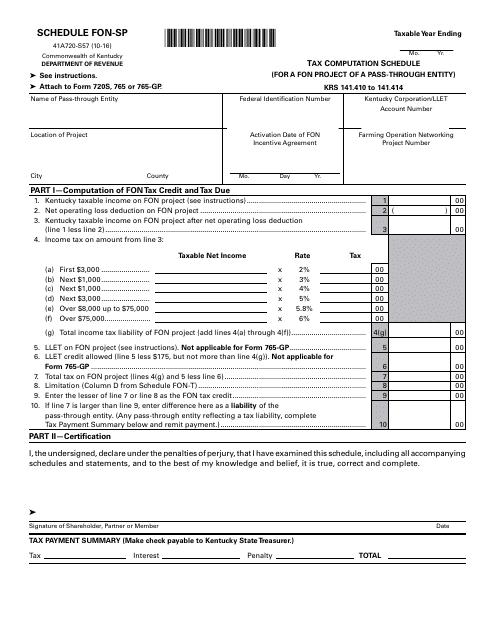

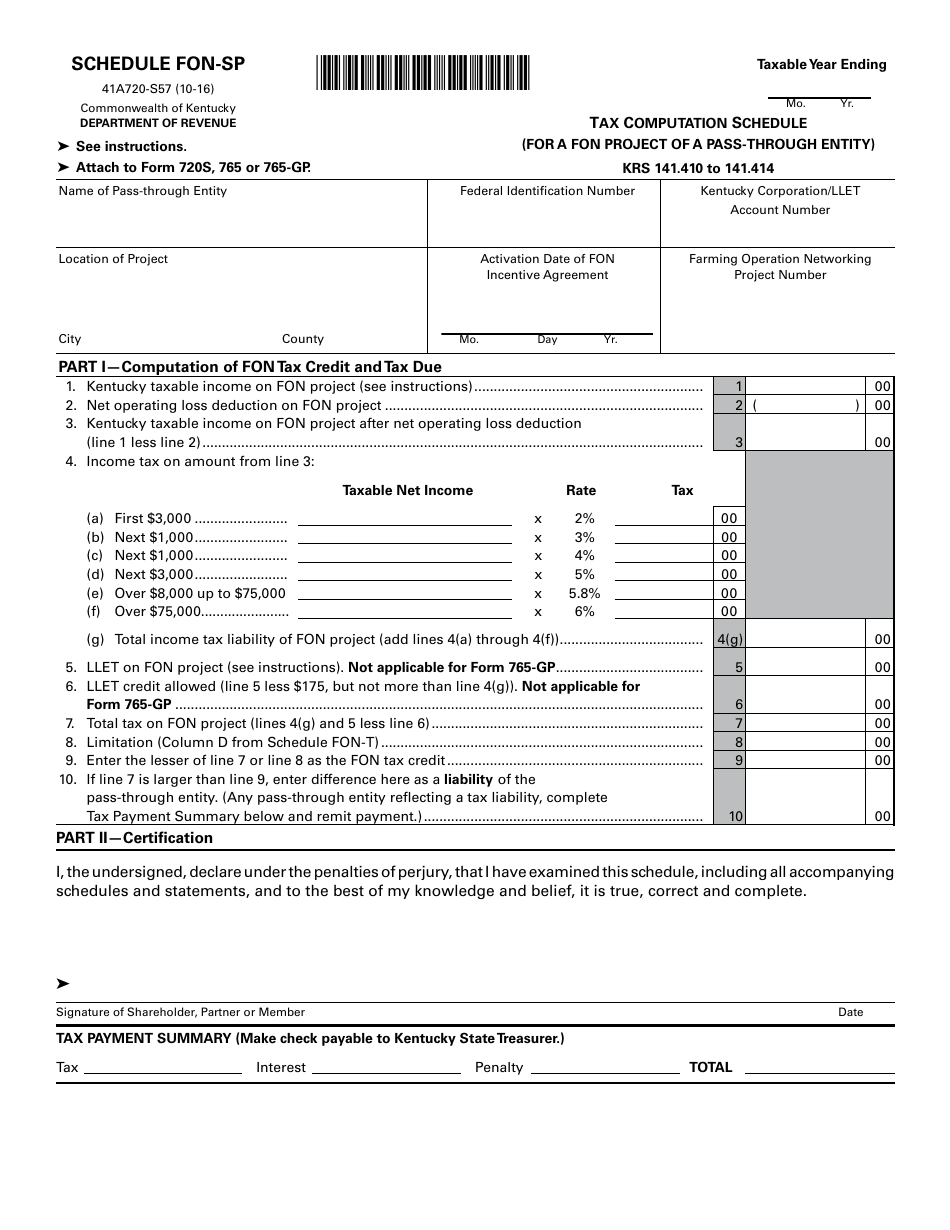

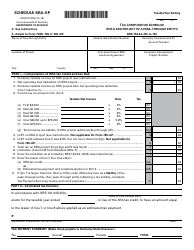

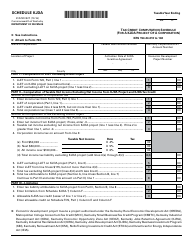

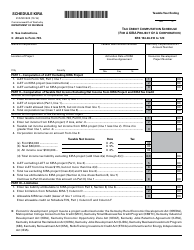

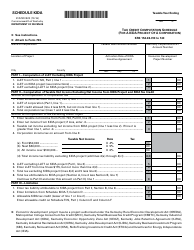

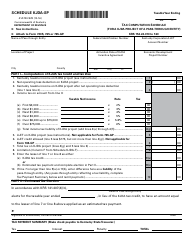

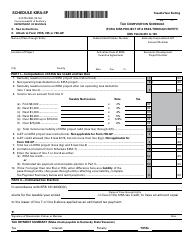

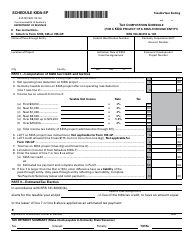

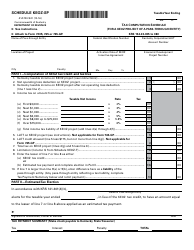

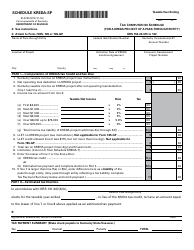

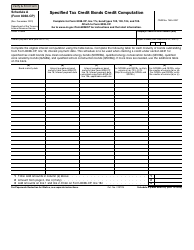

Form 41A720-S57 Schedule FON-SP Tax Computation Schedule (For a Fon Project of a Pass-Through Entity) - Kentucky

What Is Form 41A720-S57 Schedule FON-SP?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720-S57 Schedule FON-SP?

A: Form 41A720-S57 Schedule FON-SP is a tax computation schedule specifically for a Fon Project of a Pass-Through Entity in Kentucky.

Q: Who needs to file Form 41A720-S57 Schedule FON-SP?

A: Form 41A720-S57 Schedule FON-SP needs to be filed by Pass-Through Entities in Kentucky that have a Fon Project.

Q: What is a Fon Project?

A: A Fon Project refers to a specific investment project in Kentucky that qualifies for tax incentives.

Q: What information is required on Form 41A720-S57 Schedule FON-SP?

A: Form 41A720-S57 Schedule FON-SP requires information related to the Pass-Through Entity, the Fon Project, and the tax computation.

Q: When is the deadline to file Form 41A720-S57 Schedule FON-SP?

A: The deadline to file Form 41A720-S57 Schedule FON-SP is the same as the deadline for the Pass-Through Entity's tax return.

Q: Are there any penalties for not filing Form 41A720-S57 Schedule FON-SP?

A: Yes, failure to file Form 41A720-S57 Schedule FON-SP may result in penalties imposed by the Kentucky Department of Revenue.

Q: Can I e-file Form 41A720-S57 Schedule FON-SP?

A: As of now, e-filing is not available for Form 41A720-S57 Schedule FON-SP. It must be filed by mail or in person.

Q: What should I do if I need help completing Form 41A720-S57 Schedule FON-SP?

A: If you need assistance with completing Form 41A720-S57 Schedule FON-SP, you can consult the instructions provided with the form or seek guidance from a tax professional.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41A720-S57 Schedule FON-SP by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.