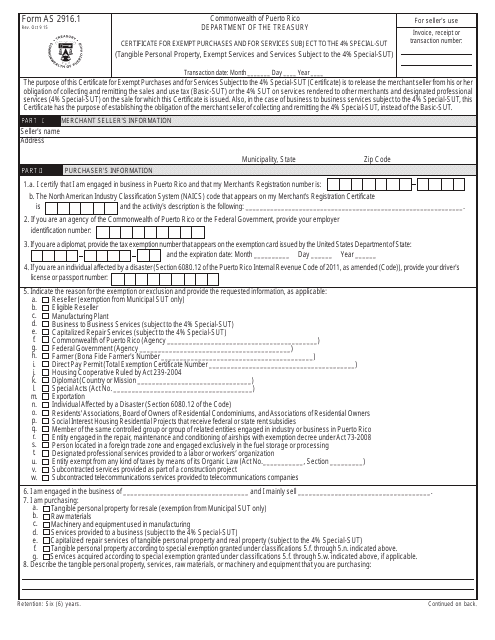

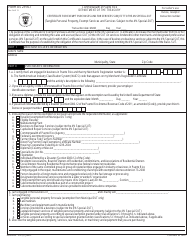

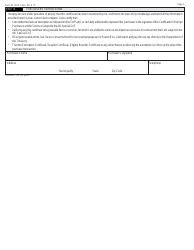

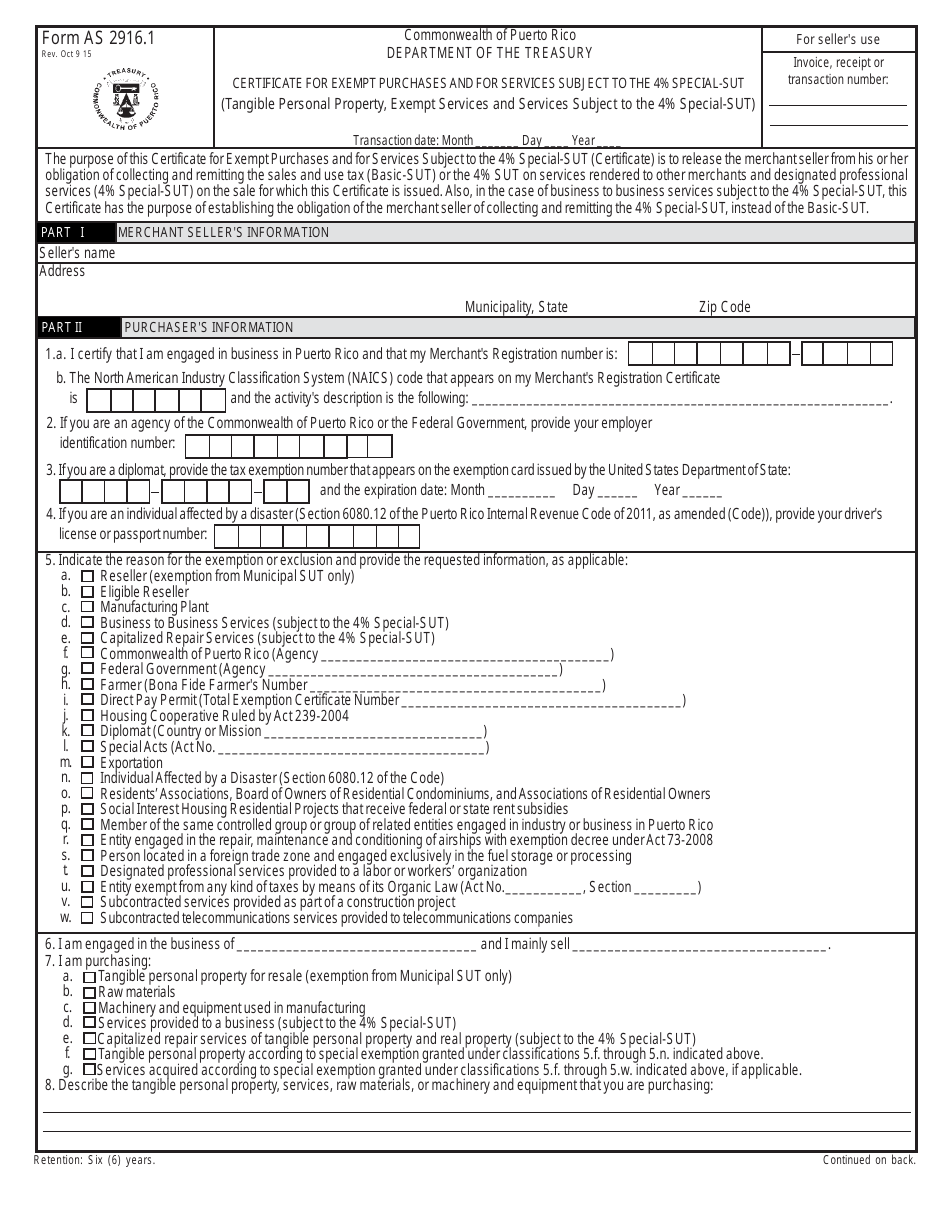

