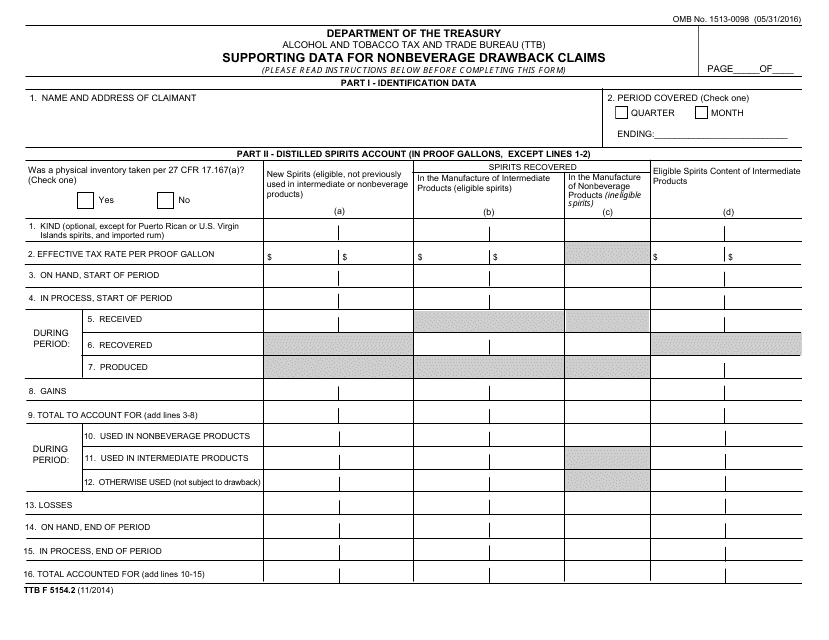

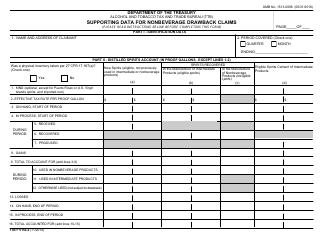

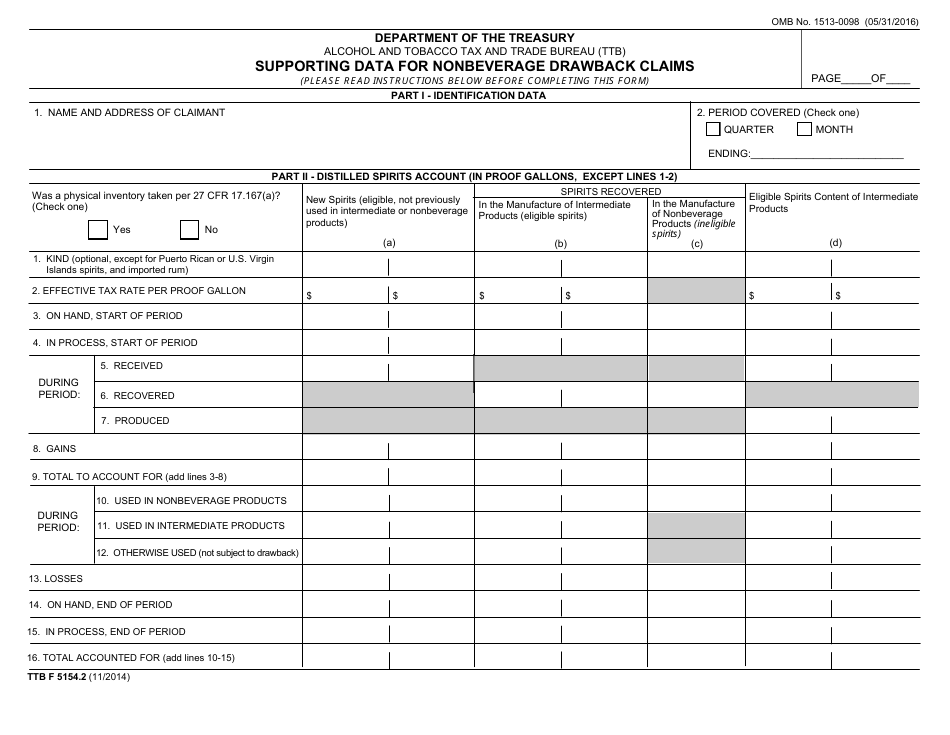

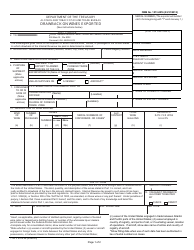

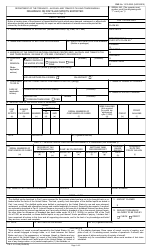

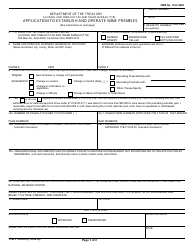

TTB Form 5154.2 Supporting Data for Nonbeverage Drawback Claims

What Is TTB Form 5154.2?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on November 1, 2014 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5154.2?

A: TTB Form 5154.2 is a form used for supporting data for nonbeverage drawback claims.

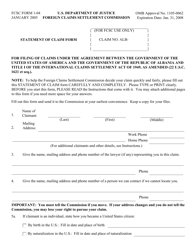

Q: What is a nonbeverage drawback claim?

A: A nonbeverage drawback claim is a claim made to the Alcohol and Tobacco Tax and Trade Bureau (TTB) for a refund on excise taxes paid on alcohol used in the production of nonbeverage products.

