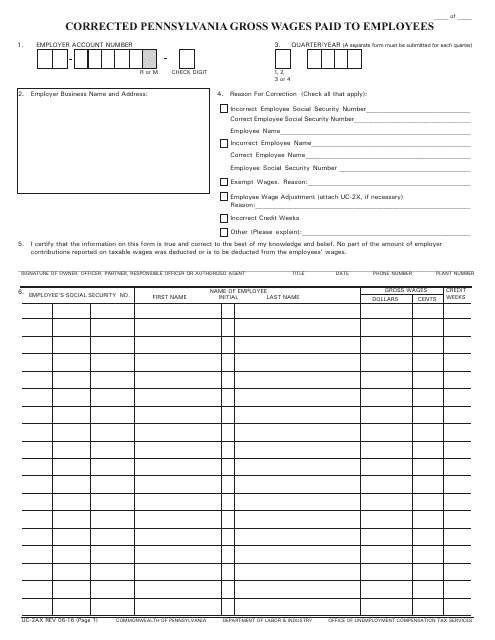

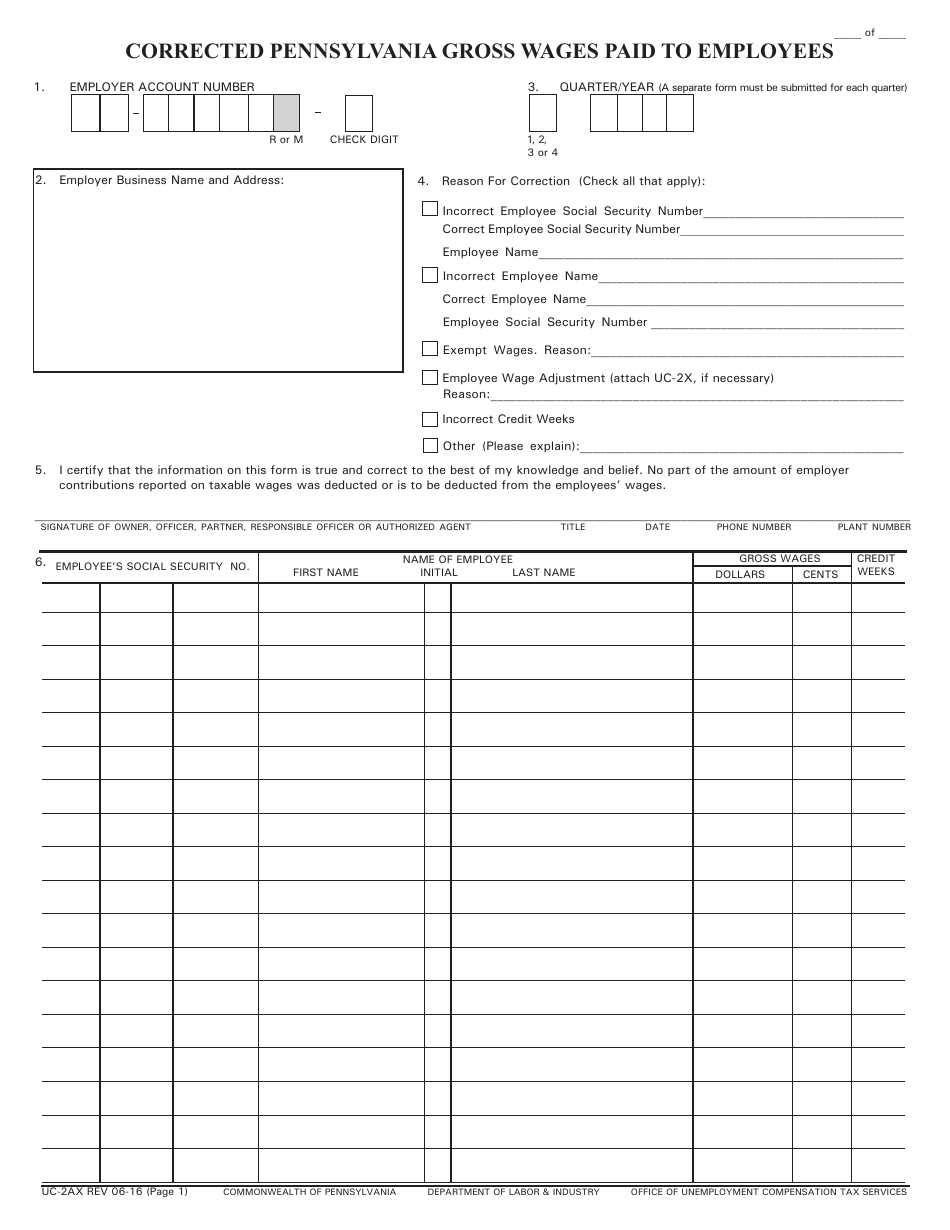

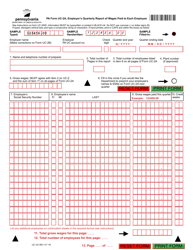

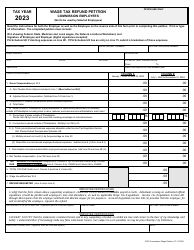

Form UC-2ax Corrected Pennsylvania Gross Wages Paid to Employees - Pennsylvania

What Is Form UC-2ax?

This is a legal form that was released by the Pennsylvania Department of Labor & Industry - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UC-2ax?

A: Form UC-2ax is a form used by employers in Pennsylvania to correct the amount of gross wages paid to their employees.

Q: What is the purpose of Form UC-2ax?

A: The purpose of Form UC-2ax is to report any corrections or adjustments made to the gross wages paid to employees for unemployment compensation purposes in Pennsylvania.

Q: Who needs to file Form UC-2ax?

A: Employers in Pennsylvania who need to correct their previously reported gross wages paid to employees for unemployment compensation purposes need to file Form UC-2ax.

Q: When is Form UC-2ax due?

A: Form UC-2ax is due on or before the last day of the month following the close of the calendar quarter in which the correction or adjustment is made.

Q: Is Form UC-2ax the same as the quarterly UC-2 report?

A: No, Form UC-2ax is not the same as the quarterly UC-2 report. The UC-2ax form is specifically used for corrections or adjustments to previously reported gross wages, while the UC-2 report is used to report total gross wages paid for a quarter.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Pennsylvania Department of Labor & Industry;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form UC-2ax by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Labor & Industry.