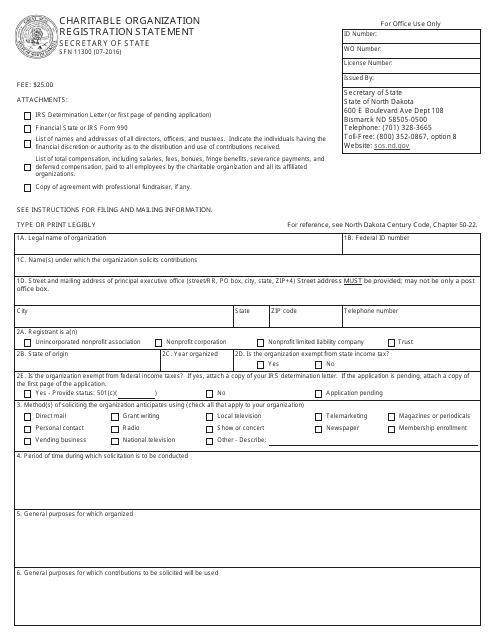

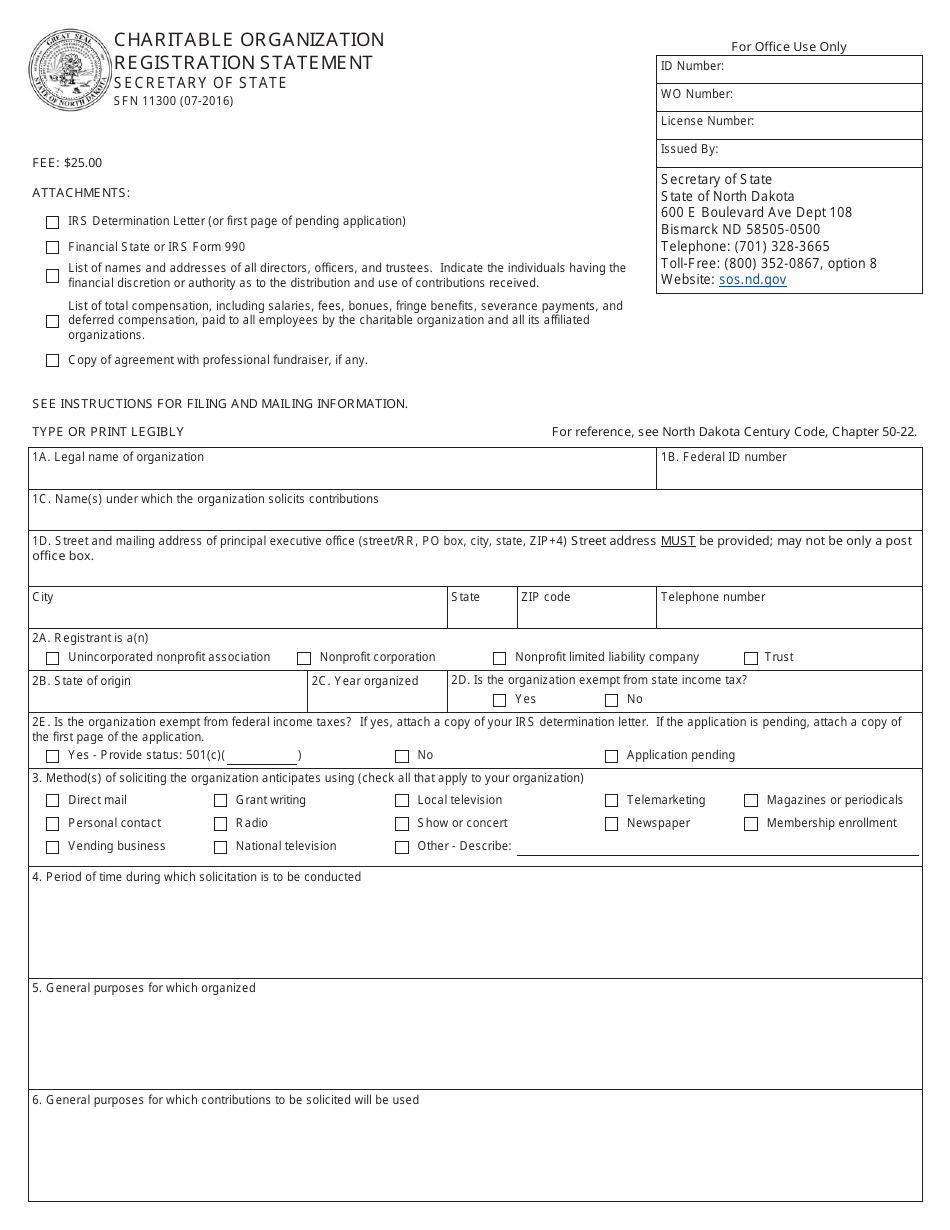

Form SFN11300 Charitable Organization Registration Statement - North Dakota

What Is Form SFN11300?

