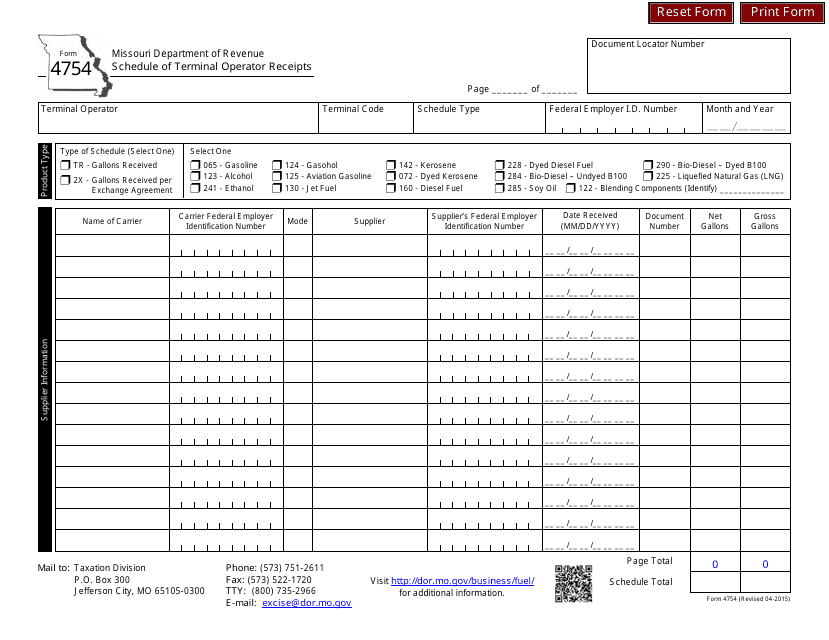

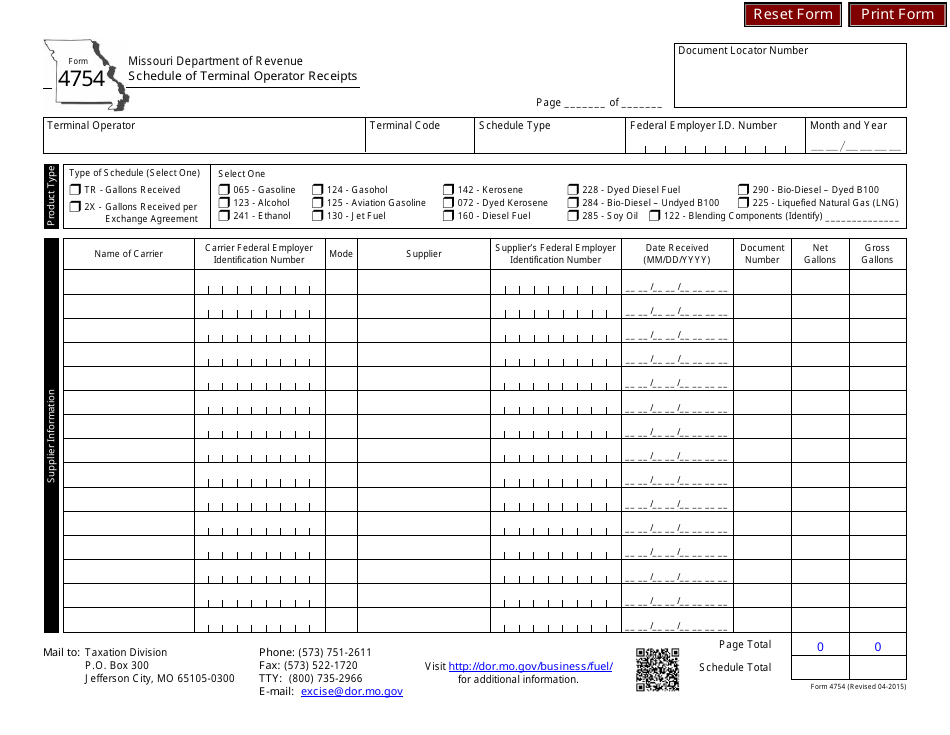

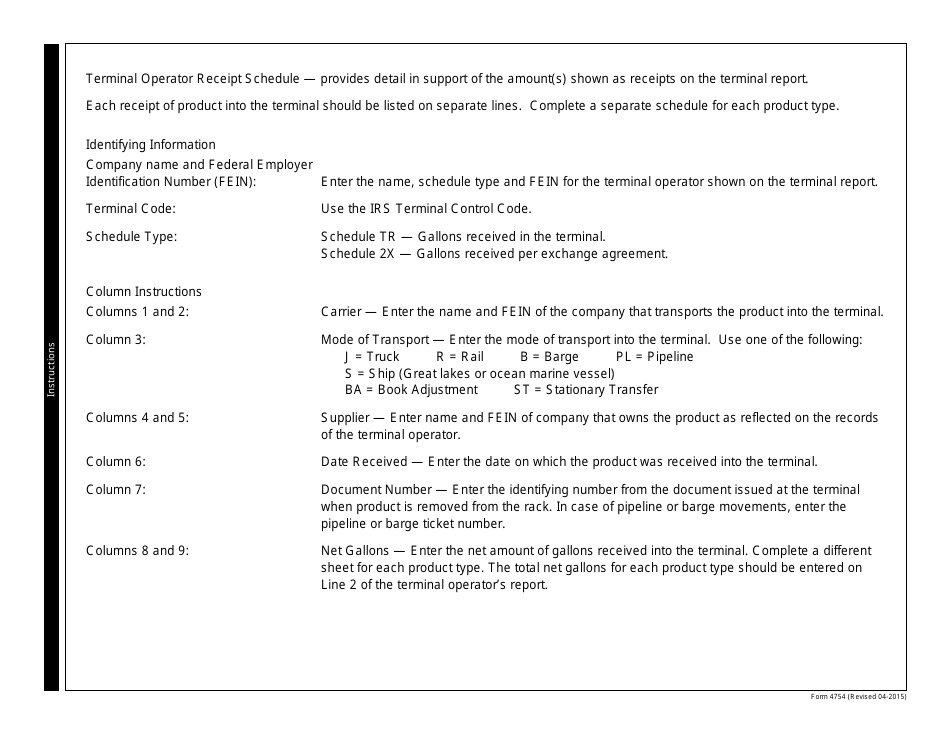

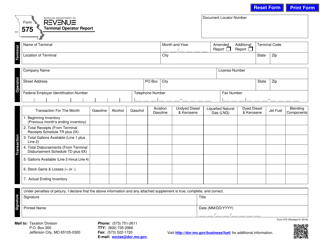

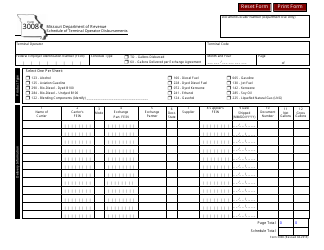

Form 4754 Schedule of Terminal Operator Receipts - Missouri

What Is Form 4754?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4754?

A: Form 4754 is the Schedule of Terminal Operator Receipts for Missouri.

Q: Who needs to file Form 4754?

A: Terminal operators in Missouri need to file Form 4754.

Q: What is the purpose of Form 4754?

A: The purpose of Form 4754 is to report the receipts from terminal operations in Missouri.

Q: When is Form 4754 due?

A: Form 4754 is due on or before the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form 4754?

A: Yes, there are penalties for not filing Form 4754, including possible fines and interest charges.

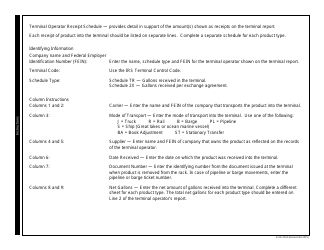

Q: What information is required on Form 4754?

A: Form 4754 requires information such as the terminal operator's name, location, and receipts for the reporting period.

Q: Do I need to keep a copy of Form 4754 for my records?

A: Yes, it is recommended to keep a copy of Form 4754 for your records in case of future audits or inquiries.

Form Details:

- Released on April 1, 2015;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4754 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.