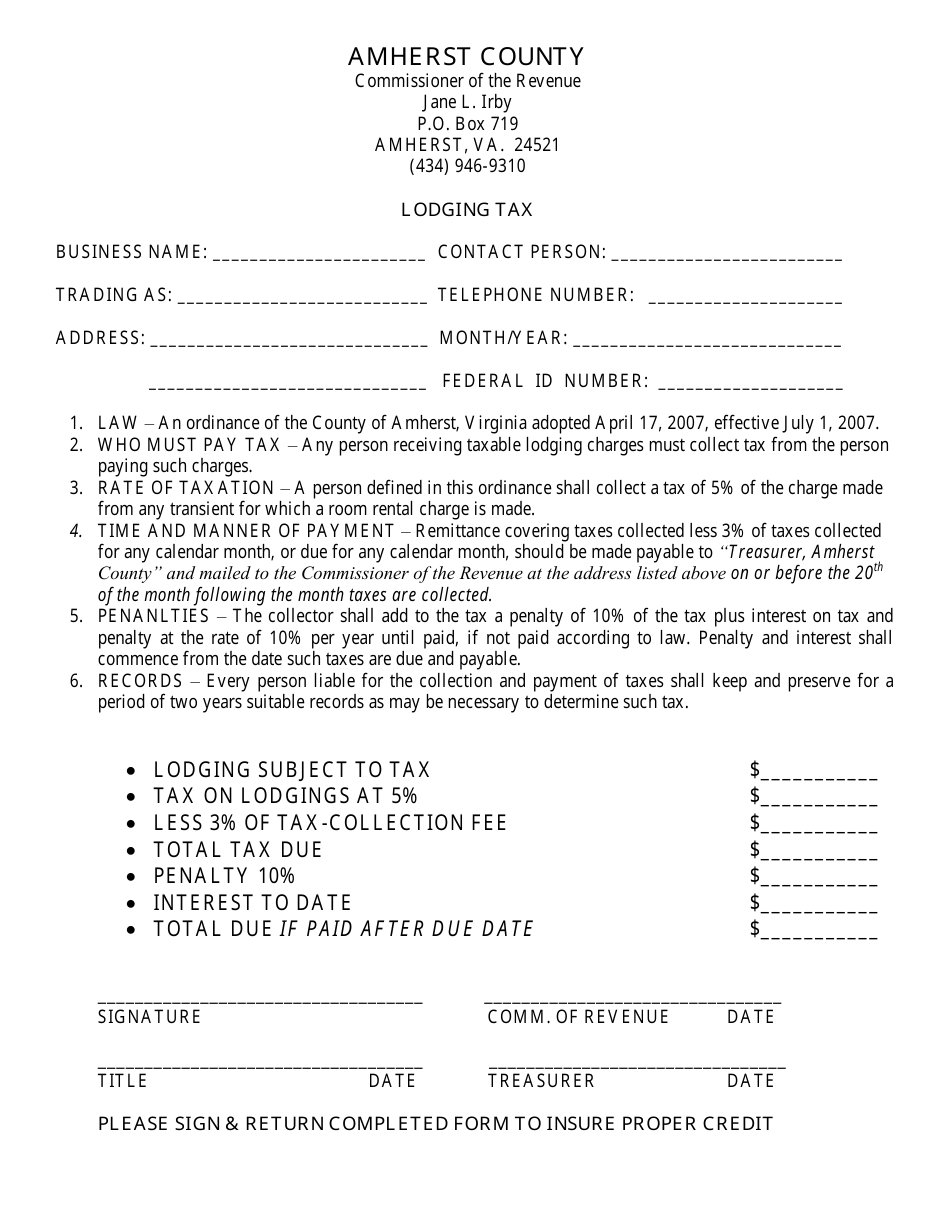

Lodging Tax - Amherst County, Virginia

Lodging Tax is a legal document that was released by the Commissioner of the Revenue - Amherst County, Virginia - a government authority operating within Virginia. The form may be used strictly within Amherst County.

FAQ

Q: What is the lodging tax rate in Amherst County, Virginia?

A: The lodging tax rate in Amherst County, Virginia is 5%.

Q: What is the lodging tax used for in Amherst County?

A: The lodging tax in Amherst County is used to support tourism and economic development initiatives.

Q: Are there any exemptions from the lodging tax in Amherst County?

A: There are no specific exemptions from the lodging tax in Amherst County.

Q: Who is responsible for collecting and remitting the lodging tax in Amherst County?

A: Lodging establishments are responsible for collecting and remitting the lodging tax to Amherst County.

Q: Is there a penalty for failing to collect or remit the lodging tax in Amherst County?

A: Yes, there are penalties for failing to collect or remit the lodging tax in Amherst County, including interest and potential legal action.

Form Details:

- The latest edition currently provided by the Commissioner of the Revenue - Amherst County, Virginia;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Commissioner of the Revenue - Amherst County, Virginia.