This is a legal form that was released by the North Dakota Secretary of State - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN11300?

A: Form SFN11300 is the Charitable Organization Registration Statement for North Dakota.

Q: Who needs to file Form SFN11300?

A: Any charitable organization that operates in North Dakota must file Form SFN11300.

Q: What is the purpose of Form SFN11300?

A: The purpose of Form SFN11300 is to register a charitable organization with the state of North Dakota.

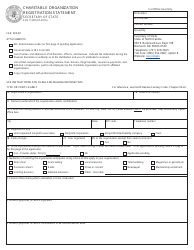

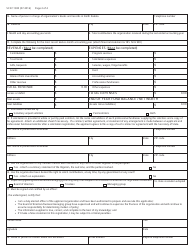

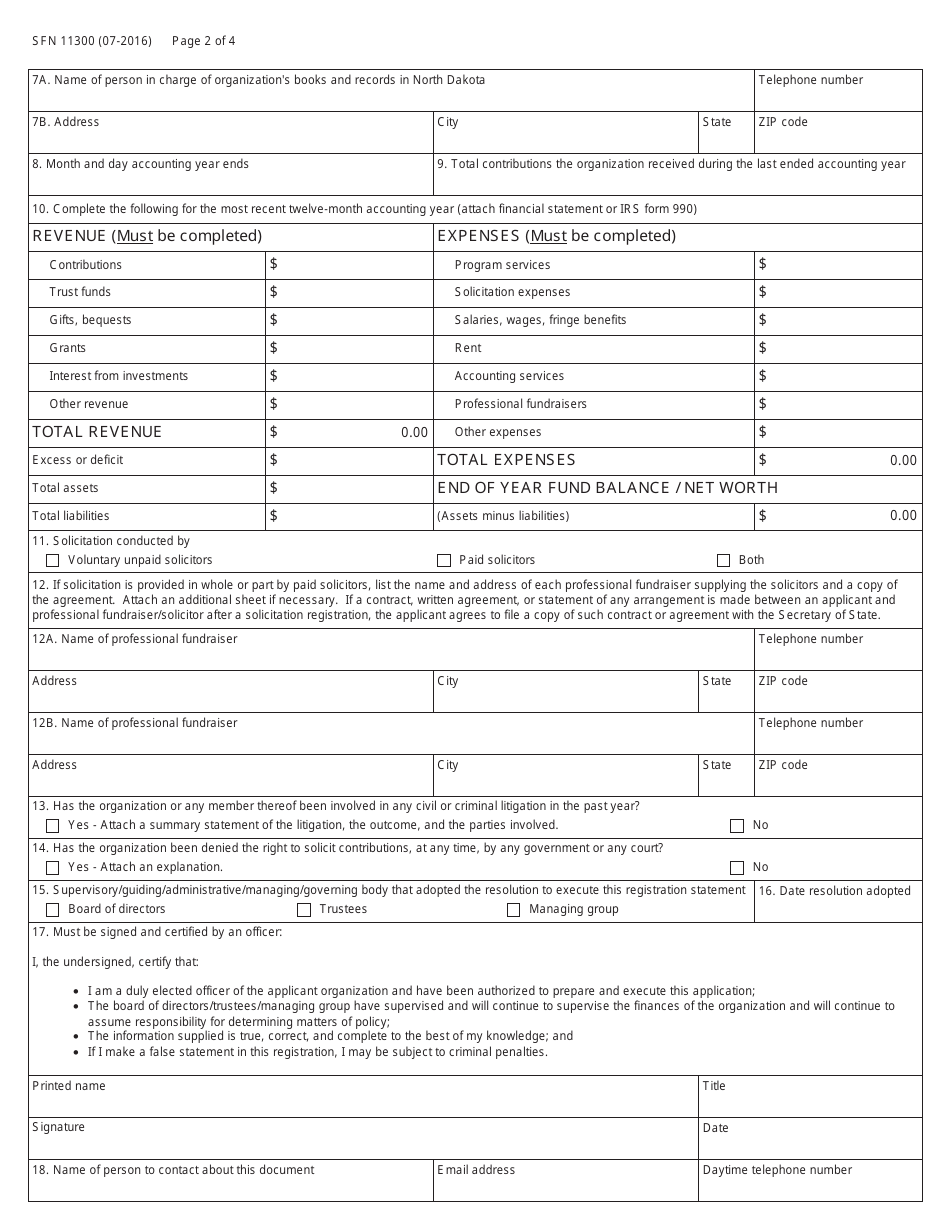

Q: What information is required on Form SFN11300?

