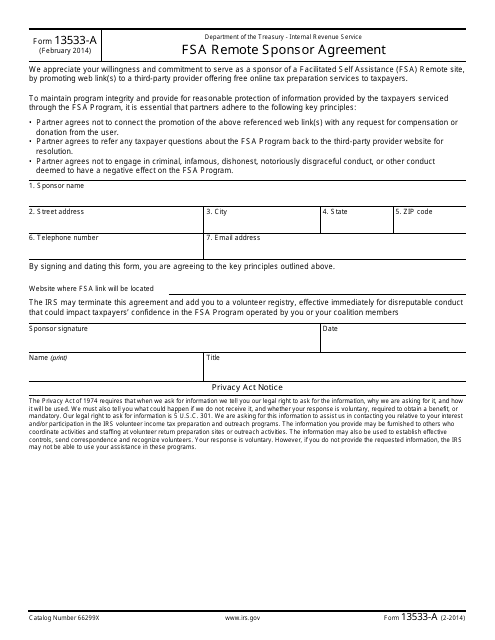

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 13533-A

for the current year.

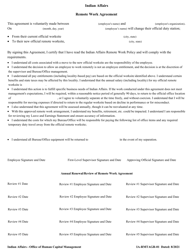

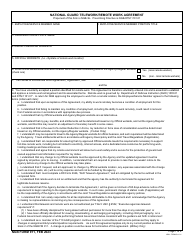

IRS Form 13533-A FSA Remote Sponsor Agreement

What Is IRS Form 13533-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2014. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 13533-A?

A: IRS Form 13533-A is the FSA Remote Sponsor Agreement.

Q: What is FSA?

A: FSA stands for Flexible Spending Account.

Q: What is a Remote Sponsor Agreement?

A: A Remote Sponsor Agreement is an agreement between a Flexible Spending Account (FSA) administrator and an employer that allows employees to participate in the FSA program.

Q: Who needs to fill out IRS Form 13533-A?

A: The FSA administrator and the employer need to fill out IRS Form 13533-A.

Q: Why is IRS Form 13533-A important?

A: IRS Form 13533-A is important for establishing an agreement between the FSA administrator and the employer to offer FSA benefits to employees.

Q: Are there any specific requirements for completing IRS Form 13533-A?

A: Yes, there may be specific requirements depending on the FSA administrator and the employer. It's important to carefully follow the instructions provided with the form.

Q: Can individuals fill out IRS Form 13533-A for personal use?

A: No, IRS Form 13533-A is not intended for individual use. It is for the FSA administrator and the employer to establish an agreement.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 13533-A through the link below or browse more documents in our library of IRS Forms.