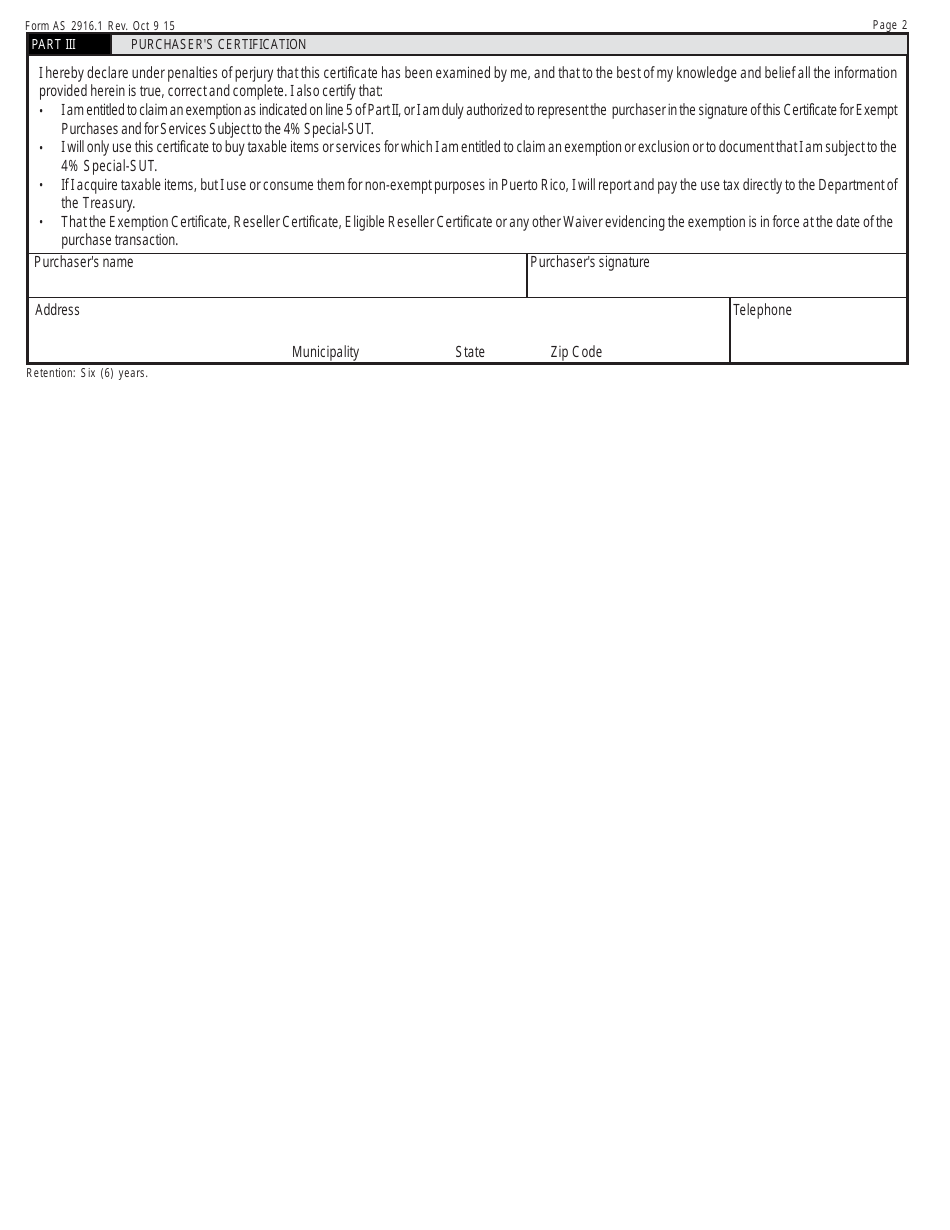

Form AS2916.1 Certificate for Exempt Purchases and for Services Subject to the 4% Special-Sut - Puerto Rico

What Is Form AS2916.1?