A: Form SFN11300 requires information such as the organization's name, address, mission statement, and financial information.

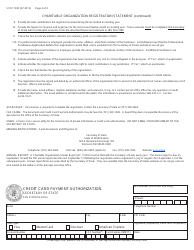

Q: Is there a fee to file Form SFN11300?

A: Yes, there is a fee to file Form SFN11300. The fee amount depends on the organization's annual revenue.

Q: When is Form SFN11300 due?

A: Form SFN11300 is due on the organization's fiscal year-end.

Q: What happens if I don't file Form SFN11300?

A: Failure to file Form SFN11300 may result in penalties or the revocation of the organization's charitable status in North Dakota.

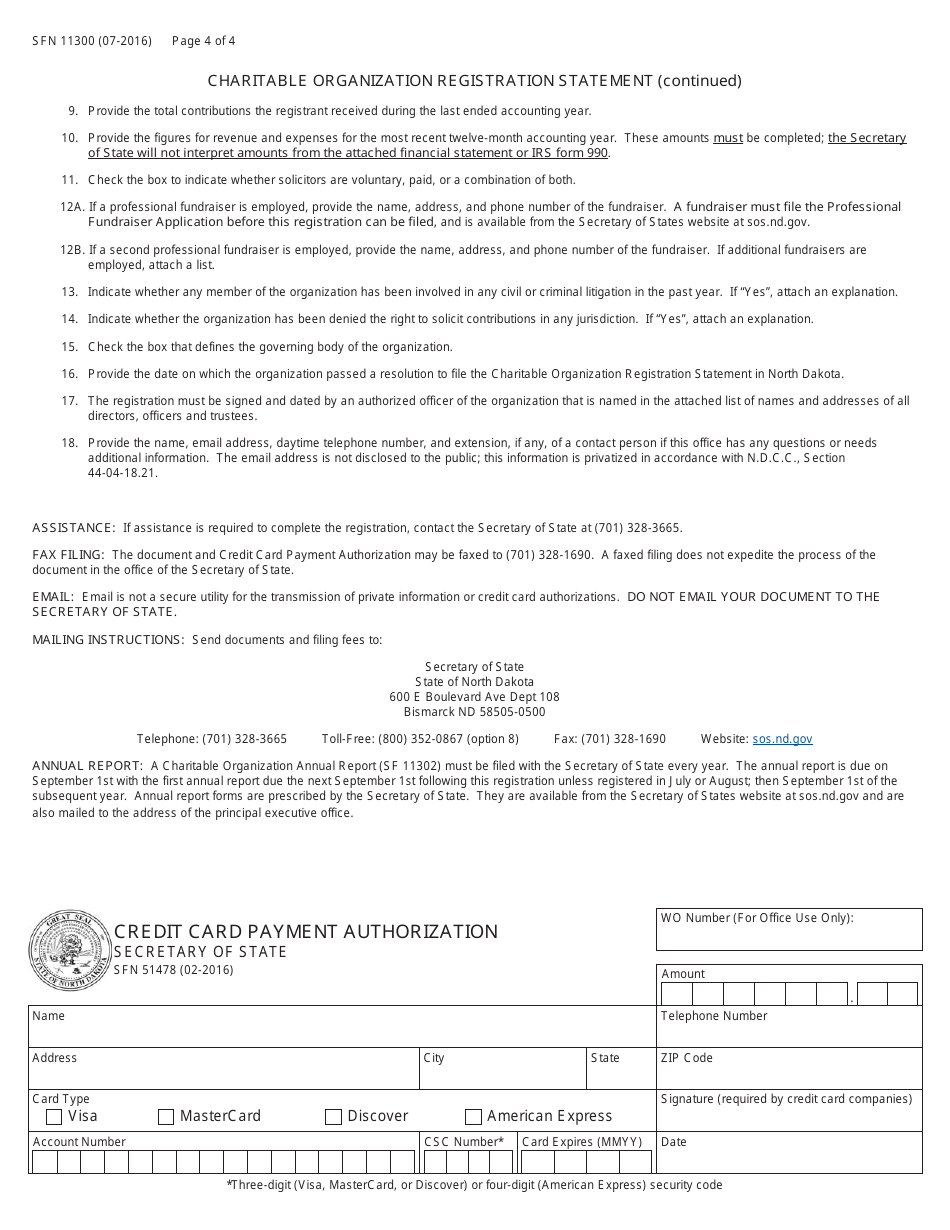

Q: Can I mail Form SFN11300?

A: Yes, you can mail Form SFN11300 to the North Dakota Secretary of State's office if you prefer to submit a physical copy.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the North Dakota Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SFN11300 by clicking the link below or browse more documents and templates provided by the North Dakota Secretary of State.