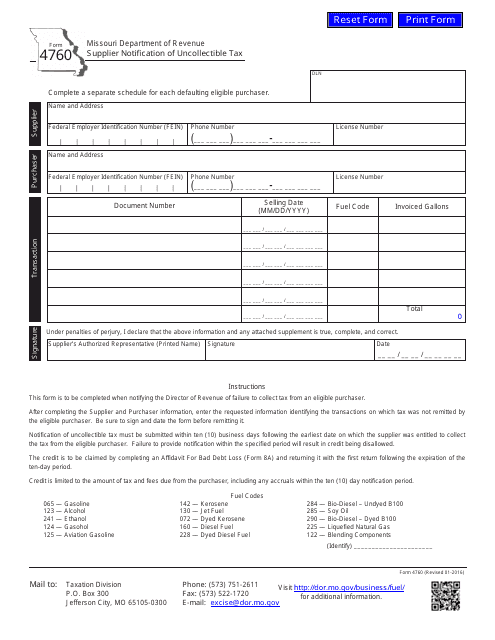

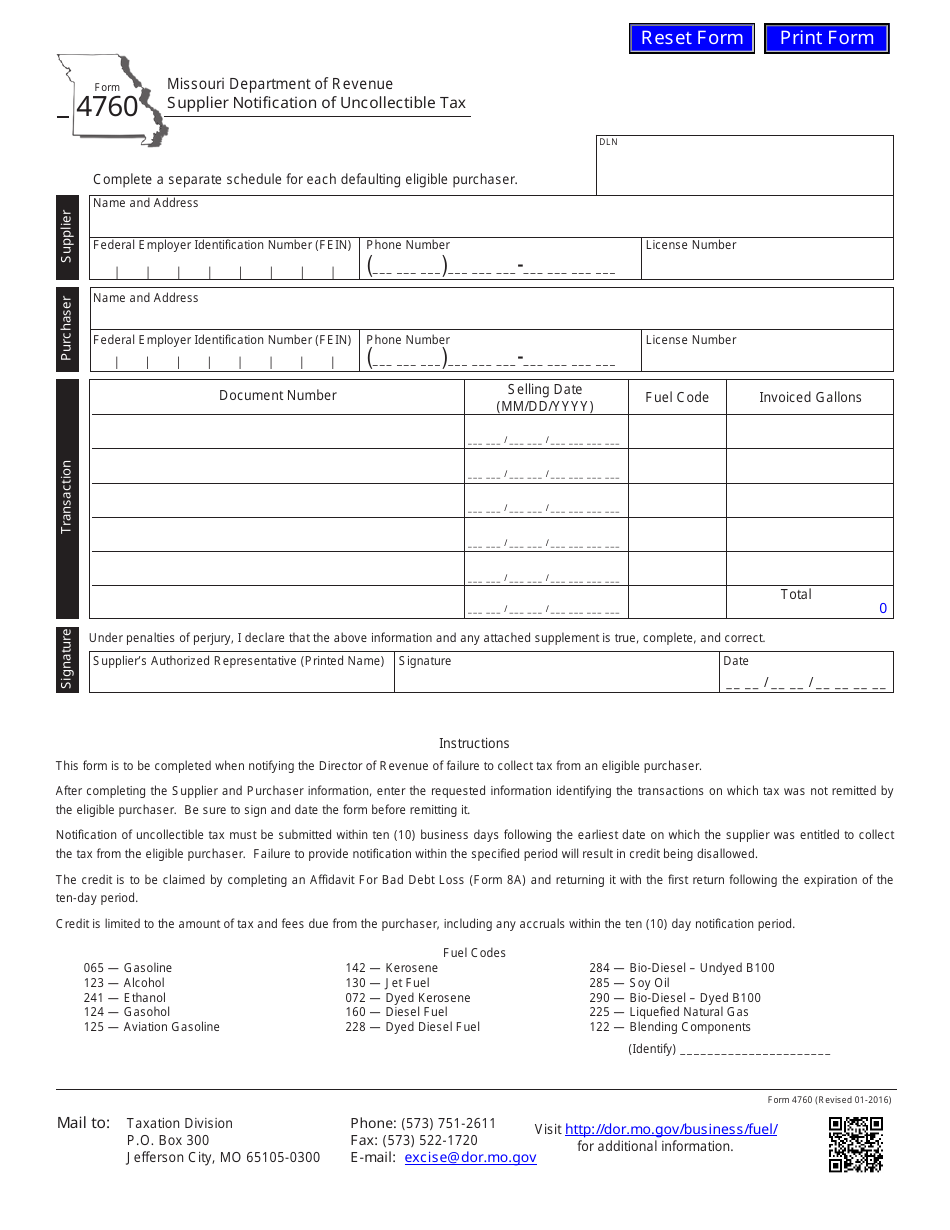

Form 4760 Supplier Notification of Uncollectible Tax - Missouri

What Is Form 4760?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4760?

A: Form 4760 is the Supplier Notification of Uncollectible Tax for Missouri.

Q: Who needs to file Form 4760?

A: Suppliers who are unable to collect sales or use tax from customers in Missouri need to file Form 4760.

Q: Why would a supplier be unable to collect sales or use tax?

A: A supplier may be unable to collect sales or use tax if a customer is unable or unwilling to pay the tax.

Q: What information is required on Form 4760?

A: Form 4760 requires information about the supplier, the customer, and the amount of uncollectible tax.

Q: When is Form 4760 due?

A: Form 4760 is due on or before the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form 4760?

A: Yes, failure to file Form 4760 can result in penalties and interest.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4760 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.