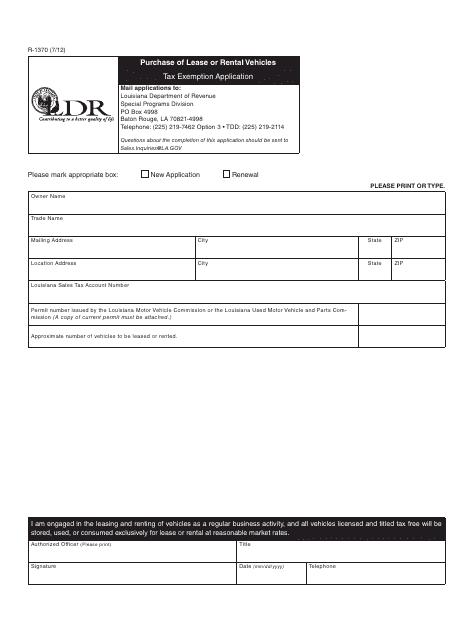

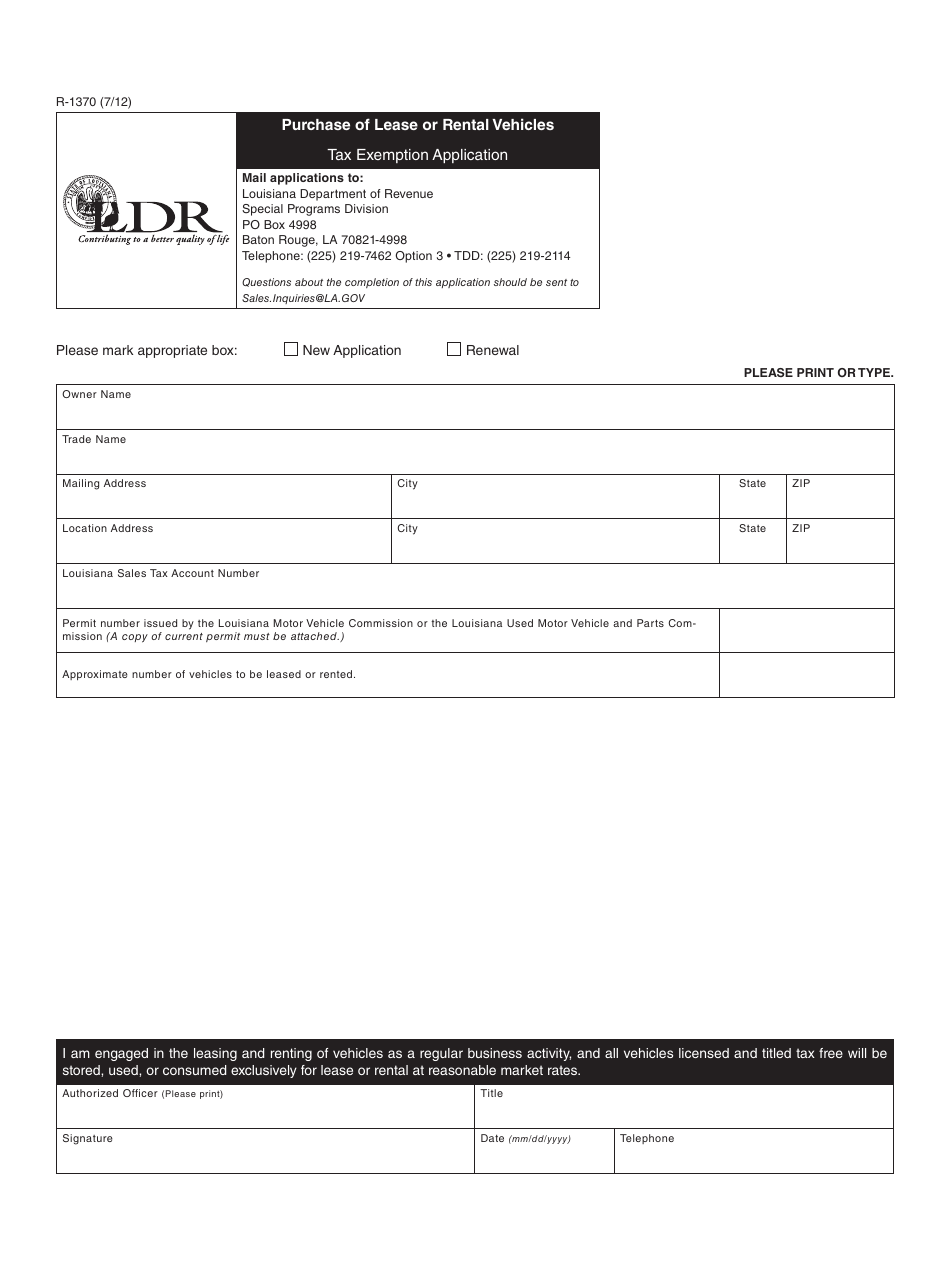

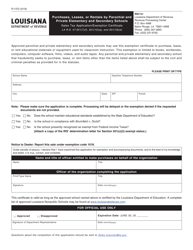

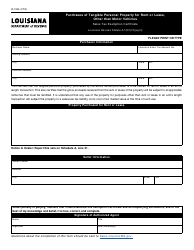

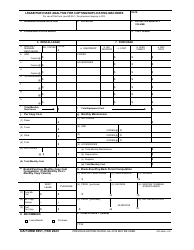

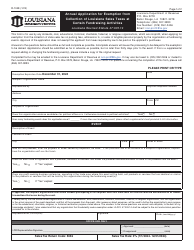

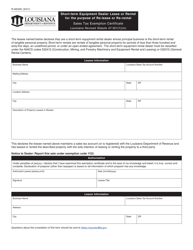

Form R-1370 Purchase of Lease or Rental Vehicles Tax Exemption Application - Louisiana

What Is Form R-1370?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1370?

A: Form R-1370 is the Purchase of Lease or Rental Vehicles Tax Exemption Application for Louisiana.

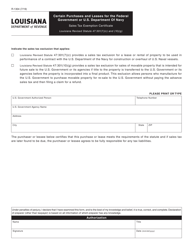

Q: What is the purpose of Form R-1370?

A: The purpose of Form R-1370 is to apply for tax exemption on the purchase of lease or rental vehicles in Louisiana.

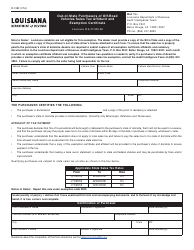

Q: Who needs to fill out Form R-1370?

A: Any individual or business that wants to claim tax exemption on the purchase of lease or rental vehicles in Louisiana needs to fill out Form R-1370.

Q: What information is required on Form R-1370?

A: Form R-1370 requires information such as the applicant's name, address, vehicle identification number (VIN), and details of the lease or rental arrangement.

Q: When should I submit Form R-1370?

A: Form R-1370 must be submitted to the Louisiana Department of Revenue within 30 days of the purchase of lease or rental vehicles.

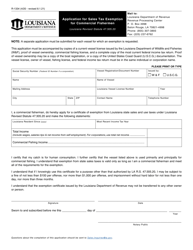

Q: Is there a fee for submitting Form R-1370?

A: No, there is no fee for submitting Form R-1370.

Q: What happens after I submit Form R-1370?

A: After you submit Form R-1370, the Louisiana Department of Revenue will review your application and notify you of the outcome.

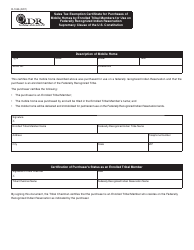

Q: Can I claim tax exemption on all types of lease or rental vehicles?

A: No, tax exemption on lease or rental vehicles is limited to certain categories, such as vehicles used exclusively for agricultural purposes or by certain non-profit organizations.

Q: What if my application for tax exemption is denied?

A: If your application for tax exemption is denied, you may have the option to appeal the decision or request further clarification from the Louisiana Department of Revenue.

Form Details:

- Released on July 1, 2012;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1370 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.