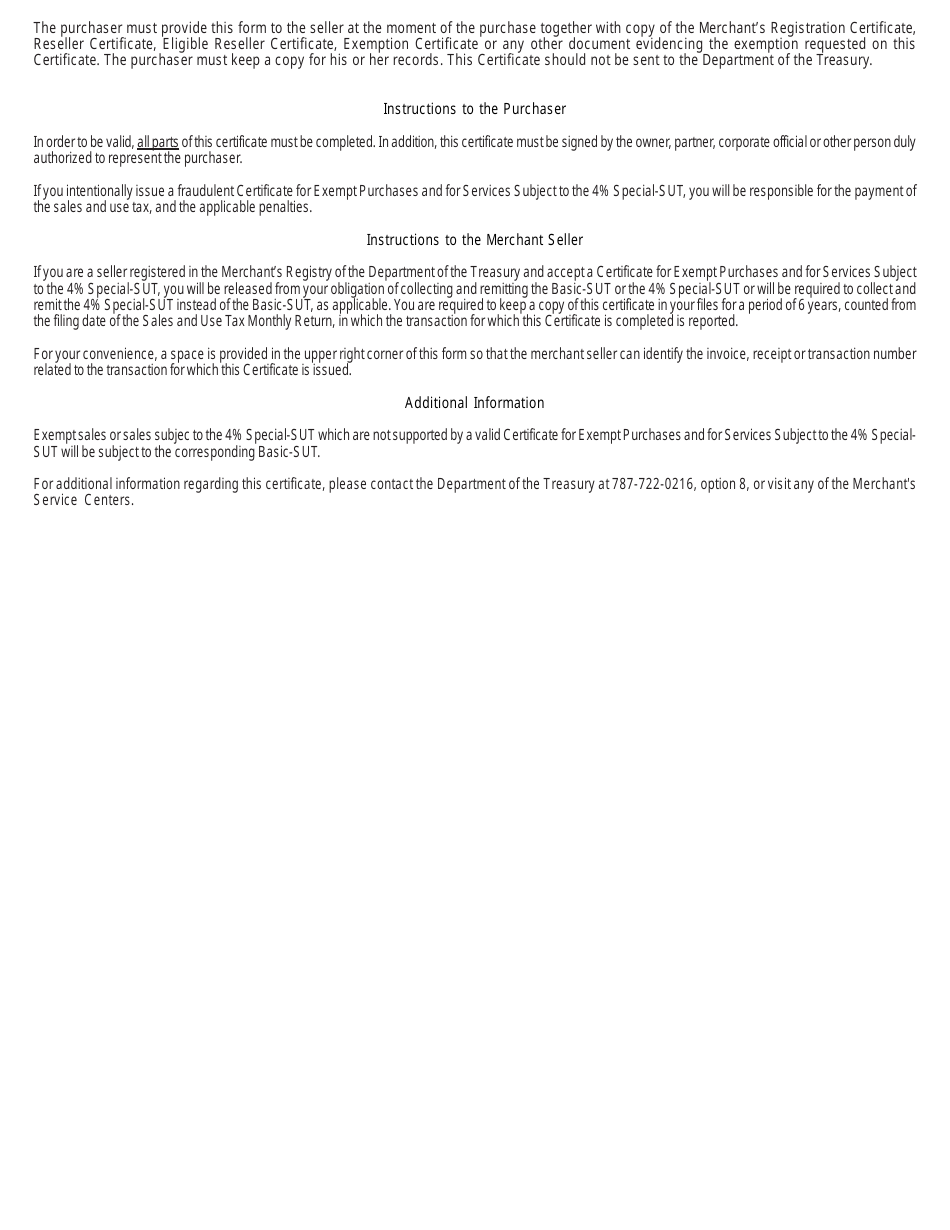

This is a legal form that was released by the Puerto Rico Department of Treasury - a government authority operating within Puerto Rico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is AS2916.1 Certificate?

A: AS2916.1 Certificate is a form used for exempt purchases and for services subject to the 4% special tax in Puerto Rico.

Q: What is the purpose of AS2916.1 Certificate?

A: The purpose of AS2916.1 Certificate is to certify that certain purchases or services are exempt from taxation or subject to the 4% special tax.

Q: Who should use AS2916.1 Certificate?

A: Businesses or individuals in Puerto Rico who want to claim exemptions from taxation or get the 4% special tax rate for specific purchases or services should use AS2916.1 Certificate.

Q: What is the 4% special tax in Puerto Rico?

A: The 4% special tax in Puerto Rico is a specific tax rate applicable to certain services.

Q: Are all purchases or services eligible for exemption or the 4% special tax rate?

A: No, only specific purchases or services that meet the criteria set by the Puerto Rico Department of Treasury are eligible for exemption or the 4% special tax rate.

Q: What should I do with AS2916.1 Certificate once obtained?

A: Once obtained, AS2916.1 Certificate should be kept on file and presented when necessary to claim exemptions or the 4% special tax rate on purchases or services.

Form Details:

- Released on October 9, 2015;

- The latest edition provided by the Puerto Rico Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AS2916.1 by clicking the link below or browse more documents and templates provided by the Puerto Rico Department of Treasury.