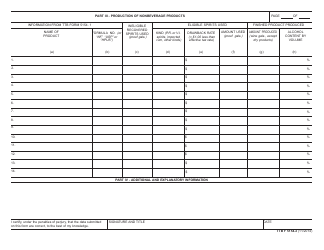

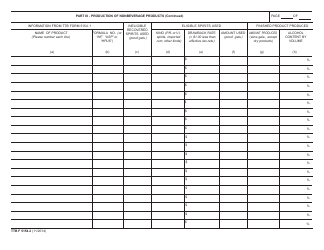

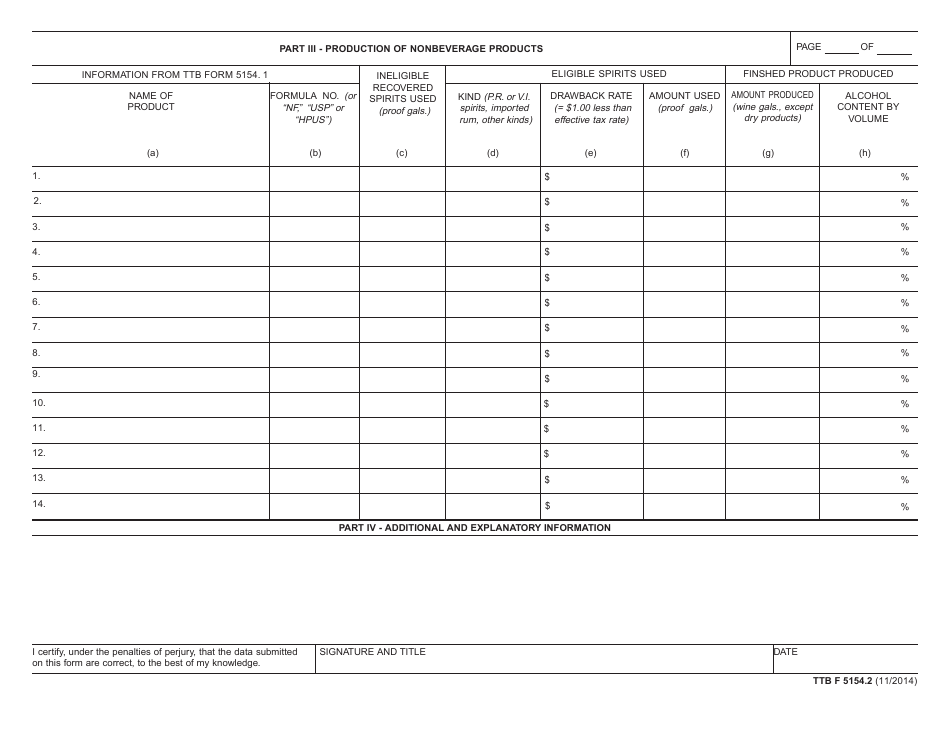

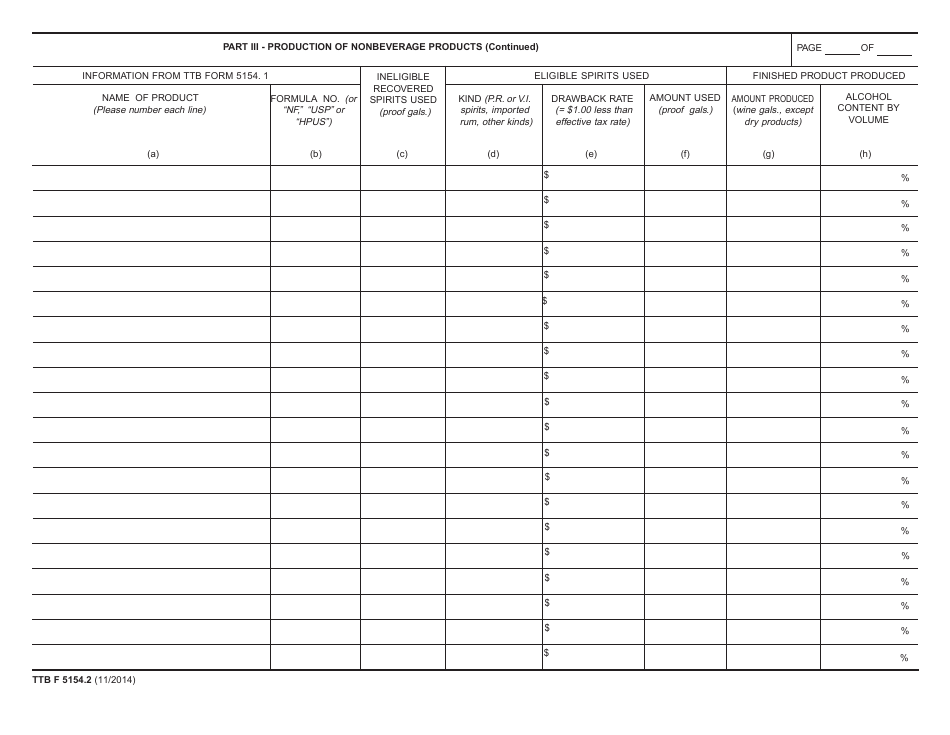

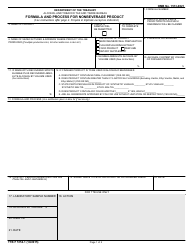

Q: What kind of supporting data is required for a nonbeverage drawback claim?

A: Supporting data required for a nonbeverage drawback claim includes information about the original alcohol purchase, the production of the nonbeverage product, and the proof of destruction of the alcohol.

Q: Who is eligible to file a nonbeverage drawback claim?

A: Any person who has paid excise taxes on alcohol used in the production of nonbeverage products may be eligible to file a nonbeverage drawback claim.

Form Details:

- Released on November 1, 2014;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5154.2 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.