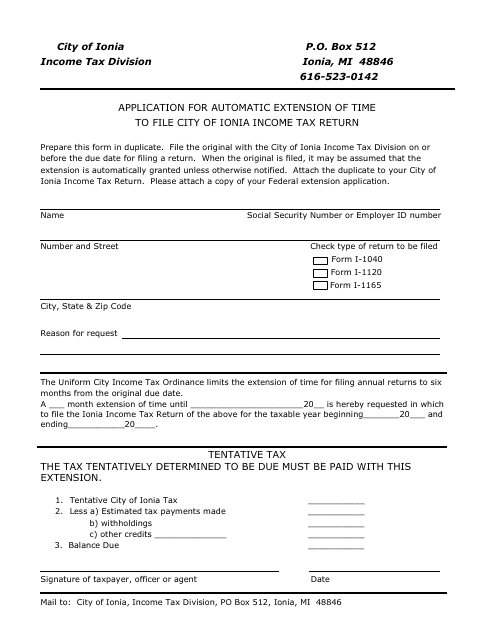

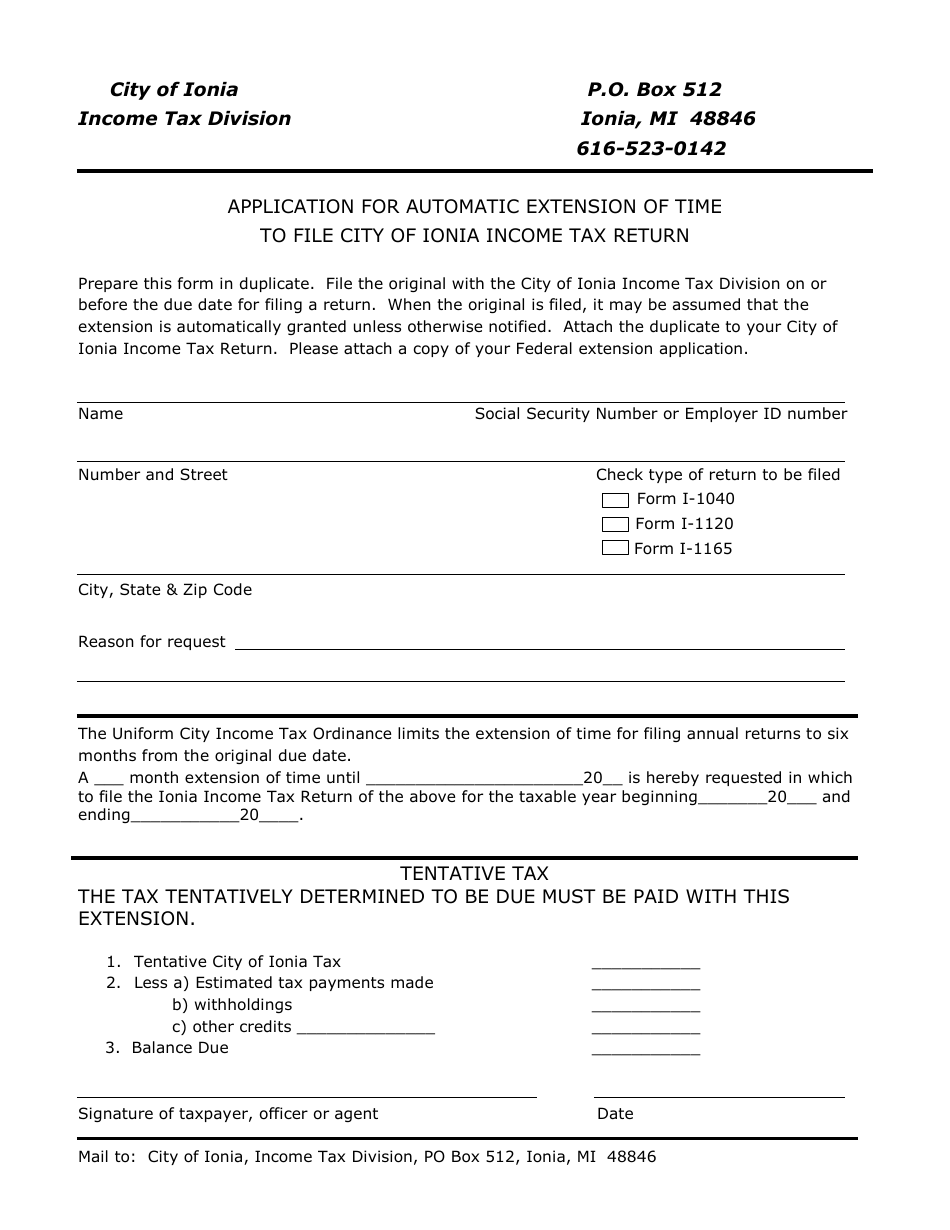

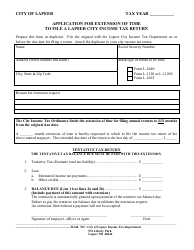

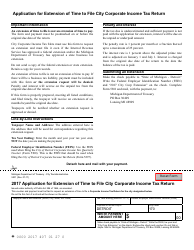

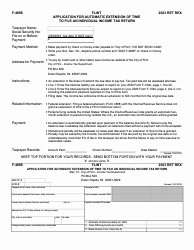

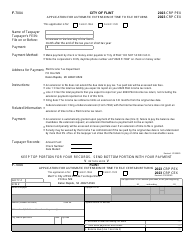

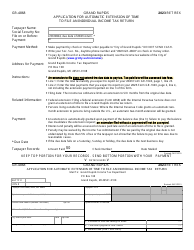

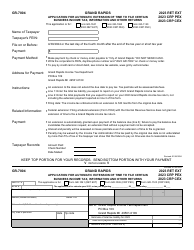

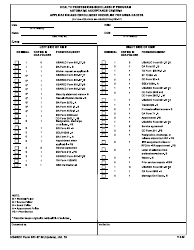

Application for Automatic Extension of Time to File City of Ionia Income Tax Return - City of Ionia, Michigan

Application for Automatic Extension of Time to File City of Ionia Income Tax Return is a legal document that was released by the Income Tax Department - City of Ionia, Michigan - a government authority operating within Michigan. The form may be used strictly within City of Ionia.

FAQ

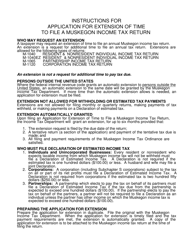

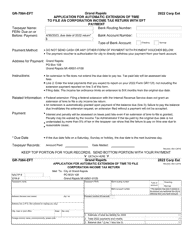

Q: What is an Automatic Extension of Time to File City of Ionia Income Tax Return?

A: An automatic extension allows taxpayers to submit their City of Ionia income tax return after the original due date.

Q: Who can apply for an Automatic Extension of Time to File City of Ionia Income Tax Return?

A: Any taxpayer residing or working in the City of Ionia, Michigan can apply for an automatic extension.

Q: How do I apply for an Automatic Extension of Time to File City of Ionia Income Tax Return?

A: To apply for an automatic extension, you need to submit Form CIT-EXT to the City of Ionia Income Tax Office.

Q: What is the deadline to apply for an Automatic Extension of Time to File City of Ionia Income Tax Return?

A: The deadline to apply for an automatic extension is the original due date of the City of Ionia income tax return, which is April 30th.

Q: How long is the extension granted for?

A: The extension granted is for 6 months. Therefore, if you apply for an extension, your City of Ionia income tax return will be due on October 31st.

Q: Is there any late payment penalty for filing the return after the original due date?

A: Yes, late payment penalties may apply if you file your City of Ionia income tax return after the original due date.

Q: Can I apply for an extension if I owe taxes?

A: Yes, you can still apply for an extension even if you owe taxes. However, any taxes owed will still need to be paid by the original due date.

Q: Is there a fee for applying for an automatic extension?

A: No, there is no fee for applying for an automatic extension of time to file City of Ionia income tax return.

Form Details:

- The latest edition currently provided by the Income Tax Department - City of Ionia, Michigan;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Income Tax Department - City of Ionia, Michigan.