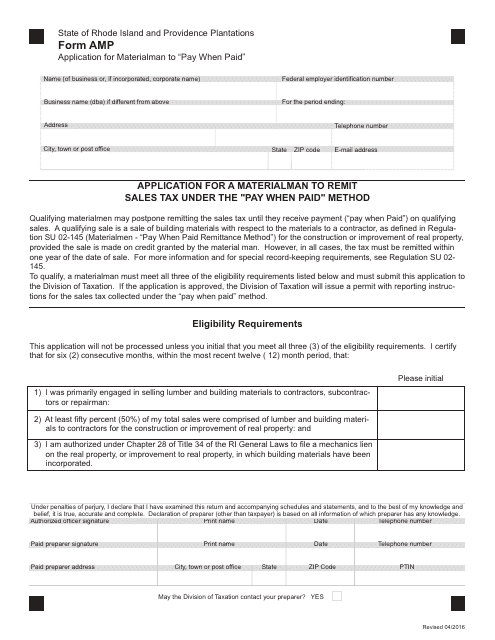

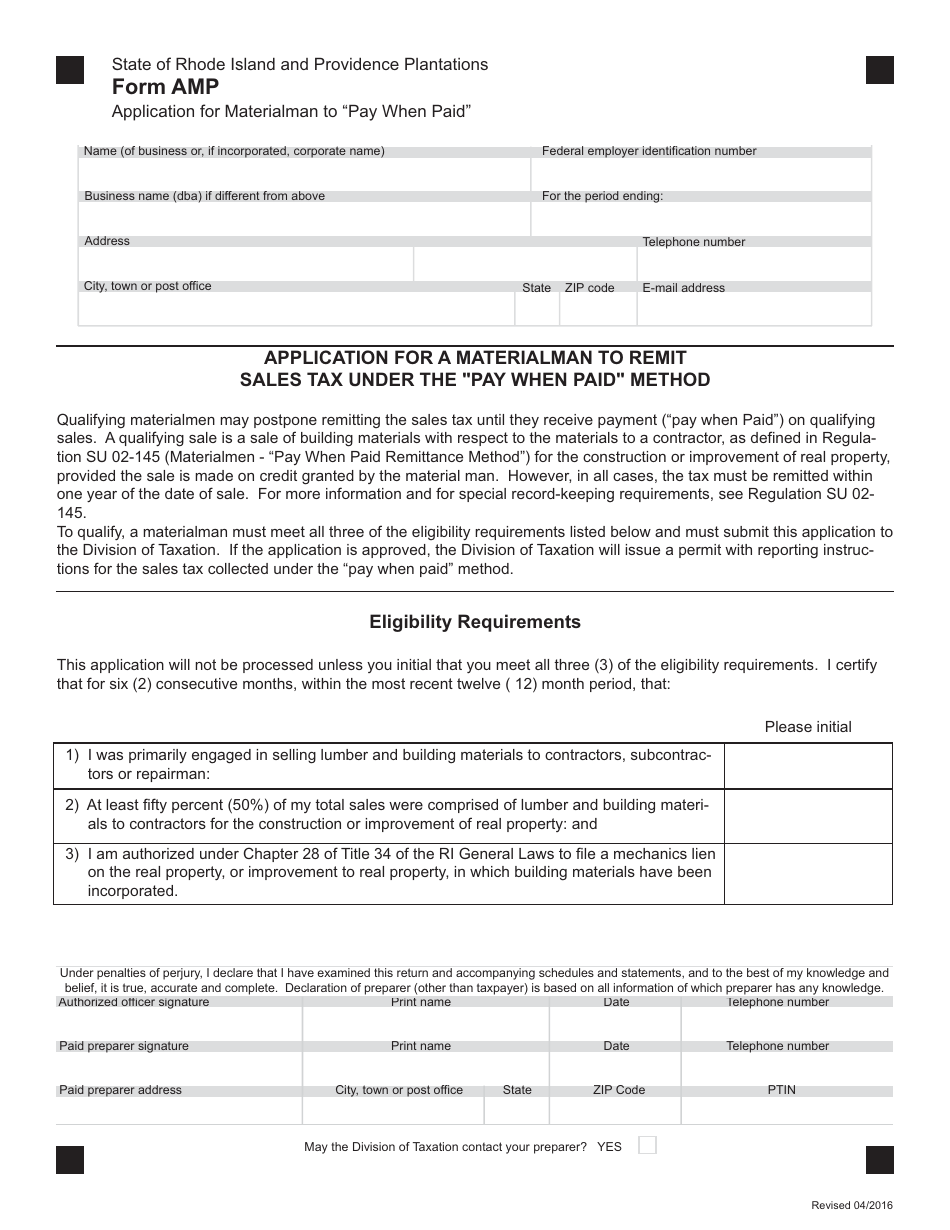

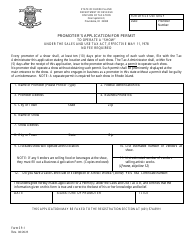

Form AMP Application for a Materialman to Remit Sales Tax Under the "pay When Paid" Method - Rhode Island

What Is Form AMP?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an AMP application?

A: An AMP application is a form used by materialmen in Rhode Island to request permission to remit sales tax under the pay when paid method.

Q: What is the pay when paid method?

A: The pay when paid method allows materialmen to remit sales tax to the state after they have been paid by the contractor for the materials they have provided.

Q: Who can use the AMP application?

A: Materialmen in Rhode Island can use the AMP application to request permission to remit sales tax under the pay when paid method.

Q: Are there any requirements to qualify for the pay when paid method?

A: Yes, materialmen must meet certain criteria to qualify for the pay when paid method, including having a valid Rhode Island vendor's license and meeting certain sales thresholds.

Q: What are the benefits of using the pay when paid method?

A: Using the pay when paid method allows materialmen to defer the payment of sales tax until they have been paid by the contractor, which can help with cash flow management.

Q: Are there any drawbacks to using the pay when paid method?

A: One potential drawback is that if the contractor does not pay the materialman, the materialman is still responsible for remitting the sales tax to the state.

Q: Can I use the pay when paid method for all my sales tax remittances?

A: No, the pay when paid method is only available for materialmen and only applies to sales tax on materials provided to contractors.

Q: How long does it take to get approval for the AMP application?

A: The approval process can take several weeks, so it is important to submit the application well in advance of when you will need to remit sales tax.

Q: What happens if my AMP application is denied?

A: If your AMP application is denied, you will need to remit sales tax on a regular basis, as specified by the Rhode Island Division of Taxation.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AMP by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.